The only way is up

Updated: 2013-08-09 09:45

By Lyu Chang and Wang Ying (China Daily)

|

|||||||||||

|

An employee of Xizi Otis Elevator Co Ltd assembles an escalator. Elevator and escalator sales have risen rapidly in China alongside urbanization. Provided to China Daily |

|

Maintenance is a growing part of China's escalator and elevator business. Provided to China Daily |

Elevator and escalator Manufacturers ride high on the back of China's urbanization

Wang Xiuli is a lift attendant. For the past five years, all she has had to do is to sit on a wooden chair and press buttons in an elevator of a 10-story office block built in the 1990s. It's grating on her nerves and gives her headaches.

The good and bad news (for her) is the job that pays around 1,000 yuan ($163; 123 euros) a month won't last long.

It is rare to see a lift attendant these days in the US and Europe. Mostly they are retained for nostalgic customer service reasons in grand department stores and hotels.

In the third and fourth-tier cities of China, there are still many like Wang to be seen, but as more advanced automated elevators replace the old ones and fill the thousands of new buildings springing up, their days, like their buttons, are numbered.

The upside is that many more lift personnel jobs will be created as business steadily increases for elevator and escalator manufacturers currently riding high on the continuing construction boom.

In the past decade, thanks to China's economic development and increased demand for construction projects, the elevator market in the country has grown rapidly.

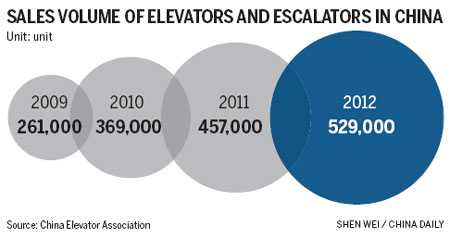

Last year, compared with sluggish sales in the US and Europe, the elevator and escalator market in China clocked sales of about 529,000 units, an increase of 15.8 percent year-on-year. Although growth slowed slightly from 24 percent in 2011, China still ranked first in the world for the amount of new elevators installed, according to data from the China Elevator Association.

Li Shoulin, head of the association, says the country's ongoing urbanization plan is the driving force behind such growth.

"A large amount of infrastructure construction is needed during the urbanization process," Li says. "As a result, more and more elevators and escalators will be installed in public places such as office buildings, commercial shopping centers, airports, railway stations and residential areas."

Shanghai Mitsubishi Elevator Co Ltd, a subsidiary of the Japanese Mitsubishi Electric Elevator, has maintained double-digit growth over the past few years as China's property boom ensures robust demand for elevator installations, says a company representative. Last year, it sold more than 60,000 elevators, and orders have continued to soar.

"The market is growing much faster than we expected," he says. "Before, no one thought we would produce 60,000 units last year, and now we are trying to reach the next goal of 100,000 units."

Foreign elevator brands account for 80 percent of the Chinese market, the world's largest. ThyssenKrupp Elevator, from Germany, is setting up a new factory in Zhongshan in the southern province of Guangdong with an investment of 300 million yuan. It is expected to be completed next year.

Andreas Schierenbeck, CEO of ThyssenKrupp Elevator AG, says part of its strategy in China is to invest in expensive technology to improve research and development and operational efficiency due to ever-increasing labor and operational costs.

Due to a shortage of qualified technicians, newcomers to the market in China often try to lure experienced and trained people from established companies through offering higher wages, but ThyssenKrupp says it will invest heavily in training. The company's global training center in Shanghai, SEED Campus, trains administrative and management staff as well as field technicians.

The company also plans to expand its business locations in the country from 184 to 250, covering most regions, to meet the growing demand for elevators and escalators in the newly emerging mega cities.

China's urban population is expected to swell to a billion by 2025, and the country will have as many as 221 cities, 10 of them with a 10 million-plus population, the consultancy firm McKinsey & Co states in its latest report.

As cities get bigger, so do the buildings, and there will be more growth potential for elevator companies.

Alan Cheung, president of Xizi Otis Elevator Co Ltd, the largest subsidiary of the US-based Otis company, says there is 51 percent urbanization in China at present, with still a long way to go to achieve the 80 percent urbanization level of Western Europe and the US.

"If China's urban population maintains an increase of 1 percentage point each year, about 15 million rural residents will enter cities," he says. "That population will increase demand for urban infrastructure and thus the demand for elevators and escalators during the process of social transformation."

Otis, one of the largest elevator manufacturers in terms of units every year, has built a factory in Chongqing to expand into central and western China.

"We chose Chongqing as our second production base in line with the government's long-term policy to develop the interior and western areas rather than just the coastal cities," he says.

Cheung says another growth point in China's elevator market arises from demand for repair and maintenance services. There are about 2 million units installed in China requiring maintenance.

"We want to be a service-oriented company instead of just a manufacturer or an equipment installation company," says Cheung, adding that the company's strategy for the future was built around customers' requirements.

The US company will continue to invest in the after-sales sector, expanding its repair and maintenance service staff by 30 percent to about 1,500 over the next few years.

"We expect profits to be maintained in the coming years, but we have to be more competent," he says.

The Finnish company Kone hopes to strengthen its position in the Chinese market by increasing its share in Giant Kone Elevators from 40 percent to 80 percent in 2011.

In April, Kone elevator industrial park was established in Kunshan, near Shanghai. At 240,000 square meters, the new Kone Park includes three elevator factories and one escalator factory.

Matti Alahuhta, CEO of Kone, was quoted by the Financial Times as saying that Giant Kone was especially strong in third and fourth-tier cities.

"As growth slows in the coastal cities, urbanization is moving to the central and western parts of the country, so those markets are still growing very fast," he says.

Alahuhta cites forecasts that the world's 600 biggest cities will account for 62 percent of global economic growth between 2007 and 2025. An increasing proportion of those cities are in China.

Contact the writers through lvchang@chinadaily.com.cn

( China Daily European Weekly 08/09/2013 page20)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|