Banks scramble to share in tech bounty

Updated: 2014-07-11 07:21

By Mu Chen and Meng Jing (China Daily Europe)

|

|||||||||||

In 2005, William Ng was tasked with kicking off Deutsche Bank's American Depositary Receipt business in the Chinese mainland, Hong Kong and Taiwan.

"At the beginning, it was pretty much a one-man shop," recalls Ng of his efforts to build the bank's market for ADRs, which are equity instruments that make it easier for non-US companies to list in the United States.

Ng says while he was "running around on the front line," his support staff consisted of only half the work hours of one other person.

China is now one of the most important areas for Deutsche Bank's ADR business and the region with the strongest growth momentum thanks to China's Internet boom, according to Ng, now head of sales of global equity services for Greater China at Deutsche Bank. "Nowadays we have a sizable onshore team with strong market recognition and impressive credentials."

The technology, media and telecom sector accounts for more than 90 percent of Deutsche Bank's ADR client base in China. The bank doesn't disclose details on its Chinese clients, but they include a string of big names, such as the NASDAQ-listed JD.com, China's largest online direct sales company, and YY Inc, a leading Chinese social platform that engages users in real-time group activities through voice, text and video.

But so much money is changing hands amidst China's tech boom that it has attracted lots of attention from top global banks, leading to stiff competition.

ADRs were created by J.P. Morgan for British luxury department store Selfridges in 1927. As a depositary bank, Deutsche Bank acts as a fiduciary agent for both the issuer and the investor, Ng explains. The company deposits its common shares in the bank and the bank creates and issues the ADR, which can represent a fraction of a share or multiple shares.

It is a repackaging of a company's shares that makes it easier for both a foreign company to enter the US capital market and the US investor to buy shares in a non-US company.

TMT is by far the leading sector of Chinese companies to list in the US and the sector's dominance is expected to grow, Ng says.

An increasing number of Chinese Internet companies have been rushing to go public in the United States since the second half of 2013 after Wall Street closed its doors to Chinese companies for two years because of accounting scandals and critical reports from short-sellers.

Hong Kong-based Ng is confident in the potential of China's TMT sector and his company's ADR business in the region. Because of the large number of Chinese Internet companies seeking to raise capital in the US, he travels to the Chinese mainland nearly every week.

He views the TMT sector as a beneficiary of China's policy of supporting small and medium-sized enterprises and providing a healthy environment for their growth.

"The Chinese market is so big; there will be a steady stream of companies that will make it," Ng says, "and some will grow to a certain size, become a leader in their industrial segment and then they might reach the stage to go ahead with an IPO."

While ADR is considered a niche market, it's not an easy one. While few banks offer the service, those that do tend to be large, strong competitors, Ng says.

Aside from Deutsche Bank, the other leaders in ADR are JPMorgan Chase, Citigroup and Bank of New York Mellon. Together they contribute to a highly competitive and pressurized market with falling margins and a higher expectation of service by clients.

"Pretty much every one of our deals came after severe competition," Ng says. "To win any of them is no easy feat."

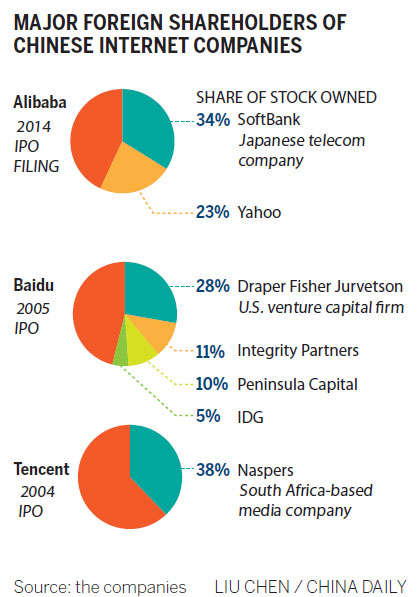

At this stage, the IPO candidate that everyone on Wall Street is trying to woo is Alibaba Group Holding Ltd, a dominant force in China's e-commerce industry.

It would be difficult for any company in the world to pass up the opportunity to participate in a deal with the potential to raise $20 billion in the US.

Contact the writers at muchen@chinadaily.com.cn and mengjing@chinadaily.com.cn

(China Daily European Weekly 07/11/2014 page7)

Today's Top News

Germany wins World Cup on Gotze's brilliance

German suspect was not in contact with spies: US

Xi makes 'symbolic' stop in Greece

Baidu big winner in World Cup

Luxury car sales accelerate

Pianist Lang is on his game in Rio

School helps HIV students

$2.9 billion in gambling assets seized

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|