Looking to East as Western demand falls

Updated: 2014-07-04 08:09

By Yan Yiqi and Shi Xiaofeng (China Daily Europe)

|

|||||||||||

|

Delegates attend the ministerial conference of China and Central and Eastern Europe on promoting trade and economic cooperation, held in Ningbo, Zhejiang province, on June 8-11. Han Chuanhao / Xinhua |

Trade volume between the two expected to hit $60 billion this year

Not many Chinese consumers may associate the southeastern European country of Bulgaria with the fragrance of roses, but Alexander Draganov is out to change that.

Draganov, executive director of Rosbio Bulgaria Ltd, recently visited China for the first time to expand the market for the organic essential oils, medicinal herbs, herbal extracts and seeds his company sells.

Their premier products are made from roses, for which Bulgaria is famous. Rose water can be used in desserts, skin care and fragrances.

Draganov was in a good mood after he spent four days participating in the Central and Eastern European Countries' Products Fair held in Ningbo, Zhejiang province, in June.

"I am amused by the enthusiasm shown by the Chinese consumers. On the first day alone, our rose water almost sold out, so we had to stop selling it to save for the next three days," Draganov says.

Rosbio Bulgaria was one of 180 enterprises from Central and Eastern Europe to show their products to Chinese consumers. Products ranged from Polish mead - a drink made from fermented honey - to crystal goblets to precision machine parts.

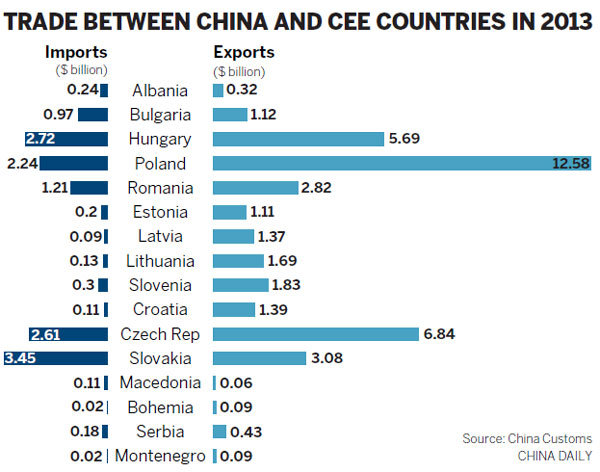

The trade fair, however, was more significant than may have met the eye. For the 16 CEE countries, increasing exports to China's massive and lucrative market is essential given the regional trade imbalance with China. In 2013, for example, China exported $12.6 billion in goods to Poland - China's largest trade partner among the 16 countries - but imported just $2.2 billion from the country.

CEE countries also need to diversify their export base given the weakness of their customary markets in the European Union in recent years.

For China, the transformation from a mostly export-driven economy to a more mature, consumer-driven one is advanced by outreach to the CEE and other areas of the world with untapped potential. It also lessens China's dependence on trade with the EU and the United States.

The fair was an offshoot of the ministerial conference of China and Central and Eastern European countries on promoting trade and economic cooperation on June 8.

The meeting was the next step following one in November between Chinese Premier Li Keqiang and leaders of CEE countries in the Romanian capital of Bucharest, which saw the signing of a cooperation guideline to boost trade and investment exchanges.

Li advocated more China-CEE exchange in six fields, including the economy and trade, nuclear energy, finance and cultural exchanges. Both sides vowed to double their trade over the next five years and discuss plans to build a new railway link connecting the nations.

In Bucharest, trade was given great weight.

Li said China and CEE countries are at similar developmental stages, share comparable national incomes and have complementary economies. Trade between the region and China is, however, only equivalent to one-tenth of China-EU trade, despite the CEE's large share of Europe's area and population, which Li said leaves "large room for cooperation".

In 2013, bilateral trade between China and CEE countries reached $55.1 billion. During the same period, however, China's trade volume with the European Union was $559.06 billion.

With both China and CEE countries seeing room for improvement, trade volume is expected to exceed $60 billion this year.

Gao Hucheng, China's minister of commerce, has said China would encourage the nation's enterprises to import agricultural and animal products, especially food products, from CEE countries, and help them promote their brands in China.

"Many of these products are in great demand in China and we are willing to continue to help these qualified products to enter the Chinese market," he said.

CEE countries view the Chinese market as strategically important.

"For many decades, the CEE countries largely depended on the EU markets in terms of exports," says Ma Shuzhong, a professor with the Department of International Economics at Zhejiang University.

"Starting in 2008, however, the demand from the EU markets shrank rapidly due to the financial crisis. Therefore, they are keen to distribute their export focus to other emerging markets like China."

Due to the CEE countries' similarities in geography and development, farm goods such as dairy, meat and honey are their premier products.

"These products are in great demand in China. Increasing imports of these products is mutually beneficial," Ma says.

Even before the June meeting, China's CEE imports had already started to grow.

In the first quarter of 2014, bilateral trade grew by 10.5 percent from a year earlier. CEE exports to China rose by 38.9 percent while China's total imports in that time grew by only 1.6 percent.

Draganov says he anticipates strong demand from Chinese consumers.

Rosbio Bulgaria sold 60 tons of rose water to China last year, and Draganov expects sales of at least 100 tons this year.

"Rose water, steamed from thousands of tons of rose petals, is one of the most expensive waters in the world. Our rose water sells at 7,000 euros ($9,527) for each kilogram. Although the product is expensive, we have strong faith in the Chinese market."

"The Chinese economy is growing so rapidly that their buying capacity is high. France and Italy attract Chinese consumers with luxury handbags. I think Bulgaria can attract them with our rose water," he says.

Experts believe that increasing imports from CEE countries can also help strengthen confidence in China's economy.

Li Jian, a researcher with the Chinese Academy of International Trade and Economic Cooperation, says that while imports from CEE countries account for only a very small portion of China's total imports now, the positive signals it gives off are important.

"China is trying to transition from an investment-oriented economy to internal demand-driven one. While total imports appeared to be weak at the beginning of this year, a strong growth of imports from CEE countries can indicate that internal demand in China is still strong," says Li.

Although the CEE countries have many products in common, each is trying to develop trade relationships with China in their own specialized ways.

Poland

For Poland, reaching a more balanced trade relationship with China was one of the most important subjects the country's officials raised with Chinese counterparts during the meeting in June, says Andrzej Dycha, undersecretary of state of Poland's Ministry of Economy.

Poland, China's largest trading partner in the region, has the largest trade deficit with China.

"Trade imbalance is a problem for both sides to deepen economic cooperation. Poland has many competitive products like metal materials, natural amber products and agricultural products," he says.

There is a lot of room for trade between the countries to grow, Dycha says, and Polish exporters are keen to enter the Chinese market.

Michat Gvzowski is sales manager of Polish company Ogrody Sabinu. The company produces and sells aronia products, a specialized Polish fruit similar to cranberries. Gvzowski says the company is trying to enter the Chinese market because it looks so promising.

"As a healthy fruit, aronia are warmly welcomed in European countries and in South Korea. By the end of May, we exported 100,000 liters of aronia juice to South Korea," he says. "We expect the Chinese market could be larger than the Korean one. Now we are looking for agents in China to do the job and see how the market will be."

But Gvzowski says the company might not be able to meet Chinese demand. Annually, the company's farms produce 920,000 liters of aronia juice. "We are prepared so that if the Chinese market demand exceeds our productivity, we will expand more farms in Poland to add to our supply," he says.

Joanna Lebiedzinska, sales specialist at Corpo Company in Poland, is also eager to enter the Chinese market. Her company mainly sells honey and mead, and it is just starting to export honey to China, which she calls a promising market.

"We used to import honey from China and sell it to European countries. In recent years, we acknowledged that an increasing number of Chinese people are looking for healthier honey products from other countries. European honey is pure and loaded with lots of nutrition," she says.

While Polish exporters are optimistic, Polish officials are expecting China to provide smoother sailing for their exports.

Dycha says that some Polish exporters find access to the Chinese market very difficult because trade barriers or restrictions.

Dycha says one solution he proposed early this year was the elimination of the current rules barring Polish pork and beef exports to China.

China stopped importing Polish pork in February after two cases of African swine fever were found in the country. Last year, Poland exported 52,000 tons of pork to China, worth 67.7 million euros.

According to Dycha, the country's exports of agricultural products expected to reach 20 billion euros in 2014. Last year, Poland's total exports were 148.7 billion euros.

"Now, about 80 percent of our agricultural products are exported to EU countries. The Chinese market, with great potential, is expected to account for larger proportions," he says.

Slovakia

Meanwhile, Slovakia has the largest trade surplus with China of all CEE countries. In 2013, China imported $3.45 billion of goods from Slovakia and exported $3.08 billion.

"We have a saying in Slovakia that 'Curiosity is the mother of knowing.' I am very curious about the Chinese market and that is the reason why I am here," says Dusan Petrik, state secretary of Slovakia's Ministry of Economy.

"China and Slovakia have 65 years of good relationships with each other," he says. "Slovakia is good at wine, bearing components for textile machines, bearing components for railways, energetics, information technology and the car industry. And we hope our products in these sectors will be widely seen in the Chinese market."

Kinex Bearing is a top manufacturer in its field and is famous for producing bearings for textile machines. The Slovak company holds 80 percent of the Chinese textile machine bearing components market.

Zhang Peng, general manager of the company's China branch, says that it is seeking to expand its market to more areas.

"Last year, our sales revenue in China reached 100 million yuan (11.8 million euros, $16.1 million), after tax. It makes us believe that the Chinese market has large potential," he says. "This year, we are expanding to railway bearing components and airplane components. We have also stepped into the car industry."

While the company is expanding to other fields, it still must deal with fierce competition in the Chinese market, Zhang says.

"Our market focus will still be textile machine components since it is what we are strongest in. To compete in the Chinese market, we have to be prepared with our best performance," he says.

To reinforce its sales, it established a branch in Shanghai. "Needless to say, the Chinese market is one of the most important ones to our company," he says.

Hungary

Hungary is China's third-largest trading partner in CEE and in recent years, their bilateral trade has grown fast.

During his visit to China in February, Hungarian Prime Minister Viktor Orban expressed the country's desire to boost trade.

"Trade between China and Hungary increased six fold during the past decade. The cooperation has helped improve our economic and social development," Orban says.

Hungary expects a new bilateral trade record this year, according to State Secretary for Foreign Affairs and External Economic Relations Peter Szijjarto.

"Last year, bilateral trade between China and Hungary grew by more than 10 percent year-on-year, a record high in the two countries' history. And I think this year will follow last year to break the record again," he says.

During his June 7 meeting with Zhong Shan, China's vice-minister of commerce, Szijjarto says he expressed hopes for an extension of import licenses for Hungarian beef, pork, goose and duck meat to more Hungarian companies.

China has issued licenses to six Hungarian exporters of meat products.

"These products are strong points for our country, but have been the weakest parts of our exports to China. With licenses on the way, we believe the exports can reach a record high this year," he says.

Hungary's exports to China exceeded $2 billion in 2013, but only $2 million was food, according to Szijjarto. With the upcoming lifting of the ban on several meat products, he believes a more balanced trade relationship would result.

Last year, China's exports to Hungary reached $5.69 billion, dropping by 0.8 percent year-on-year, while imports from the country grew by 16.9 percent to $2.72 billion

Contact the writers at yanyiqi@chinadaily.com.cn and shixf@chinadaily.com.cn

|

Andrzej Dycha, undersecretary of state of Poland's Ministry of Economy. |

|

Alexander Draganov, executive director of Rosbio Bulgaria. |

(China Daily European Weekly 07/04/2014 page6)

Today's Top News

Gambling costs World Cup fans their lives

US supports Ukraine's decision to suspend ceasefire

It's all about making a spectacle

China likely to see 7.5% growth in second quarter

Palace Museum feeling the squeeze of visitors

Myanmar pagoda replica given to China

US sends 300 more troops to Iraq over concerns

Hong Kong at the crossroads

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|