Virtues of the state-owned firm

Updated: 2013-05-24 09:29

By Andrew Moody (China Daily)

|

|||||||||||

|

Colin Mayer says M&As have in many cases destroyed the value of organizations. Zou Hong / China Daily |

Long-term view enables enterprises to deliver in contrast to investor-driven needs of private sector

China's state-owned enterprises have a better ownership model than many Western firms which are often cruelly exposed to free markets, Colin Mayer believes.

The professor of management at Oxford University's Said Business School insists these corporations -often attacked for being wasteful and inefficient - are able to plan for the long term and have delivered results for the Chinese economy.

"The state has been a tremendous source of continuity and long-term investment in Chinese corporations and has contributed to the success of the Chinese economy," he says.

"This is in marked contrast to the very short-term approach by investors, particularly in UK corporations."

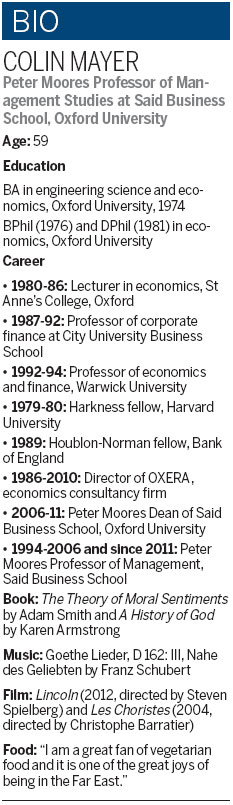

Mayer, 59, one of the world's leading experts on management, was in Beijing to lecture at the School of Business at Renmin University of China.

He was speaking about his new book, Firm Commitment: Why the Corporation is Failing Us and How to Restore Trust In It.

In it, he argues that the firm in the West over the past 20 years has gone from an "Alice in Wonderland" concept to being "Frankenstein in Transylvania" as it has become a victim of the forces of mammon.

Firms, he argues, came into existence many centuries ago to achieve set goals and also serve the interests of managers and employees and not just those of shareholders.

Now, however, he says only the interests of shareholders, whether they be pension funds or other institutional investors, matter and these have become greedy for short-term financial gain.

Mayer says mergers and acquisitions or stripping corporate assets have been seen as driving efficiency but in many cases they have merely destroyed the value of organizations.

"This idea emerged from the way business education was taught in the 1960s. Pensions funds and life insurance companies were emerging as important investors at the same time.

"A corporation existed to maximize the interests of the shareholders and that is what is taught to students when they walk through the door of the business school."

Mayer, speaking in a meeting room at Renmin University, had just arrived in China from South Korea, a country that has been successful in nurturing enterprises such as Samsung and Hyundai into global giants.

"Korea is another example where the presence of long-term investors has been extremely beneficial to the development of the Korean economy. There the long-term investors have been the families in the chaebol (family-owned conglomerates) that have allowed these corporations to develop, invest and reach a critical size."

Mayer, who first came to China in 1985 for a conference on corporate responsibility, accepts that China's state-owned enterprises, which still dominate the key strategic industrial sectors, do need to reform, but he cautions the government against following any Anglo-American model.

"The ownership model (of state-owned enterprises) does need to adapt going forward, but it has to retain the emphasis both on the long-term perspective, which has been an important contributor to their success, and also the notion that corporations have a purpose beyond that of shareholder interests."

He says one model that China could adopt and one that might become increasingly attractive in the West is transferring ownership to shareholders who want to make a long-term commitment.

"Shareholders could register the period they intend to hold their shares. If you intend to hold for 10 years, you might get 10 times the voting rights as a shareholder who wants to hold for one year," he says.

"This is a particularly attractive model for a country like China that doesn't want to go over to the casino capitalism we have seen in the West."

Mayer, who was brought up in Ealing in west London originally, studied engineering as well as economics at Oxford, where he has spent most of his student and academic career.

A Harkness fellow at Harvard University in the late 1970s, he is also a former dean of the Said Business School at Oxford University, now housed in a magnificent modern building in the heart of the city, built with 23 million of funds from the Saudi-Syrian businessman Wafic Said.

Mayer, now the Peter Moores Professor of Management Studies there, also spends quite a lot of time in Africa working on a Gates Foundation project looking at the development of the mobile phone payment system, which has taken off on the continent, where few have access to bank accounts.

He believes it is vital for Africa, as part of its own development, to pay more attention to fostering indigenous firms.

"To date it has been dependent on essentially multinational corporations. The problem with multinational investments is they tend to be fair-weather activities. This was observed in many of the accession countries in Europe when foreign multinationals pulled out at the onset of the financial crisis.

"To get the long-termism it needs, Africa needs to build its own indigenous corporations since they are always more committed and generally invest more than multinationals anyway."

One of the purposes of his book is to examine why the firm - something that we all take for granted - came into existence out of the merchant guilds in London in the 15th and 16th centuries.

"It essentially emerged as a form of administration for, in many cases, undertaking voyages of discovery around the world for engaging in forms of commercial activity in one form or another."

What would have happened, however, if the firm had not been invented? "We would have had some organizations like employee-owned institutions such as the John Lewis Partnership model in the UK.

"These can work in the retail sector because it is a cash business. It is hopeless for manufacturing and research and development, where you have to raise capital."

One alternative for China, if it is looking for an alternative to its state-owned enterprise model, is to set up foundations.

A number of leading companies around the world - including Swedish furniture retailer IKEA; Velux, the Danish window company; Carlsberg, the Danish brewer; Bosch, the German automotive company; and Bertelsmann Stiftung, the German international media group - are all ultimately controlled by such bodies.

Mayer says that these foundations can make sure the companies meet wider social objectives than just enriching shareholders.

"They are the custodians of the values and principles of the organizations and if the board members fail to uphold them, they will take responsibility for the failure."

Mayer says that if the Chinese government looks to privatize some of its state-owned enterprises, it should also avoid copying the UK's "extreme market-orientated view" of the corporation that leaves companies vulnerable to takeovers.

"In the US, in many states you can have poison pills or anti-takeover devices that make hostile takeovers impossible," he adds.

"In the US you are better able to choose a company form that is best suited to your activity and that is why the US has been so successful. What a corporation should look like depends on whether it is in the high-tech sector, in traditional manufacturing or an entrepreneurial company. This is something China can learn from going forward."

andrewmoody@chinadaily.com.cn

(China Daily 05/24/2013 page32)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|