Power of innovation

Updated: 2013-05-31 09:57

By Cecily Liu (China Daily)

|

|||||||||||

|

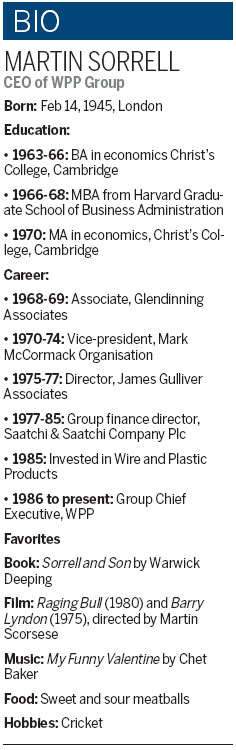

Martin Sorrell, chief executive of WPP Group, says China is taking the right steps to build an innovation economy. Cecily Liu / China Daily |

Chinese brands must respond quickly to consumer requirements, says advertising pioneer

Innovation is helping Chinese brands make strides in the global arena, says Martin Sorrell, chief executive of WPP Group, the largest advertising company in the world.

Sorrell, 68, says that China will shift from a manufacturing hub to an innovation economy in a path more rapid and powerful than other Asian economies such as Japan and South Korea that have undergone similar transformations.

"I think the Chinese are different (from Japanese and South Korean companies). They listen and learn very effectively. Coming from a big trading nation, they are very flexible and also react more quickly to changes.

"Once Chinese brands get the basic understanding about branding and marketing, which I think they are on the way to doing, they will be extremely powerful. You will see the equivalents of Samsung, Sony and Toyota emerging from China," he says.

In Sorrell's view, China is taking the right steps to build an innovation economy by strengthening its educational system, cultivating entrepreneurial spirit, accumulating trading experience and investing abroad to acquire leading technologies and brands.

"China will continue to build its internal resources, at a time that growth in the West is slowing. I think it's just a question of time (before China becomes innovative)."

Regarded as a thought leader in the advertising industry, Sorrell is also known as the major driving force behind the consolidation of the global communications industry over the past 20 years.

In 1985, Sorrell privately invested in Wire and Plastic Products, a British wire shopping basket manufacturer, and joined it as full-time chief executive in 1986.

He then started a series of acquisitions of under-priced advertising related companies, a strategy that eventually made WPP the world's largest advertising company by revenue.

Fully convinced about China's growth potential, Sorrell played a key role driving WPP's expansion in China. Last year the country became WPP's third-largest market after the US and Britain, with revenue of $1.3 billion (1 billion euros).

Several companies in the WPP network were among the first marketing and public relations companies to open offices in China, including Ogilvy & Mather in 1961, Hill & Knowlton in 1984 and Young & Rubicam in 1985.

WPP companies have also won many high-profile contracts and clients in China, including the Beijing Olympics and Shanghai Expo, and companies such as China Mobile, ZTE, Suning Appliance and Lenovo.

"Chinese companies are increasingly recognizing the need to develop branding. Traditionally they have focused on developing a good product, which has a lot of awareness and is at the right price points for Chinese consumers, but had no price premium," Sorrell says.

However, awareness is not the same as loyalty, Sorrell says. He says that many Chinese companies have built awareness through good distribution channels, but only loyalty will generate price premium.

In comparison, foreign brands have done a better job at cultivating brand loyalty in China, but lose to Chinese brands on aspects such as market penetration, partly because they are too expensive for Chinese consumers in lower-tier cities.

To explain the benefits of branding, Sorrell cites BrandZ Top 50 most valuable Chinese brands, a report WPP started to produce annually in 2010.

Calculations are made by stripping away financial components from corporate earnings to derive the company's brand value. According to the 2013 report, the 50 top value Chinese brands grew by 5.8 percent in stock market value in the 14 months ending September 2012, while Morgan Stanley Capital International China Index, a weighted index of Chinese stocks, fell 5.6 percent.

A more stark demonstration of this trend is shown by the performance of BrandZ top 10 most valuable Chinese brands, which rose by 29.2 percent in value over the same period.

The 2013 BrandZ report said that key factors contributing to the development of brand values in China include responses to consumer demand, innovation, investment in brand building campaigns, strategic plans to repair reputations damaged by safety issues, and forming alliances with reputable international brands.

The report gave high rankings to many Chinese technology and financial services companies, including China Mobile, Industrial and Commercial Bank of China, China Construction Bank, Baidu and Tencent.

Sorrell says that Chinese brands are also starting to think more about the need to respond to consumer requirements when they compete on the international stage, which they may have done less of in China's domestic market because China's large consumer population made their tasks easy.

"The problem with Chinese companies is that they are blessed with a market of 1.3 billion people - the America market only has 300 million," Sorrell says, explaining that such an innate advantage can act as a disincentive for some Chinese companies to internationalize.

While Chinese companies have good reasons to expand internationally after saturating the domestic market, they must prepare very early for international growth, he says.

"(Focusing only on domestic market) would be a strategy which would run out of road quickly. We're seeing massive investments from Chinese companies in Latin America, Europe and Africa. Chinese companies are becoming increasingly aware of the international opportunities."

Sorrell says one good example is the Chinese white goods company Haier, which gained many contracts for its air conditioners in the student accommodation market in the US.

"They had to manufacture highly effective units, and they succeeded by outsmarting Japanese manufacturers. It is a considerable achievement for Haier, because Japanese companies like Sony and Mitsubishi had dominated many export categories before China's industrial revolution started."

He says another good example is Lenovo, which started thinking more internationally about customers' needs after buying IBM's PC division in 2005. Many more Chinese brands will follow this path, he says.

"The simple truth is that China has been a manufacturing hotbed for decades because of cheap labor. Cost is starting to rise, and Chinese manufacturers now must think differently about what consumers want and be more innovative."

He says that Chinese companies will rapidly catch up with Western companies on innovation, although he does not like the idea of implying that the West is ahead.

"China's process will be much more rapid. China has not gone through a PC revolution. China has gone through mobile and smart phones, whereas we went through tablets and then smart phones and smaller screens."

Sorrell says that China's digital revolution, with new platforms like Sina Weibo and Tencent Weixin, has also provided Chinese companies great opportunities to build brands.

"Television and the press will not be as personalized as online media, whether it be search or display or video or mobile."

cecily.liu@chinadaily.com.cn

(China Daily 05/31/2013 page32)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|