China initiatives lead to common destiny

Updated: 2015-04-03 07:30

By Krishna Kumar Vr, Zheng Yangpeng and Zhao Shengnan(China Daily Europe)

|

|||||||||||

Asia-Pacific forum discusses security, cooperation and prosperity

Development of regional infrastructure as well as greater financial integration and economic prosperity were among the most important themes at this year's annual conference of the Boao Forum for Asia, which concluded on March 29.

A nongovernmental and nonprofit organization, founded in 2001 by 26 Asian and Australian states, the BFA brings together leaders from the Asia-Pacific region every year.

This year, the conference had greater significance against the backdrop of China's ambitious plans, such as the Silk Road Economic Belt and the 21st Century Maritime Silk Road initiatives; a development bank for BRICS and an emergency reserve fund; the Asian Infrastructure Investment Bank and the Silk Road Fund.

In his speech at the BFA, President Xi Jinping said China's "One Belt, One Road" initiatives will not replace existing regional cooperation mechanisms. Instead, they will help economies coordinate with each other strategically. More than 60 economies and international bodies have welcomed the initiatives.

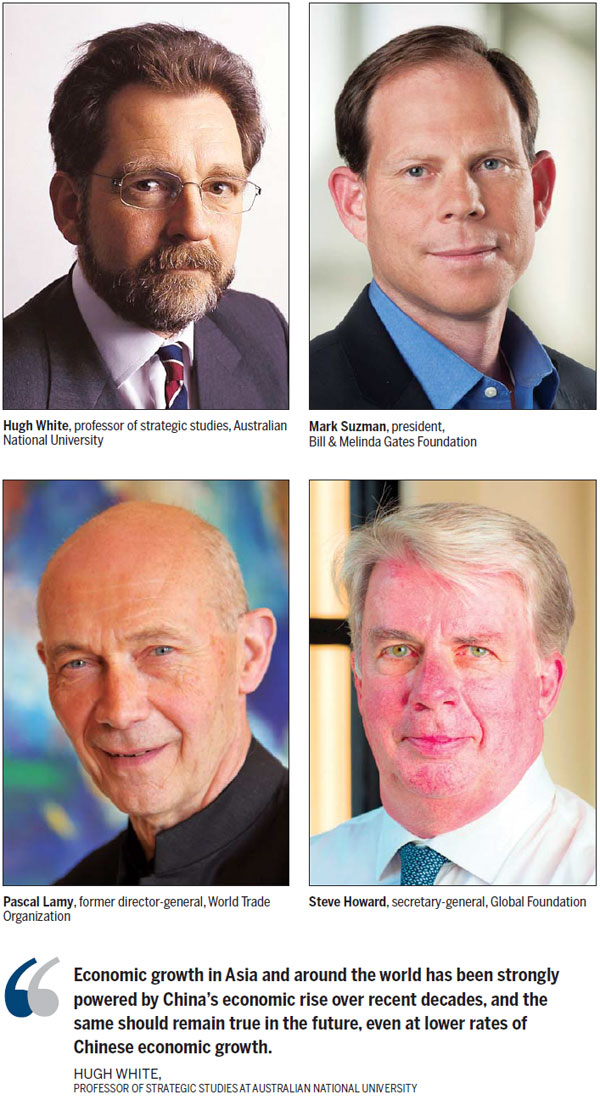

Pascal Lamy, former director-general of the World Trade Organization, says Asia's common destiny is not inward looking, but global.

"The Silk Road Economic Belt initiative symbolizes engaging with the rest of the world in a cooperative way."

The implementation plan for the economic belt includes a detailed list of a network of highways, railways and other critical infrastructure linking China to Central and South Asia, the Middle East and Europe. The maritime route expansion map will entail building and expanding ports and industrial parks in Asia, the Middle East, Africa and Europe.

Hugh White, professor of strategic studies at Australian National University, says it makes perfect sense for China, with its huge financial reserves and expertise in infrastructure development, to take the lead in this area.

Based on official data, China's foreign exchange reserves are pegged at around $4 trillion, more than 50 times bigger than they were at the start of 1996. The reserves surged as the country became the world's largest exporter, surpassing Japan to become the largest holder of foreign exchange reserves.

"Economic growth in Asia and around the world has been strongly powered by China's economic rise over recent decades, and the same should remain true in the future, even at lower rates of Chinese economic growth," White says.

"But this requires immense investment in infrastructure of all kinds, including transportation and distribution networks. The Silk Road initiatives are central to this, and therefore central also to realizing the economic potential of China's economic partners, near and far."

Fifty-two countries have joined or applied to become founding members of the China-led bank by the March 31 deadline, including some key US allies such as Great Britain, France, Germany and Italy.

The US decided not to seek membership in the AIIB.

The bank was bolstered last year by the setting up of the $40 billion Silk Road Fund and the launch of the $50 billion AIIB.

"We will, of course, seek to support the Silk Road Economic Belt initiative, as we have the strongest cultural, historical and social ties with China, and we want to build and strengthen our partnership with China, which creates opportunities," says Angus Armour, deputy secretary for trade and investment in New South Wales, Australia.

Xi previously said the Silk Road Fund and the AIIB "would complement, not substitute, existing lending institutions".

By building multilateral institutions in a responsible way, China has chosen to lead the world, says Steve Howard, secretary-general of the Global Foundation, an Australian think tank.

"And we need it (AIIB) as there is enormous gap in financing infrastructure," Howard says. "This is the heart of the matter, but a lot of energy is being spent on the political aspect. The real global focus should be on how to make this work and help the region."

According to an Asian Development Bank report, between 2010 and 2020, the region must invest approximately $8 trillion in overall national infrastructure. It also needs to spend around $290 billion on specific regional infrastructure projects in transport and energy sectors that are in the pipeline.

"There is a fast need for new investment in Asia, and the world should welcome resources that lead to improving infrastructure and living standards," says Josette Sheeran, president and CEO of Asia Society, a nonprofit educational organization headquartered in New York.

Sheeran says the success of the region relies on building processes and institutions to mitigate tension and disagreements, and find shared solutions.

Mark Suzman, president of the Bill & Melinda Gates Foundation, says the "great initiative" will not only benefit China but forge a path for development and prosperity across the region.

"Both AIIB and the New Development Bank (formerly known as the BRICS Development Bank) will be important players in the global development cooperation framework, and these undertakings offer a major opportunity for positive change," he adds.

During a panel discussion at the forum, Martin Jacques, a senior fellow in the department of politics and international studies at Cambridge University, called the founding of AIIB an "exciting moment" in history.

"What I want to say is in the past month or so the US has been taking a defensive stance on the issue and become more and more isolated," he said. "The US should review its stance on this issue."

Jenny Shipley, former prime minister of New Zealand, said her country, the first developed nation to join the AIIB as a founding member, hopes to be involved in drafting the bank's operating rules.

"The bank should face up to the future and not be excessively focused on what happened in the past," Shipley said, adding that New Zealand will propose a set of rules before the end of this year.

The bank could be innovative in how it works with other multilateral financial institutions, how the board is constituted and how loans are made, she said. For example, board members need not be resident board members, as is the case with the International Monetary Fund and World Bank.

Li Ruogu, former chairman of the Export-Import Bank of China, said the frequent comparison of the AIIB and the Bretton Woods system is "not appropriate" - referring to the monetary system of major industrial states that emerged in the mid-20th century.

He said the primary goal of the AIIB is to address the shortage of funding for Asia's badly needed infrastructure. An additional $8 trillion is needed to fund infrastructure in Asia to maintain the current economic growth to 2020, according to a previous estimate by the Asian Development Bank.

"The priority now is to formulate the articles of association as quickly as possible. We would also like to see concrete projects," Li said.

He cautioned that people should have reasonable expectations about the commercial yields likely through AIIB investments, which will be poured into long-term projects.

Hu Huaibang, chairman of the China Development Bank, said the AIIB should achieve the regional development target through commercial operations and to achieve sustainability. Fiscal balance is crucial.

"If financial institutions for development fail to abide by rule of low profit, they can't be sustainable," he said.

During the four-day forum, China also expressed its stance on the regional security issue.

Xi remarked on March 28 that countries should nurture new security concepts in the region, as Asia explores various paths.

"All of us must oppose interference in other countries' internal affairs and reject attempts to destabilize the region out of selfish motives," Xi said at the opening ceremony of the forum.

Experts interpret this remark as a comment on the US and Japan's recent attitude toward the South China Sea dispute. The US and Japan have strengthened military ties with Southeast Asian countries that have competing territorial claims with China in the South China Sea, including the Philippines.

Zheng Yongnian, director of the East Asian Institute at the National University of Singapore, said in a panel discussion that some allies of the US have abused the relationship over the issue.

"China and the US, the two most important economic pillars of the world, will not have any conflicts over the sea, since they cannot afford it," Zhang said.

Foreign Minister Wang Yi said that China would follow a dual track, agreed by China and most ASEAN countries, to properly handle historical disputes.

Contact the writers through wangchao@chinadaily.com.cn

Wang Chao contributed to this story.

|

Richard Liu (center), founder and CEO of JD.com, attends the Boao Forum For Asia annual conference in Hainan province. Provided to China Daily |

( China Daily European Weekly 04/03/2015 page14)

Today's Top News

54 dead after Russian trawler sinks in ocean

Death toll rises to 147 in Kenya university attack

Dozens killed in Kenyan university attack

Video of final seconds aboard Germanwings plane discovered

British Prince Harry reports for duty in Australia next week

Chinese World War II veterans to receive medals from Russia

Lufthansa insurers set aside $300 mln over crash

Sarkozy makes political comeback

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|