Early trade data bodes well for exports this year

Updated: 2014-03-21 08:16

By Luo Jiexin and Xu He (China Daily Europe)

|

|||||||||||

Number crunching, field research show significant fall in over-invoicing and reduced inflows of hot money

China's trade experienced a roller coaster ride in the first two months of the year. It beat market expectations to jump sharply in January but nosedived in February.

By analyzing the two months' figures together and after field research that took our analysts to traditional exporting hubs of the Yangtze and Pearl river deltas, we remain cautiously optimistic about this year's trade prospects.

To make sense of the January-February figures, a question must first be answered: Did these figures reflect the real picture? In other words, was there over-invoicing - in which speculative capital flows across the Chinese border under the guise of trade?

After more economic indicators were made public, to crosscheck the trade figures, we found that the authenticity of trade figures was high for the first two months.

First, port throughput of goods for foreign trade increased 9.5 percent year-on-year in the January-February period, according to the Ministry of Transport. The growth was much higher than the trade growth of 3.8 percent. Usually, if port throughput growth is much slower than the growth of trade, it indicates that fake trade is rampant because a lot of deals are only recorded on customs books but do not go through ports at all. That is clearly not the case in January and February.

Second, the mainland's trade with Hong Kong decreased sharply in the two months. Imports and exports totaled $287 billion (206 billion euros), representing a drop of 23.6 percent. This showed fake trade - which often flows through Hong Kong, a proxy for international hot money - was not significan.

Third, exports of integrated circuits, an oft-used form of fake trade favored by speculators for their small size and high value, fell substantially. In Guangdong province, a hotbed of fake trade, exports of integrated circuits dropped 84.6 percent in January. The only explanation was that fake trade had been largely curbed, resulting in such an unusually drastic decrease.

Imports of commodities, which are often used by traders and speculators as a form of financing, slowed down in February, with the depreciation of the renminbi greatly narrowing room for speculative profits. In this sense, the statistical distortion stemming from "commodity financing" is not severe.

After considering all these factors, it is clear that January-February trade figures were authentic but trade figures of the first two months of last year were inflated by over-invoicing.

To make a fair comparison, we adjusted figures by deducting all suspicious parts such as trade with Hong Kong and exports of certain goods. After these adjustments, trade growth in the first two months of this year stood at 9 percent on a yearly basis, with exports rising 8 percent. That beats the yearly trade growth target of 7.5 percent set by the government.

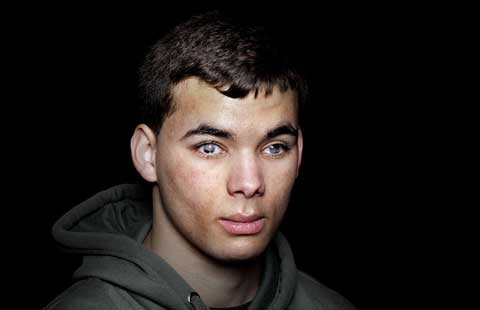

If these figures are not convincing enough, our field research of 32 small to medium-sized trade companies in Guangdong, Jiangsu and Zhejiang provinces found a markedly improved sentiment. These companies mostly export labor-intensive goods such as suitcases, caps, clothes and T-shirts.

More than two-thirds of them said their orders in the first two months rose more than 10 percent, with customers mainly coming from the United States and Europe.

Most executives of the companies said some old US and EU customers, who had not patronized them for one or two years, have come back since the second half of last year and placed big orders in the past few months.

This reflected a solid recovery of Western demand and offered an explanation to an usual phenomenon: growth in Chinese exports of cases, bags, clothes and shoes defy the general trend of double-digit growth in January, traditionally a weak season for exports of labor-intensive goods.

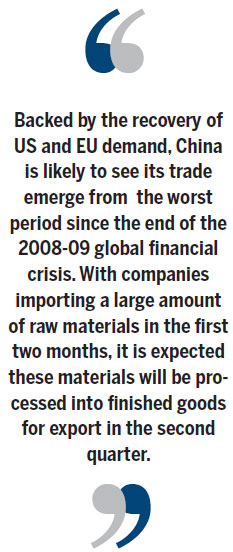

Backed by the recovery of US and EU demand, China's trade is likely to emerge from the worst period since the end of the 2008-09 global financial crisis. With companies importing a large amount of raw materials in the first two months, it is expected these will be processed into finished goods for export in the second quarter.

The authors are Shanghai-based financial analysts. The views do not necessarily reflect those of China Daily.

(China Daily European Weekly 03/21/2014 page13)

Today's Top News

China, the Netherlands seek closer co-op

Crimea is part of Russia

Images may help solve jet mystery

Obamas wowed by China

Xi leaves Beijing for first trip to Europe

Beijing beefs up hunt for missing jet

Putin signs law on Crimea accession

Australia to resume ocean search for missing jet

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|