For action on economic front, wait a while

Updated: 2014-03-21 08:16

By Ed Zhang (China Daily Europe)

|

|||||||||||

Reform is not as easy as pushing a button, but it will be a lasting force once started

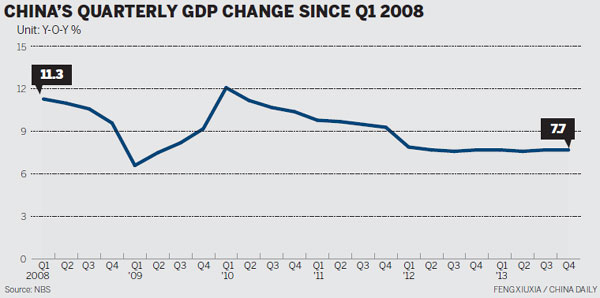

After the January-February data, investors can't be optimistic about China's GDP growth in the first quarter of the year.

Some economists forecast that it will go down from 7.7 percent in the fourth quarter of 2013 to 7.6 percent. There is a likelihood that the figure can be lower.

For the whole year, China would do well to achieve 7.2-7.3 percent growth, because that would be close enough to its yearly target set at 7.5 percent.

In his press conference on the closing day of the recent annual session of the National People's Congress, Premier Li Keqiang clearly indicated that as long as the urban employment situation allows, the Chinese government can tolerate slightly lower GDP growth and that it is not obsessed about numbers just for their sake.

The slowdown in China's growth is only natural following its export-led growth peak around the Beijing Olympics in 2008, which was soon interrupted by the financial crisis in the US and then the debt malaise in the eurozone.

The government dealt with this catastrophic turn in the market with a massive credit stimulus (4 trillion yuan, or $600 some billion, from the central government alone) and lifted growth rate back into the 10 percent-plus range, at one point even higher than the highest point in 2008.

Such a bailout program, in hindsight, was an over-reaction by a newcomer in the global market, unprepared to see such an abrupt change. In some cases, it was little more than an effort to keep bailing out the same industry making the same products that a changing market no longer had as much demand for as before. Small wonder then that over-capacity has become such a rampant disease, especially in industries featuring high demand for resources, low profit and severe pollution. Growth of such a kind would have been unsustainable, if not suicidal.

So, the slowdown since 2012 (GDP growth has remained under 8 percent since) can only be seen as a return to the normal - perhaps only the beginning of the return, for although China has managed to shed some overcapacity in the last couple of years, it is still a long way from striking an ideal strategic rebalance. Half, if not more, of the country's industry would have to be phased out or to go through major overhaul in several years when the economy is trying to adapt to new trends in the world, according to China's younger and tech-savvy business commentators.

Their observations are not only important for forecasting China's long-term performance; investors had better keep them in mind and compare them with the short-term realities across various industries. Opportunities, if defined as meaningful growth, can only come along where bankruptcies are reported, old funds allowed to default or collapse, large companies break up, and small companies multiply, and rules are remade to allow new services to reach out to young consumers.

When the government doles out an investment stimulus or consumer incentives, the stock market may respond favorably, but just for a short period, because they are unlikely to generate steady growth.

So we can look forward to an uneventful first quarter, and perhaps the next, when many local governments remain disorganized in their funds and unfinished projects, and when only some large state-owned corporations begin to talk about their plans to work together with private capital to build subsidiaries with mixed ownership.

Important projects, such as the pilot free trade zone in Shanghai, or the urban cluster covering Beijing, Tianjin and Hebei, are yet to generate tangible results or any innovation in the government's service to society and the business community.

The only true area of robust business is the mobile Internet service, where real money, not just ideas and plans, is flowing and making an impact. Even the central bank's ban on virtual credit cards on security grounds can be expected to be made obsolete when more sophisticated solutions are developed.

For the rest of the economy, any excitement will only come in the third quarter at the earliest. Reform is not as easy as pushing a button; but once the process starts, it will be a lasting force.

The author is editor-at-large of China Daily. Contact the writer at edzhang@chinadaily.com.cn

(China Daily European Weekly 03/21/2014 page15)

Today's Top News

China, the Netherlands seek closer co-op

Crimea is part of Russia

Images may help solve jet mystery

Obamas wowed by China

Xi leaves Beijing for first trip to Europe

Beijing beefs up hunt for missing jet

Putin signs law on Crimea accession

Australia to resume ocean search for missing jet

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|