China seen as FDI land of promise

Updated: 2013-07-05 09:49

By Li Jiabao (China Daily)

|

|||||||||||

|

Chinese companies are investing broadly in industries across the world, according to a United Nations Conference on Trade and Development report. Yan Daming / for China Daily |

Capital outflow continued to grow last year, reaching a record $84 billion

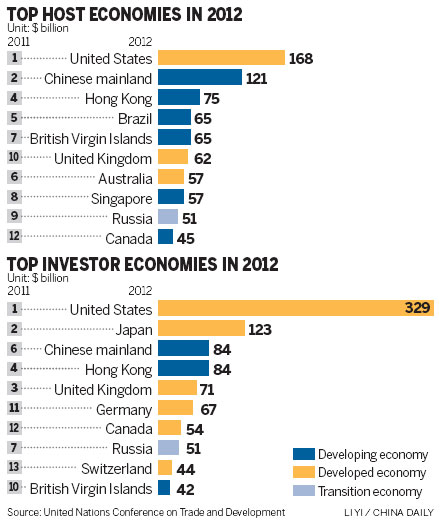

China moved up from sixth place to third in outward foreign direct investment last year, after the United States and Japan, the United Nations Conference on Trade and Development says.

The organization's World Investment Report 2013, published on June 26, cites a survey this year in which 60 percent of investment promotion agencies "ranked China as the most promising source of FDI".

FDI outflow from China continued to grow last year, reaching a record $84 billion (64.5 billion euros), while total outward FDI from East and Southeast Asia rose 1 percent to $275 billion amid a sharp decline in global FDI outflows, the report says.

China's outbound direct investment in non-financial sectors rose 20 percent year-on-year to $34.3 billion in the first five months of the year, while spending surged 28.6 percent year-on-year to $77.22 billion, says the Ministry of Commerce.

"China's outward direct investment grew at a striking pace," says James Zhan, director of the investment and enterprise division of the UNCTAD. "Driven by multiple goals of exploring markets, enhancing corporate performance, acquiring natural resources and strategic assets, Chinese companies made very broad outward investments in different sectors and regions. It's worth noting that Chinese investment in the overseas infrastructure sector increased very fast."

Liang Guoyong, an economic affairs officer in UNCTAD's investment and enterprise division, says Chinese companies have become the targets of investment protectionism because of their fast-growing overseas investments, as well as the broad scope of the spending.

"The motivation of getting natural resources and strategic assets, including technologies and brands, easily leave Chinese companies as the targets of protectionism, as China, at present, tends to invest in Europe and the US for advanced technology and brands," Liang says. "Mergers and acquisitions in the process often arouse employment concerns in the host countries. State-owned enterprises, the major drivers of China's outbound investment, were often easily targeted, which also accounts for the rising protectionism against China."

After the Chinese meat giant Shuanghui International Holdings Ltd proposed to buy Smithfield Foods Inc, the world's largest pork producer, a number of US senators urged the Obama administration to consider whether the proposed $4.7 billion deal, the biggest takeover of a US company by a Chinese firm, posed a threat to the US food supply that could justify blocking it.

Meanwhile, FDI inflows to China fell 2 percent year-on-year to $121 billion in 2012, second only to the US, while China remained the top investment destination for transnational corporations in the medium term, the report says.

FDI in China's non-financial sectors fell 3.7 percent year-on-year to $111.72 billion, the Ministry of Commerce says. FDI in China grew 1.03 percent in the first five months of 2012 year-on-year to $47.6 billion.

"The structure of FDI inflow to China has changed following the country's economic restructuring and industrial upgrading," Zhan says. "Owing to rising costs in the eastern region, some investment and production activities are being transferred into inland areas and the share of the central and western regions in China's total FDI inflow rose from 12 percent in 2008 to 17 percent in 2012."

Some low-end manufacturing plants are moving to Southeast Asian countries with lower costs than China, and FDI inflow to China's high-tech and advanced manufacturing sectors is increasing rapidly, he says.

"The total number of foreign research and development centers in China doubled in the past five years and reached 1,800 at the end of 2012. The quality and structure of China's FDI kept improving."

Liang says that transnational corporations are increasingly attracted to China due to the country's huge market and fast economic growth, as well as the opening up of its services sector.

China's economic growth eased in recent months as the new leadership steer the country to a more balanced and sustained growth path. GDP in the last quarter of 2012 rose 7.9 percent year-on-year, and fell to 7.7 percent in the first quarter of the year.

"With the improvement in FDI inflow, China kept enhancing its participation in global value chains," Zhan says.

lijiabao@chinadaily.com.cn

(China Daily European 07/05/2013 page21)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|