Long way ahead for reform

Updated: 2013-10-04 08:59

By Xu Wei and Tang Yue (China Daily)

|

|||||||||||

Breaking up the former railways ministry was the easy part, but debate is raging about the next steps

For many years, the former ministry of railways had a popular nickname - "tie lao da" or "railway boss" - for very good reasons. Founded on Oct 1, 1949, along with the People's Republic of China, the ministry was like an independent realm with its own colleges and judicial establishments all over the country.

According to China Statistical Yearbook, the number of staff in the railway system had reached 1.76 million by the end of 2011.

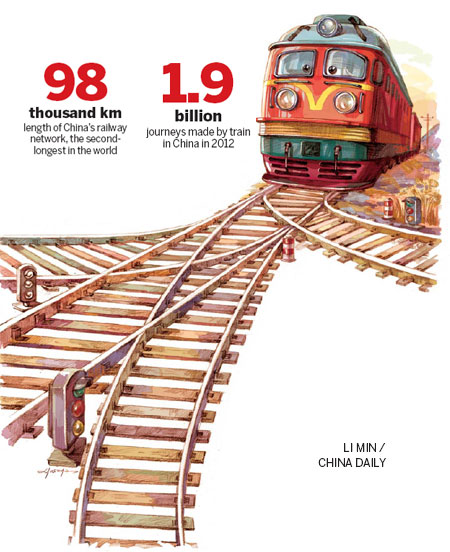

Covering 98,000 kilometers, the country's railway network in operation ranks second only to that of the United States and plays a very important role in travel and cargo transport.

However, the railway has long been a target of public criticism for corruption, bureaucracy and extreme difficulty in securing tickets during the annual Spring Festival travel peak.

It came as no surprise when the central government dismantled the ministry in the cabinet reshuffle in March.

With its administrative powers inherited by the Ministry of Transport and its commercial side taken up by the China Railway Corp, the bold move was seen as a major step to transform an industry that has been a key feature of the planned economy.

Just the beginning

Four months later, Liu Zhijun, railways minister from 2003 to 2011, was given a suspended death sentence for bribery and abuse of power.

The dismantling of the dominant railway kingdom and the verdict on its former chief are surely good news for the reformers and the public, but it won't solve all the problems overnight.

"This lays the foundation for future reforms, but there has to be more substance to this than merely breaking the railways ministry into two," says Zhang Guoqiang, a researcher at the National Development and Reform Commission's Comprehensive Transport Institute.

Indeed, the breakup of the ministry has led to more crucial questions and quite a debate about what should come next.

Should private investment gain access to the railway business? Should fares be increased and, if so, by how much? Is it a good idea to further break up the system into regional operators to encourage competition?

One thing experts do agree on is that any changes to the network must be gradual and made with caution.

Unlike in the US and many European countries, where reliance on trains has fallen significantly due to a boom in air travel, China's railways still make a "fundamental contribution to the economy and society", says Zhao Xu at the Unirule Institute of Economics.

Last year, the railway handled 1.9 billion passenger journeys. Meanwhile, 4 billion metric tons of cargo are shipped on its tracks every year, including as much as 85 percent of wood and crude oil supplies and almost 1.7 billion metric tons of coal, according to a People's Daily report.

More than 30 years have passed since China launched the reform and opening-up policy, and it is high time that key components of the economy such as the railway took more audacious steps forward.

Zhang says reform is the only choice for solving long-standing problems within the network, as well as improving efficiency and supervision against corruption.

For example, rail routes in many European countries are connected to seaports. But in China, efforts since the 1980s to do this have come to nothing due to the rigid railway system, he says.

"This reform will be one of trial and error; there is no roadmap," Zhang says, explaining that China cannot follow the model of another country because a railway is unique to each nation's economic development.

"We are in uncharted waters here."

Massive debts

In March, the State Council announced the duties of the China Railway Corp: railway dispatch and command, freight and passenger business management, construction and maintenance. The 18 railway bureaus, three transport companies and all other assets of the former ministry of railways also went to the new corporation.

The ministry's massive debts, however, come as the other side of the inheritance.

Launched with a registered capital of 1.03 trillion yuan ($167.8 billion; 125 billion euros), the company had total liabilities of 2.84 trillion yuan by the end of March, according to Xinhua News Agency.

To allow private investment entry to the railway business is seen as a possible way out of the red tape. Previous investment came from bank loans and bond issues.

Liu Shijin, deputy director of the State Council's Development Research Center, says that the railways "need money and the private sector has a large amount of it waiting for the green light".

"The main problem the reform should solve is allowing funding from outside and establishing a clear business and governance structure, one that protects the interests of investors," he says.

The green light came in July when Premier Li Keqiang said in an executive meeting of the State Council that it is necessary to further reform the financing of the railways and to introduce private investment.

Chen Bingcai, a researcher with the National School of Administration, however, says more details need to be confirmed before moving to the next stage.

"We have seen the signal of allowing private investment twice before, but it was not realized in the end. I believe there will a more concrete and clear policy, such as how to properly divide the ownership and the management right," Chen says.

"Without legislation or detailed policy, it will probably not go into effect at the local level."

There are also many voices urging caution, such as Zhang of the National Development and Reform Commission. "We need to shift funding away from bank loans and state subsidies," he says, but authorities must "carefully consider the national interests involved".

Open for debate

Another key reason for dismantling the former railways ministry was to break the monopolies that had existed within the network for more than half a century and to introduce competition.

To achieve this, some observers say the corporation has to be broken up further, but how far that should go is a matter of heated debate.

Zhao Jian, a professor with Beijing Jiaotong University who specializes in the railway industry, suggests setting up three regional operators under the parent corporation, covering northern, central and southern China.

Others have raised plans for even more segmentation of the transport network.

"Breaking up China Railway Corp by geographical location would only mean the monopoly switches from a national one to regional ones," says Zhao Xu of the Unirule Institute of Economics.

He suggests allowing a number of companies to operate different routes, and to cross over into each other's markets, to spur competition and create a consumer-driven market.

By contrast, Zhang is hesitant about breaking the monopoly, citing the contribution the railways make to China's economy.

The consensus among researchers is that railway investment accounts for an estimated 2 to 3 percent of China's GDP growth.

"Putting all the emphasis on smashing the monopoly will harm the development of the railway economy in the long run," Zhang warns.

More expensive tickets?

While industry insiders debate the possible directions the railway system should go, the public is concerned about more immediate impacts of the reform, such as ticket prices and freight costs.

As China Railway Corp is a purely profit-driven entity saddled with the defunct ministry's huge debts, a ticket price rise would be an understandable course of action. According to Sheng Guangzu, the head of the corporation, rail tickets are generally priced lower than their market value.

However, any suggestion of an increase in the costs for passengers was dismissed by the central government. In a March statement, the National Development and Reform Commission, the country's economic planner, announced that train stations nationwide would stick to government-set prices.

Despite the statement, a price rise seems inevitable. "The cost of resources is rising, and railway transport is no exception," Zhang says.

The only way to constrain costs and avoid hitting passengers in the pocket, he says, is for other means of transport, such as air travel or highways, to play a larger role.

China's 12th Five-Year Plan (2011-15) aims to expand the national highway network by 25,000 km, bringing the total length to about 83,000 km, build 82 airports and expand 101 existing ones by 2015.

The plan also sets out to solve the lack of cohesion between different modes of transport and to promote hubs.

However, the public concern over ticket prices that erupted after the dismantling of the ministry shows that the reform must carefully balance public interest with the desire to make a profit.

"Under the old system, losses from public transport were offset by revenues from freight. As a commercial enterprise, China Railway Corp will be unwilling to take the losses," says Zhao Jian of Beijing Jiaotong University.

The problem could be solved through subsidies from the state, he says. "The question is, how much should those subsidies be?"

Xin Dingding contributed to this story.

Contact writers through tangyue@chinadaily.com.cn

(China Daily European Weekly 10/04/2013 page14)

Today's Top News

China, Russia co-work for security in Asia-Pacific: Xi

Animal welfare to be added in training

Talks 'can help Chinese banks' in UK

Robust home sales during holiday

APEC 'should take lead' in FTA talks

Beijing targets polluting cars

China warns US, Japan, Australia over sea issues

US on path to default if Obama won't negotiate

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|