Cleared for takeoff

Updated: 2013-07-05 09:49

By Karl Wilson (China Daily)

|

|||||||||||

Aviation infrastructure projects seek to keep pace with airlines' rapid fleet expansions

Across the length and breadth of Asia, trillions of dollars will be spent over the coming years and decades as new airports and navigation services are built to cope with fast expanding fleets of airlines meeting growing demand for air travel.

According to the International Air Transport Association, the Asia-Pacific region will represent 33 percent of the estimated 3.6 billion global passengers in 2016, up from 29 percent in 2011.

The Asia-Pacific is now the world's largest regional market for air transport according to the IATA, ahead of North America and Europe which each account for 21 percent.

The region also dominates with over 50 percent of all global air freight.

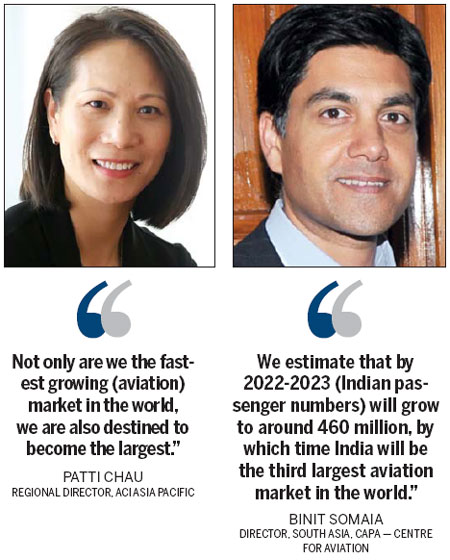

"Not only are we the fastest growing (aviation) market in the world, we are also destined to become the largest," says Patti Chau, Asia-Pacific regional director for the Airports Council International.

"Many airports in the region, most of them major hub airports, recorded double-digit growth rates last year in passenger traffic, due to the robust economic growth in their own countries and the rising propensity to travel in the region," she says. These airports include Osaka, up 19.2 percent; Abu Dhabi, 18.9 percent; Riyadh, 17.9 percent; Tokyo Narita, 17.2 percent; Jakarta, 14.4 percent; Dubai 13.2 percent; Bangkok 10.6 percent; Singapore 10 percent and Seoul Incheon, 11.3 percent.

Beijing was the busiest among the Asia-Pacific airports in 2012, handling more than 81 million international and domestic passengers, Chau says.

"Taking second place was Tokyo Haneda Airport with 67 million passengers and the other three airports that followed were Jakarta, Dubai and Hong Kong with around 57 million passengers," she says.

The world's two biggest aircraft manufacturers, Boeing and Airbus, say that within the next 20 years more than half of the world's air-traffic growth will come from the Asia-Pacific region.

Boeing estimates that airlines in the region will need 12,030 new aircraft, valued at $1.7 trillion, over the next 20 years. This will take the regional fleet from 4,710 aircraft in 2011 to 13,670 in 2031.

Earlier this year in Singapore, John Leahy, chief operating officer (customers) for Airbus, said that over the next 20 years the region's airlines will purchase around 9,870 new passenger and cargo aircraft valued at $1.6 trillion.

"This represents 35 percent of all new aircraft deliveries worldwide over the next 20 years, ahead of Europe and North America," he said. "In terms of value, the region will account for 40 percent of the global market for new airliners."

Analysts say total traffic in the region is expected to grow at around 6.4 percent annually, fueled by national economic growth and the increasing accessibility of air transport services.

Aviation infrastructure development is trying to keep pace.

Albert Tjoeng, assistant director for corporate communications at IATA, says the situation in Southeast Asia with airports is "mixed".

"There are some airports that are investing in infrastructure to handle the expected traffic," he notes. "Singapore, Kuala Lumpur and Hong Kong are investing in additional runways and terminals.

"And at the other end of the spectrum there are airports such as Jakarta and Manila that lack the infrastructure capacity to accommodate the traffic growth, and do not have a definite plan on what they will be doing about it."

More than two-thirds of the world's airports now under construction are in China, which is expected to spend more than $250 billion on its aerospace sector, according to Research and Markets' latest report China Aviation Industry Analysis.

By the end of 2015, China will have added 82 new airports - taking the number of passenger and cargo airports in the country to 264. Among them, 16 are relocations and 91 expansions.

Outside Beijing, construction is underway on a third international airport to serve the capital.

Beijing Daxing International Airport, on the southern outskirts, will cover more than 90 sq km, have nine runways by 2030 and an annual capacity of 130 million passengers - 23 million more than London's Heathrow and New York's JFK airports combined.

The Indian government is planning to spend $12.5 billion over the next four years on airports, with 75 percent of the investment expected to come from the private sector.

Binit Somaia, director for South Asia of CAPA - Centre for Aviation, says India will need to invest $40 billion in airports and associated infrastructure by 2025.

India has seen its passenger numbers (domestic and international) rise from 42 million in the 2000-2001 financial year to 160 million in 2012-2013.

"We (CAPA) estimate that by 2022-2023 this will grow to around 460 million, by which time India will be the third largest aviation market in the world," he says.

Airports were simply not a priority, catering to an industry that was seen as elitist, Somaia says.

"There has since been a shift in thinking which increasingly recognizes that aviation is in fact a critical component of the economic infrastructure of a country and that it can drive business, trade and tourism to support growth and create jobs," he says.

A vibrant aviation industry can be a tool of economic development, he believes. Since 2005, the Indian government has actively sought to modernize airports.

By the end of 2014, once the upgrading of Mumbai is complete, all six of India's leading cities (accounting for almost 70 percent of traffic) and many smaller ones will have modern and efficient airports, he adds.

"In fact, in the last few years several Indian airports have been climbing the Airport Service Quality rankings and winning awards, something which was unthinkable a little over five years ago," he says. "So the situation is improving quite rapidly and will continue to do so."

Somaia adds that before 2005, excepting a relatively small airport at Cochin, development of airports had been the exclusive domain of the Indian government.

The government asked the private sector to take a 74 percent majority role in public-private partnerships to upgrade or develop four of the leading gateways - Delhi, Mumbai, Bangalore and Hyderabad.

"Almost $10 billion has been invested in the sector since then, the majority of it private capital," Somaia says.

ACI's Chau says last year's traffic showed that nine of the top 20 busiest airports in the world are in the Asia-Pacific region.

Strong traffic growth comes at a cost.

"Many of the airports in our region are actually already operating beyond their design capacity," Chau says.

"Take Jakarta's Soekarno-Hatta airport for example, which was designed with a capacity of 22 million passengers and is handling more than double this figure. The government is now adding a third terminal which will boost capacity to 62 million passengers a year."

Around the region, governments and private enterprises are investing heavily in infrastructure, Chau adds.

Malaysia is adding a new terminal capable of handling 45 million passengers a year at Kuala Lumpur International Airport and Singapore is adding a fourth terminal to boost capacity at Changi Airport to 82 million passengers a year by 2017.

An expansion costing $166 million for Phuket International Airport in Thailand is underway and scheduled for completion by 2015. It will then be able to handle 12.5 million passengers a year, up from the existing annual capacity of 6.5 million passengers in one of the world's most popular resort destinations.

karlwilsonchinadailyapac.com

(China Daily European 07/05/2013 page15)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|