Shopping malls mushroom in China

Updated: 2013-10-04 08:59

By Wang Ying (China Daily)

|

|||||||||||

Rising middle-class, higher purchasing power to fuel growth in retail facility construction

The booming shopping mall construction across the world's second-largest economy will take the total amount of malls in China to more than 10,000 by 2025.

It comes from a belief that shopping centers will exceed office and residential projects to become the cash cow for developers.

The glitzy and trendy Huaihai Road in Shanghai provides a snapshot of the ongoing retail construction frenzy. As one of the busiest streets in China's financial hub, Huaihai Road's profile and retail space rental have both increased after revamping and reopening of shopping malls owned by Hong Kong developers such as New World China Land Ltd, Sun Hung Kai Properties and Wharf (Holdings) Ltd, say analysts.

Nationwide, there are about 3,100 shopping malls scattered across the country. This figure is estimated to exceed more than 10,000 by 2025, Guo Zengli, director of Mall China, which is affiliated to the China Commercial Real Estate Commission, was quoted as saying by Guangzhou-based Yangcheng Evening News.

"In spite of the changing economic environment, the wealth of the nation's middle class keeps growing steadily, but their demand for buying is far from being sufficiently met," says Joe Zhou, head of research for Jones Lang LaSalle East China.

A recent HSBC forecast shows that 93 million Chinese households will join the middle class - the main driving force behind national purchasing power - by 2015. According to Forbes' Chinese Mass Affluent Group Report 2013, the country's middle class is defined as a group of people having financial assets worth between $100,000 and $1 million.

"Over the past four years, the total financial assets of the Chinese middle class remained at 1.33 million yuan per capita," says Shi Guowei, research director of Forbes China and joint writer of the report.

The fast-growing middle class and their burgeoning buying power are making the idea of opening shopping centers on the Chinese mainland increasingly attractive. The China Chain Store and Franchise Association expects the number of mainland malls to jump 40 percent to more than 4,000 by 2015.

The construction of shopping malls will exceed office buildings and residential properties as the most profitable type of property investment on the mainland over the next two to five years, according to the research by ARA Asset Management, a property investment firm partly owned by Hong Kong billionaire Li Ka-shing.

Ng Beng Tiong, the chief executive of ARA Private Funds, says district shopping centers with a gross floor area of 1 million square feet (92,900 square meters) or bigger and a high number of visitors will offer the biggest upside with limited risks for private funds in the coming years on the mainland.

Ng, a former investment banker, is targeting an internal rate of return of 20 percent from the building and operating of shopping centers on the mainland. The projects will be funded by a newly raised $441 million formed by Asia Dragon Fund II.

In contrast with residential developments that are easily affected by government policy, shopping centers will experience a robust growth in China because domestic buying power is still being viewed as a main driver of the country's economic growth, Zhou says.

A report jointly compiled by Knight Frank and Holdways shows that in 2012 the total value of retail sales and per capita consumption expenditure of urban households rose 14.3 percent and 10 percent on an annual basis, respectively.

Analysts say retail projects will outshine other commercial properties in the long term. In Shanghai, the average gross yield of prime retail projects is above 6 percent, while prime offices are between 5 and 6 percent. Residential property has remained between 3 and 4 percent, says Regina Yang, head of research and consultancy with Knight Frank, Shanghai.

Although shopping malls may bring higher returns on investment for developers than residential or office projects, the fierce competition in the market means development experience and the expertise to manage these projects will be highly demanding, analysts say.

Also, the mall-construction race may lead to a short-term glut and high vacancy if their locations are not well chosen or the tenants are not attractive enough to pull in customers.

The total shopping mall space in China's seven major cities will more than double in five years to 87 million square meters, while the supply in Beijing and Shanghai each will exceed 14 million sq m, according to research by Shenzhen World Union Properties Consultancy Co Ltd, a listed real estate consulting services company.

Favorable policies with good availability of sites available for shopping centers, are key reasons for the high volumes of ongoing development, according to James Hawkey, managing director of retail services at Cushman & Wakefield Asia-Pacific.

Hawkey suggests potential oversupply exists in eight out of 10 major cities on the Chinese mainland, a result of rapid development.

Per capita shopping center space in the United States is more than 2 sq m. In major European Union countries where high streets play a bigger role in retail, per capita space is often between 0.5 sq m and 0.7 sq m. In major cities in China, per capita shopping center space is fast approaching EU levels, Hawkey says.

"But it is happening too fast," he says, adding that a large proportion of the new supply is being built by inexperienced developers. As a result there may be significant problems in terms of location, design and management.

Returns for successful shopping centers can be very high, adds Hawkey. However, less successful centers have poor returns and, as the shopping center market in many cities is now intensely competitive, some will fail.

In the next few years, a lot of retail supply is scheduled to come into the market, according to James Macdonald, head of Savills Research China.

Beijing and Shanghai may see their retail stock increase by 14 percent and 30 percent from the end of 2012 to the end of 2014, while Chengdu in Sichuan province, Shenyang in Liaoning province and Chongqing are expected to expand their retail stockpiles by 88 percent, 50 percent and 53 percent respectively during the same period, Macdonald says.

Inexperienced retail developers are a worse problem than oversupply, says Annie Lei, national director of retail services at Cushman & Wakefield China. Lack of experience leads to a vicious circle, with poor planning and positioning, leading to problems with design and brand mixture and, ultimately, problems with long-term operations," she says.

Chen Zhongwei, head of research at CBRE China, says his company was aware of such a tendency and suggests property developers be cautious in investing in shopping malls.

A successful shopping mall needs a professional team with capabilities of operation, management, proper position and tenant recruiting, Chen says.

Chen advises domestic developers to stay focused on their core business.

"In spite of consistent policy curbs toward the residential market, homebuyers' demand remains firm and we do not see the home market collapsing within the next five years," he says.

More than 90 percent of listed developers have their profits generated from the residential sector, suggesting a great contribution from house building, Chen says.

Shi Jing in Shanghai contributed to this story.

wangying@chinadaily.com.cn

|

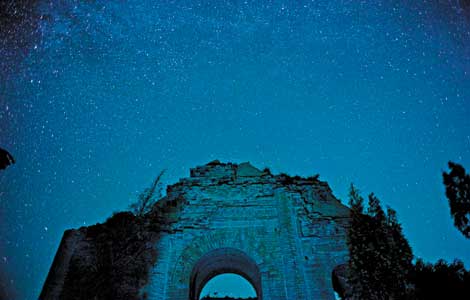

The We-Life Future Plaza, a newly opened shopping mall and entertainment complex in northeastern Beijing. China is expected to have more than 10,000 shopping malls by 2025 as construction of such facilities booms across the country. Wang Jing / China Daily |

( China Daily European Weekly 10/04/2013 page23)

Today's Top News

China, Russia co-work for security in Asia-Pacific: Xi

Animal welfare to be added in training

Talks 'can help Chinese banks' in UK

Robust home sales during holiday

APEC 'should take lead' in FTA talks

Beijing targets polluting cars

China warns US, Japan, Australia over sea issues

US on path to default if Obama won't negotiate

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|