Transformation:Innovation on the way

Updated: 2014-06-27 07:30

By Andrew Moody (China Daily Europe)

|

|||||||||||

|

Engineers at Bell Labs in Shanghai. It is the research and development center of the company in China. Provided to China Daily |

China has set deadlines for innovation. the question is whether it can meet them

Is China about to lead the world as an innovator again?

The world's second-largest economy invented gunpowder, the compass, printing and papermaking, but has fallen behind not just in recent decades but for most of the last two centuries.

After reform and opening up in the late 1970s, China became the workshop of the world, mainly through low cost original equipment manufacturing.

Now, however, as China's economy starts to slow and wages rise, there are greater incentives for Chinese companies to innovate to improve profitability by greater productivity.

Although China's investment in research and development is still just 38 percent of that of the United States, according to the China Europe International Business School, a number of Chinese companies are now beginning to make breakthroughs.

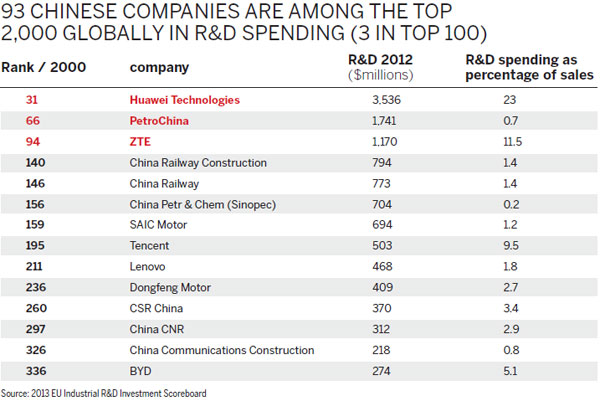

Some 93 Chinese companies are now in the top 2,000 global companies in terms of research and development intensity (research and development spending as a percentage of sales), ranked by the EU Industrial R&D Investments scoreboard in 2012.

While this is fewer than the 658 from the US, 527 from the European Union and 353 from Japan, it represents significant progress.

Huawei, the telecommunications giant, is the highest-ranked Chinese company at 31th in terms of spending, investing some $3.5 billion on research, almost a quarter of its total sales. PetroChina, the state-owned oil company (66th) and another telecommunications company, ZTE (94th), make the top 100. In fact, ZTE made the most patent applications of any company in the world in 2012.

Many Chinese companies are now acquiring technology through acquisition with high profile deals such as computer giant Lenovo buying the Motorola handset division from Google this year for $2.91 billion.

Chinese companies are also snapping up research and development facilities in the US and Europe. There have been several acquisitions of German small and medium-sized businesses in engineering and manufacturing technology. Many expect this to be a significant trend in the next decade. Much of the progress has been in line with the Chinese government's Five-Year Plan (2011-15), which places emphasis on achieving breakthroughs in areas such as integrated circuits, space research and nanotechnology.

China's achievements in research came under the spotlight at the China Innovation Research Findings Conference held at the CEIBS campus in Shanghai in May.

Attended by research and development heads from some of the leading multinationals in China such as AkzoNobel, Bosch, DSM, Philips and Shell as well as Chinese companies, it presented the findings of the work of the business school's Centre on China Innovation, set up three years ago.

George Yip, professor of management and co-director of the center, believes China is on the brink of major technological breakthroughs.

"Chinese companies are investing more and more in research and development, and the Chinese government's investment in research institutions has started to produce results," he says.

"Although China has been modernizing for 35 years or so since reform and opening up in the late 1970s, I think the next few years are going to see a dramatic take off."

Yip, former dean of the Rotterdam School of Management and co-author of Strategic Transformation: Changing While Winning, says one of the key breakthroughs has been in aerospace technology.

COMAC (Commercial Aircraft Corporation of China) is to launch its first commercial airliner, the C919, to rival Boeing and Airbus, in 2016.

"It is leading-edge technology and almost no other country in the world can do this outside the United States and Europe. It will sell very large volumes in China and from there to the rest of the world."

Bruce McKern, former co-director of the center and now visiting fellow at Stanford University's Hoover Institution, says the Chinese have built a strong research base from essentially copying technology.

"They started to learn how to innovate by copying. They then improved on the copying with their own innovations. As a result they have become good at incremental innovation," he says.

The Australian academic says this type of incremental innovation is now vital for the current stage of China's economic development, where production has to become more efficient to absorb higher labor costs.

"A richer society that has higher labor costs has to innovate because it has to find a way of producing things more efficiently. This is the path we are on now.

"It doesn't require radical innovation. The Chinese don't have to reinvent the wheel or the steam engine, but the time will come when there is an earth-shattering innovation. I fully expect that to happen, but it is not necessary at the moment."

Some are skeptical that China will make technological breakthroughs.

Regina M. Abrami, co-author of Why China Can't Innovate, with William C. Kirby and Warren McFarlan, argues that the academic system works against the free flow of ideas.

"Young PhDs are often beholden to a university professor and basically told what they are going to do research on. So it becomes more like an apprenticeship program than self-mastery of a topic. China is not unique on this so it is not completely a East versus West thing, but it is a barrier to innovation."

Abrami, a senior fellow in the department of management at Wharton School, speaking from Hong Kong, says there is no issue with the innovative or intellectual capacity of the Chinese people.

"The institutional structures are such that although China has made tremendous leaps and bounds in terms of process innovations and spin-offs, you are not seeing these disruptive innovations."

The Chinese government set itself the target as far back as 2006 to transform the country into an innovative society by 2020 and a world leader in science and technology by 2050.

However, some doubt there is a direct relationship between research and development effort and economic performance.

Edmund Phelps, the Nobel-prize winning economist and director of the Center of Capitalism and Society at Columbia University, believes there may be no link at all.

"It is curious that some industries have a lot of research and development going on and other industries have not. If you look at national data you see Germany is right up there in terms of research and development but it happens to focus on one or two industries that are relatively heavy on research and development. I just don't think research and development data is very meaningful or helpful."

Phelps, also dean of New Huadu Business School at Minjiang University inFuzhou and author of Mass Flourishing, which raises innovation issues, also does not believe that despite Apple iPhones and the new information age, the current period is a great innovation age.

His measure of innovation success is its impact on economic productivity, and he says it is clear that more advances were made in the late 19th century and from 1920 to 1960 than now.

"Productivity growth has slowed markedly from the late 1960s and early 1970s. I take that to mean that either innovation has shrunk as a slice of the economy and that Silicon Valley wasn't enough to offset that diminution of innovation elsewhere or maybe that innovation doesn't have as large an impact on productivity as it used to."

Gong Li, senior managing director and chairman of global management consultant Accenture China, says China has a problem with bringing up groundbreaking research.

"Research and development in China is more about the 'D' than the 'R'. There are about 110 products of which China is the largest manufacturer in the world but only about 10 of them have enough IP in them to be a China product," he says.

Li, who was a scientist himself majoring in physics at Fudan university and doing a postgraduate degree in electrical engineering at the University of Houston, says there is still too much of a "rush mentality" in China that hinders basic research.

"Research takes years and there might not be any benefit immediately from it but Chinese companies want a return in three years. As a result it is not an easy environment for basic research."

Han Jian, associate professor of management, who is also co-director of the CEIBS Centre on China Innovation, agrees there is some evidence that there is a skills gap that makes blue sky research difficult in China.

She has recently conducted panel research with the research and development heads of 15 multinational and Chinese companies as part of the innovation center's recent findings conference.

"One leading Chinese company's research and development head said there was still a lack of really innovative people with, in particular, maths skills. He also said there was a lack of people able to express ideas in a logical and comprehensible manner and to come up with a holistic picture that can be defended and analyzed."

However, Han has problems with seeing research and development success at individual country level since much of it is conducted by multinationals and industry specific.

"The main priority for the multinationals in China is building teams. It is not just about having enough really smart people but about motivating the people who are not so smart. These people are often doing the donkey work, and it is about them being a meaningful part of the jigsaw."

Abrami at Wharton says there is also a lack of capital for early-stage entrepreneurs compared with the US and Europe.

"The lack of angel investors compared to what we see elsewhere is a problem. I think also there is less scope for failure in China. If you think of Silicon Valley, it is almost a badge of pride about how many companies you have been involved with that have bombed. I don't get a sense there is a lot of room for that in China," she says.

A major issue for research and development in China remains intellectual property rights.

McKern at the Hoover Institution says it has been a major issue for foreign multinationals in China.

"They have always been looking for ways to prevent leakage. The big change here, however, is that Chinese companies who have developed their own technology are clamoring for protection and putting pressure on the government," he says.

Klaas Vegter, who heads electronics company Philips' research and development in China, says there can be too much focus on IP protection and research in China.

"In my personal view, IPR is overstated. In many markets, the product lifecycle right now is so rapid the idea you can protect IPR is almost ridiculous."

"The average patent lifecycle is 17 years, and the product just one to two years."

Vegter says a distinction now has to be made between core DNA technology and the products that appear on the shelves in shops.

"We have made a distinction between innovations that are secret processes and products which are assembled, even if there happens to be 10 years of research behind them," he says.

"If you assemble anything and bring it to market, three months later it is copied."

Regardless of the IP issue, there can be no doubting the government support to research and development in China.

There is increased investment in the research bases of the universities and there are more than 100 science and technology parks across the country.

Certain industries have been given major funding. China Railway Construction Corporation, which has been behind China's success in high-speed rail, has received a grant of 173 million yuan ($27.7 million, 20 million euros), which made up a third of its 521 million operating income.

China Development Bank offered a $6 billion grant to Goldwind, the China wind power company, to fund its international expansion.

Yip at CEIBS says the development of China's research base is following the pattern of what has happened in other countries.

"Countries like Germany began with copying to start with in the 19th century. Through that it became better at engineering. It was not doing fundamental innovation," he says.

Timothy Beardson, the former investment banker and now author of Stumbling Giant: The Threats to China's Future, which has just been published in paperback, agrees.

"China has been criticized for encouraging intellectual piracy, but we should remember that this was exactly the intellectual activity that was chosen by the US in the early years. The US profited from international copyright piracy for a century," he says.

Yip adds that too much emphasis can be placed on the importance of coming up with radical new inventions since they are not always that commercial.

"If you look at the Apple iPhone, which was a breakthrough innovation, it only has 30 percent of the smartphone market around the world. That means the imitators have a 70 percent share. So from an economic point of view it makes no difference who invented the thing. It just gives you bragging rights."

Yip says the key transition for China is not coming up with cutting edge new technologies but moving from making products for other people to being able to put your own brand label on them.

"This should be the key focus of China's research efforts. This is what gives you industrial liftoff."

Phelps at Columbia believes the sheer numbers game should work to China's advantage and that it could emerge eventually as a technology leader.

"Even, if in China people, by nature or personality, are uncomfortable with striking out on their own and breaking away from the group, the sheer numbers of them engaged in research is impressive, so a huge amount of innovation might come out."

andrewmoody@chinadaily.com.cn

(China Daily European Weekly 06/27/2014 page6)

Today's Top News

Prime London properties lure investors

FIFA bans Suarez for 4 months

Tycoon criticized for charity in NY

50 trapped Chinese back to Baghdad

Northern Iraqis flee their home, avoiding Sunni millitans

DPRK test-fires newly developed missiles

RIMPAC drill not window-dressing for China-US ties

Li puts China-UK ties on new level

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|