Luxury giants tap into mainland market

Updated: 2013-11-29 10:32

By Zhao xu (China Daily Europe)

|

|||||||||||

Retailers cater to Chinese customers' ever-increasing brand awareness

Take a stroll around one of Beijing's big shopping malls, especially those in the "stand-alone" or "high-end" brackets, and unless you're a seasoned shopper, you may be surprised by the level of privacy available.

The shops are largely empty, especially on weekdays, and host a mere smattering of visitors who occasionally find themselves making slightly awkward eye contact with a sales assistant who has clearly been waiting for a customer.

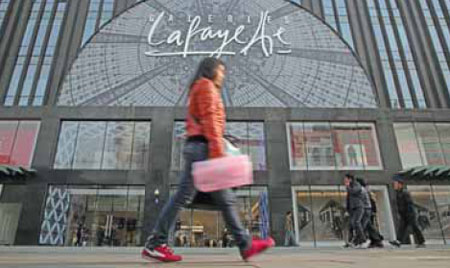

With this in mind, it's little wonder that the recent openings of Galeries Lafayette in Beijing and Lane Crawford in Shanghai have raised a few eyebrows among industry observers.

The companies are dissimilar to an extent. Lafayette, the French company whose flagship store on Boulevard Haussmann in Paris is reportedly the second-most-visited site by Chinese tourists in the French capital - the first being the Eiffel Tower - has just one store in China.

However, Lane Crawford, the British-owned, Hong Kong-headquartered luxury retailer, has always seen Asia as its biggest market. Its new store in Shanghai, China's undisputed capital of fashion, marks its eighth opening in the country, with five outlets in Hong Kong and two in Beijing.

The flurry of major department or multi-brand store openings - including 10 by Corso Como, a cutting-edge Italian outfit that prides itself on a galvanizing mix of fashion, art and music - has dropped a stone into the otherwise ripple-free waters of the Chinese fashion market.

The issue lying at the center of the ripples' concentric circles is the long-term profitability of these projects and whether they can live up to their status as retail meccas by attracting Chinese consumers long after the initial excitement has cooled.

One of the strongest, oft-repeated theories behind the openings is that China, with its burgeoning middle class, represents the last stronghold - or possibly foothold - for high-end and luxury fashion retailers at a time when the rest of the world is blanching at the stratospheric prices commanded by designer dresses. As proof of that, the cash splashed around by avid Chinese consumers in Britain's high-end shops during the holiday season is famously and, perhaps grudgingly, known as the "Beijing pound".

According to a report issued in December by the US consultancy Bain & Co, people from the Chinese mainland have unseated US shoppers as the world's biggest buyers of luxury goods, and the two together accounted for 25 percent of global luxury sales through purchases at home and abroad.

But observers shouldn't be fooled by the apparent boom, according to Yu Kun, a veteran fashion editor at Cosmopolitan magazine. "China is expecting economic growth of 7.5 percent this year, the lowest for 23 years. There's a very visible slowdown in Chinese demand for luxury goods and expensive products in general," he says in reference to the closure of a number of high-profile department stores in major Chinese cities during the past few years, including several branches of Maison Mode, a name that at one time was synonymous with luxury fashion in Shanghai, and by extension the whole of China.

These setbacks haven't gone unnoticed by the recent arrivals. One clear solution for Lafayette is to reach out and reach down simultaneously.

"Of course, our selection for every Galeries Lafayette store in France and overseas includes luxury and high-end brands, but not only those items," says Chief Executive Laurent Chemla in Beijing. "Obviously, a large middle class is emerging in China and it has expressed a clear interest in trends, designers and new shopping experiences in general."

The man who masterminded the opening of the Beijing store described his price-positioning strategy as a "scissors approach"; "We want to attract people who may not necessarily have high spending power but are passionate about fashion and want to express their individual taste, and also the more mature customers who are looking for luxury items," he says.

That point is driven home to customers at the company's six-story, 47,000-square-meter store. The merchandise on offer ranges from statement jewelry and printed sweaters to pop shoes and designer T-shirts. Instead of shouting luxury, the ambience exudes a youthful energy, the kind that has charged through the many so-called street shots, randomly taken photos of stylish passersby in cities from Paris to Milan that are studied diligently by the fashion-infatuated millions worldwide. The prices for the majority of items in the store range from 1,000 yuan ($164; 121 euros) to 8,000 yuan.

Yu welcomes Lafayette's embrace of streetwise fashion. "Dressing up or dressing down? For me, the latter choice is for fashion insiders who are uninterested in displays of wealth, and are not new to the concept of studied casualness, or understated luxury."

But Yu's approval was not shared by all observers. In fact, Lafayette's friendly pricing and its choice of the Xidan area - arguably Beijing's busiest, and probably most crowded, place for youth shopping - has caused some to question the wisdom of this decision.

"Xidan is not particularly known for being an incubator of style, and it also has very little to do with high fashion in people's common perception," says Jiang Yi, a Beijing-based independent designer who has long operated his own boutique in Beijing's trendy Sanlitun area, an expat haunt in the northeast of the city. "There's an identity problem for Lafayette in choosing Xidan as its landing locale and physically juxtaposing itself with many local department stores that sell, in my view, clothes but not fashion, let alone style."

Jiang's other concern is that, by opening its arms to the middle classes, Lafayette may risk alienating its more privileged customers in a society where the wealthy insist on being treated accordingly.

It's not that Lafayette isn't taking note, according to Chemla. In fact, he's aiming for exclusivity, as evidenced more by the products than the price tags.

"Our Beijing store is focused on new and exclusive fashion brands," he says. "It carries around 500 brands. Of these, roughly 300 are directly imported and operated by the brand's own staff. The main reason for that is that the majority of them - around 200 - did not have any prior presence in China ... this goes hand-in-hand with our strategy to be the place where new brands and trends are launched in Beijing."

Chemla's determination to end the seemingly endless repetition of brands in many Chinese stores is shared by Andrew Keith, president of Lane Crawford, who has made the showcasing of emerging industry talents an anchoring point for his new store, which covers 14,000 square meters on Shanghai's high-tone Huai Hai Zhong Road.

"In China we see an increasing awareness of brand and product exclusivity," he says. "The Chinese are looking for brands that are relatively rare in the market."

"Rarity with renown" seems to be Lane Crawford's selection criteria when it comes to niche international designer labels. Chosen designers include Proenza Schouler, Jason Wu and Alexander Wang. Their popularity, Wu and Wang especially, among the Chinese fashion pack, is ably testified - probably to their delight and dismay - by the number of fake items being sold under their brand names on China's major online shopping portals.

"Admit it or not, what the young generation of Chinese fashionistas is looking for is 'recognizable cool', meaning 'edge with pedigree'" says Jiang. "They want to look effortlessly stylish, but at the same time they are reluctant to spend thousands on an item that fails to elicit the envy of their peers."

When asked how Lafayette Beijing will make up for lost social cachet when compared with the flagship store, whose innate charm lies in its Parisian location, Chemla says, "The way the Beijing store is organized is very focused on a 'mix-and-match' attitude ... This is very French!

"We are targeting all customers who love fashion and look for a unique lifestyle to enjoy life. From this aspect, the Beijing store shares the same customer base as the French store," he says. "At the same time, the Beijing store will make Galeries Lafayette available to Chinese consumers who don't have the opportunity to go to Paris often."

In response, Jiang offers his own advice for foreign-based retailers looking to establish a base in China. "Go to the second-tier cities," he says. "That's where all the money has come from."

Zhou Huiting, Wu Wencong and Tang Yue contributed to this story.

zhaoxu@chinadaily.com.cn

|

Lane Crawford has recently opened an outlet in Shanghai in the hope of cashing in on the market potential in the world's second-largest economy. Gao Erqiang / China Daily |

|

French company Galeries Lafayette has recently opened an outlet in Beijing. Photos by Wang Jing / China Daily |

( China Daily European Weekly 11/29/2013 page20)

Today's Top News

Cameron to arrive with big delegation

China launches moon rover

Honor Cairo Declaration

34th high-speed railway starts

Testing time for China's tea growers

8 dead in police helicopter crash onto Glasgow pub

Xi stresses fight against HIV

Premier's trips bear fruit

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|