Falling back in the field

Updated: 2013-07-05 09:47

By Cindy Chung, Ben Chow and Li Ting (China Daily)

|

|||||||||||

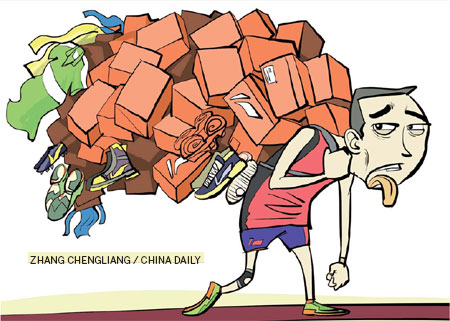

Chinese sportswear makers are struggling and starting to cramp in the race for profits

The best way to gauge the fast-moving consumer goods market is to go shopping. After frequent visits to physical and online sports stores, we concluded that now is the best time to buy Chinese sports brands.

Chinese sportswear makers are embroiled in unprecedented challenges that will surely knock some of them out of the running.

In April, several Chinese sports companies, including Li Ning and Peak Sports, staged massive discount promotions in many of Beijing's supermarkets.

Products in Wumart supermarkets, for instance, were sold with an average 50 percent discount, and the promotions were held on two weekends, instead of the usual one.

The same month, Li Ning T-shirts were sold at 19 yuan ($3; 2.37 euros) each - about 80 percent off - on Vancl.com, one of China's largest e-retailers. The products were inventories from two to three years ago. (Older unsold goods are usually shifted through outlet shops, low-tier markets and charity donations.)

April is generally off-season for sales in sports products such as sneakers and jerseys. It is more the time when new arrivals are enthusiastically marketed. Retailers often put out-of-season sports goods on sale before spring, when it is still too cold for outdoor activities in most parts of China.

Clearly, the recent sales, which ran against tradition by their size and timing, reflect an inventory crisis.

Domestic brands had pinned high hopes on a sports market that they believed would grow by at least 20 percent annually following the Beijing Olympics. Almost all sports companies pressed the expansion button to open as many stores as possible, and ran their production lines at full capacity.

But the market has only grown by single digits since 2010 due to the economic slowdown and cooling demand for sportswear. The lull was sudden and unexpected, resulting in high stocks and mounting accounts receivable, forcing the companies to curb expansion.

Among the six largest listed sportswear companies - Anta, Li Ning, Peak Sport, China Dongxiang, Xtep and 361 Degrees - only 361 Degrees increased its number of stores last year. The other five closed a total of nearly 5,000 outlets. The slimming-down continued this year. Li Ning, for example, shut down another 1, 200 shops.

The blind expansion was also a result of an anomaly in accounting practice. Chinese sports companies are not in the habit of checking how many goods are really sold to end consumers. As soon as they sell an amount to wholesalers and distributors, they use the figure as sales. As it may take some time for distributors to resell the goods, and given the distributors' habit of stocking some goods to cushion the risk of future price hikes, the number of products actually sold to end consumers may be much lower than the sales figures on sports producers' balance sheets.

The disparity made producers over-optimistic about the market potential and resulted in excessive inventories. Unable to sell the inventories and having to maintain a large sales network, their profitability inevitably declined.

Li Ning last year posted its first annual loss since its listing in 2004, amounting to 1.98 billion yuan, mostly because it earmarked massive provisions for excessive inventories.

Others managed to make profits but witnessed steep slumps in them. Anta Sports Products, the largest sportswear manufacturer by revenue in China, saw its 2012 net profit decline 21.5 percent to 1.36 billion yuan.

It is not an exaggeration to say that Chinese sportswear firms are going through their most difficult period.

And if life for the big listed companies is tough, the situation of smaller players can be described as dire. According to a report by China National Commercial Information Center, about 20 percent of small footwear companies went bankrupt last year, the highest rate in five years.

Again, fewer orders and high inventories are the key problems, the report says.

If running up high inventories amid a slow market is not the end of the world for Chinese sportswear makers, a loss of a future development strategy is.

Liu Wenru, mayor of Jinjiang in Fujian province, which produces 20 percent of the world's sports shoes and 40 percent of the domestic supplies, said recently: "The days when apparel and footwear makers easily made money by boosting their manufacturing capacity are a thing of the past.

"It is time for them to focus on innovation and design as well as to enhance differentiation in marketing to compete with high-end foreign brands."

But it is never easy to transform from a pure manufacturer to a designer, and improving marketing differentiation is exactly what Chinese sportswear firms are not good at.

Li Ning, for example, has been jumping between the idea of being an all-around sportswear brand and the dream of being a specialist in basketball outfits. It has not made up its mind yet.

361 Degrees is determined to be a youth brand, but its slow speed in rolling out new products makes its products mostly favored by those aged over 30.

Clearly, Chinese brands are not sophisticated enough to make themselves stand out from the competition. They will have to undertake a painful transition that may take five to 10 years. During the process, a large number will find themselves in a sink-or-swim situation, thus paving the way for a highly consolidated market.

Moreover, many Chinese sportswear manufacturers face another major difficulty - passing the torch to the next generation.

The China National Commercial Information Center report said nearly half of the footwear companies, including many of those that have established a sales network of more than 300 outlets across the country and have developed their own brands, said they find it hard to hand over the business to their children, who have little interest in the traditional manufacturing and retail business.

Some of these business owners, already in their 50s and 60s, are looking for potential buyers.

All this offers a golden opportunity for those who want to acquire a Chinese sportswear company. Foreign giants such as Nike and Addidas are not keen dealmakers in the Chinese market, as they stick to organic growth in this market. But they should now rethink their strategy.

Buying a medium-sized domestic brand means they can acquire valuable sales channels in lower-tier Chinese cities, the future market for sports companies, as well as a good local brand that they may use as a sub-brand, and probably a financially stable asset.

But the window of M&A opportunity may be open for only a few years. After that, a market consolidation may take place among Chinese producers, with a much lower chance of foreign giants finding a good bargain.

The authors are analysts at Universal Consultancy in Shanghai, which specializes in research of the fast-moving consumer goods market. The views do to not necessarily reflect those of China Daily.

( China Daily European 07/05/2013 page12)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|