Banks must learn to play new game

Updated: 2014-08-15 10:20

By Albert Chan(China Daily Europe)

|

|||||||||||

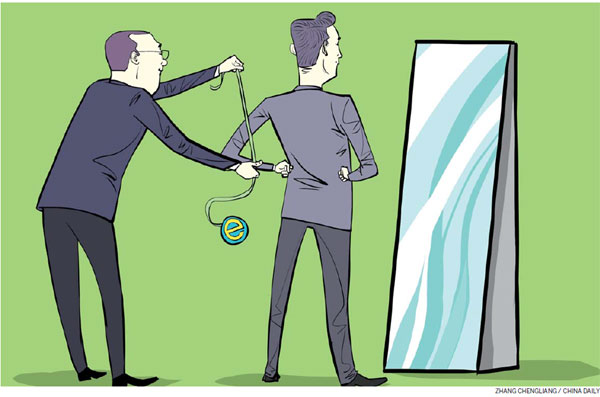

Internet firms are poised to take market share unless banks offer more day-to-day digital solutions

By any standard, the statistics of China's growth in recent years are impressive. For example, household core deposits and loan portfolios have grown 16 percent, from 23.9 trillion yuan ($3.9 trillion) in 2011 to 35.5 trillion yuan in 2014. There has been a 19 percent increase in new personal bank account openings in that period. And 1.8 billion new bank cards have been issued (including 161 million credit cards), amounting to annual growth of 20 percent, according to analysis by the People's Bank of China and Accenture.

However, banks cannot afford to rest on their laurels. Despite the significant growth in household portfolios, the number of bank branches per person remains low. This gives banks less opportunity for face-to-face conversations with customers, making it harder for banks to understand customers' changing needs.

But in a world of increasing online interaction, there are other solutions to this problem: offering truly value-enhancing digital service. We are seeing shareholder value shift to the banks that are further along their digital transformation journey. The shift is to banks that not only have stronger mobile and digital platforms themselves, but also those that are working seamlessly with business partners to offer more diverse mobile and digital services to customers. These organizations are best positioned to redefine markets with digital propositions, change the way customers interact with them, and confront competition from digital disrupters such as Tencent, which already have banking licenses.

According to data from the China Internet Network Information Center, Internet penetration in China reached 45.8 percent (or 618 million users) at the end of last year. More than 40 percent of these users now access online/mobile bank-related services. Recent data from the People's Bank of China revealed that total e-banking payments in China grew at almost 30 percent last year, and mobile payments grew at more than 200 percent in the same period.

Are China's banks doing enough to compete for online/mobile customers? We believe not. Compared with leading banks worldwide, there is a widening gap between Chinese banks and their more digitalized global counterparts. One of the key metrics used in the Accenture Banking Digital Index is the website traffic ranking (measured on a daily basis by Alexa, an Amazon company). When comparing banks internationally against all websites accessed in their home market, Malaysia's Maybank was ranked highest (8th), with South Africa's First Rand a close second (10th). In 85th place, China Construction Bank is the highest ranked mainland Chinese bank (Baidu, QQ and Taobao are the top three most visited sites in China). This suggests China's banks could invigorate their websites to attract more traffic - but to do that they need to offer services that customers want on those sites.

China's banks should become everyday banks. By that we mean they should reach out to customers on a variety of topics - from financing for a new home to health insurance, to planning their leisure activities. Offerings can be optimized for a digital world and presented in an omni-channel context, including mobile offerings. Then banks need to provide just in time, relevant discounts and offers, pre-sale advice, post-sale support and cross-sale opportunities.

For example, in the US when a customer of BBVA Compass buys a new car, BBVA Compass provides them with information on the list price and the actual value, as well as offering auto loan and insurance information. The bank's goal is to ensure its customers can negotiate the best deal. By providing this kind of service, the bank differentiates itself among young, tech-savvy customers who expect to buy products easily, and at the best possible price, using accessible digital technology.

How can banks in China do that? They should leverage their deep customer knowledge via sophisticated purchasing algorithms. Before they can do this, China's banks must accelerate the move away from cash-based purchasing (which provides limited insight into consumption behaviors) to more electronic transactions. Electronic transactions enable banks to capture contextual information about each transaction (which merchant, how much, what time) and use this information to build an analytical insight into customer needs that help not only banks but also partner companies that work with the banks.

In order to create the purchasing algorithms, and enhance their offerings to customers, banks need to engage customers more on a digital front. For example, they need to leverage social media. To earn this right, they must add value to a customer's social network, not just gather information from it. This means proactively starting the right conversations, to develop a deeper understanding of needs and goals.

They should also engage customers through games - a high priority given the popularity of mobile gaming among Chinese consumers. This means taking the essence of what makes games so addictive and applying it to non-game contexts, such as teaching customers more about finance.

Banks should rethink how their sub-branches should be used - transactional services with long queues do not leave a positive memory in people's minds. Simultaneously, banks should be reaching out to customers while they are in the branches to discover their needs, driving consultative-based selling and helping customers experience new digital channels so they become more comfortable using them.

And they should extend traditional loyalty programs to provide a single program that aggregates interactions across multiple events. This simplifies the loyalty experience for the customer and provides "big picture" visibility, while also reducing costs for the businesses that provide these programs.

Banks also should enable more businesses to accept non-cash payment options, such as mobile payments. This has multiple benefits: It makes life easier for customers and enables banks to learn more about customer habits and needs.

Above all, China's banks need to embrace the threat of peer-to-peer financing by providing a platform where it can take place - and taking part in it as both a provider and a user of financing. This includes enabling collaboration between customers in everyday financial services to enhance or replace the bank's role. While that may seem counter-intuitive, it plays to banks' strengths by administering person-to-person financing agreements.

After all, the competition is not going away. Disrupters such as Alipay and WeChat in China are encroaching on banks' territory and are becoming a significant threat to revenues.

However, banks can learn from the digital competitors. Whatever industry they move into, they succeed by attracting and retaining volume on their platforms. Banks can and must do the same by deepening their understanding of customer needs, and providing a richer set of offerings to match these needs. Becoming an integral part of consumers' and businesses' everyday activities is a vital evolution if they are to remain relevant in this new market.

There is no single path to how China's banks should start this process. Some banks of the future will have branch-less, cash-less, paperless legacies. Others will transform from a branch-based banking model. Leading banks and digital disrupters are already mapping out their path. In China, where both Tencent and Alibaba are edging in on business, we expect this journey to proceed at a rapid pace.

The author is managing director and head of Accenture's banking practice in Greater China. The views do not necessarily reflect those of China Daily.

(China Daily European Weekly 08/15/2014 page10)

Today's Top News

British Chinese call for memorial to WWI workers

Pollution control set as priority for APEC meeting

Swimmer nabs silver at Gay Games in the US

China exports to Russia to surge

Chinese economic crime suspects repatriated

Ukraine deaths double in 2 weeks

Sensitive times in the making

Chinese film fans mourn for star

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|