Gateway to Europe

Updated: 2013-05-24 09:04

By Tuo Yannan (China Daily)

|

|||||||||||

|

Sany Heavy Industry Co Ltd expects to double its growth in Europe after its $470 million acquisition of Putzmeister last year. Tuo Yannan / China Daily |

Dusseldorf becomes destination of choice for Chinese companies looking to spread wings

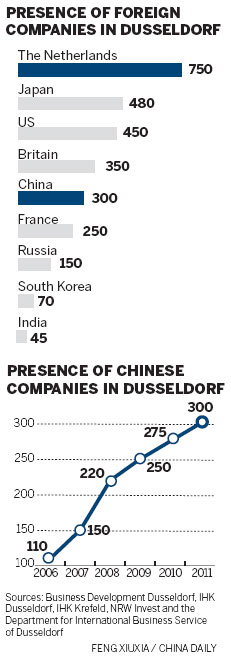

Dusseldorf is not exactly the first name that one would associate with Chinese enterprises in Europe. But the capital city of Germany's North Rhine-Westphalia state is not only an important investment destination, but also an important gateway for Chinese companies in Europe.

According to current estimates, there are about 800 Chinese companies in North Rhine-Westphalia, predominantly in Dusseldorf, Cologne and Lower Rhine regions.

Petra Wassner, chief executive officer of NRW Invest, the state's economic development agency, says that with a GDP of about 582 billion euros ($748 billion), the state has become an important beacon for economic investment in Europe. NRW generates about 22 percent of the German gross domestic product, and about 4.5 percent of the European Union members' GDP.

"At 27.1 percent (189.8 billion euros), the state recorded the highest direct investment share among all 16 federal states in Germany (699.7 billion euros) at the end of 2010," Wassner says.

"Though several thousand companies from the North Rhine-Westphalia region have invested in China during the past 10 years, it is the Chinese investment in North Rhine-Westphalia that has been more eye-catching," she says. Locations such as Dusseldorf and Cologne are often seen as the ideal conduits for Chinese companies seeking access to the vast European market.

Annette Klerks, head of the Department for International Business Service and head of China Competence Center Dusseldorf, says that 10 years ago there were only 15 Chinese companies in Dusseldorf, and the local companies that provided services to these Chinese enterprises were limited to just a few.

However, the number of Chinese companies has climbed to about 300, and every year the city on average receives enquiries from 20 new companies to join the Chinese society.

"Now we have 20 pages full of experts, consultants, law firms and even tea shops that provide services to Chinese companies," says Uwe Kerkmann, director of the Office of Economic Development of Dusseldorf. "A decade ago it would have been difficult to find law firms that had Chinese-speaking employees. That is not the case now."

In 2004, the city government started a "China goes Dusseldorf" strategy to provide one-site services for helping Chinese companies to set up shop in the region. The city even hired its first Chinese employee in its local government.

"This year, we will have more than 30 companies from China coming to our city. About 300 local companies already have business relationships with China," Klerks says.

Chinese companies consider the central location, the proximity to markets and the good transport infrastructure as their main reasons for investing in North Rhine-Westphalia, says Wassner.

"NRW is highly interesting for consumer products," she says. "Around the capital city, almost 150 million people live within a radius of about 500 kilometers.

"This is equivalent to one third of all consumers and 45 percent of the purchasing power in the EU."

Wassner says other reasons for Chinese enterprises choosing Dusseldorf include the vast and vibrant Chinese community and the tailor-made support facilities.

"Prior investments have led to the development of an important Chinese community and infrastructure, which makes it even more attractive for other Chinese companies to follow suit," she says.

"North Rhine-Westphalia provides an attractive environment with institutions like the Dusseldorf China Center, the Chinese Enterprises Association and Chinese banks like Bank of China and the Industrial and Commercial Bank of China. It makes settling in for newcomers a lot easier."

Walter Schuhen, marketing director of Dusseldorf China Center GmbH, says that of the 300 Chinese companies in Dusseldorf, 15 use the location as their headquarters.

Schuhen says that are about 2,500 Chinese people living in Dusseldorf. Although the number is not as large as the Japanese community, it is increasing every year.

"China has been the most dynamic growth driver for Dusseldorf, and on average we see 20 to 30 new Chinese companies here every year. Over one-third of our FDI comes from China," Kerkmann says.

Compared with a decade ago, most of the Chinese companies in Dusseldorf are now shifting from the import and export trading sector, and manufacturing low-price merchandise to high-tech and high value-added industries.

"About 10 years ago, a Shanghai-based sewing company took over a German company. That was the first Chinese company that merged with a local company here," Schuhen says.

Machinery firm Sany Germany GmbH, telecom equipment producers Huawei Technologies Co Ltd and ZTE, TV maker Hisense and home appliance producer Haier Inc have set up units in Dusseldorf.

Though the initial corpus required for starting an enterprise in Dusseldorf was just 20,000 euros a decade ago, it has since increased, he says without revealing the exact corpus now. In the past, many Chinese companies came to Germany without a detailed business plan or strategy, but now "they know exactly what they are doing and why they are here", Kerkmann says.

Sany Germany GmbH is one Chinese company looking to make it big in Europe. The German arm of Changsha-based Sany Heavy Industry Co Ltd aims to have a sales revenue of 100 million euros in 2015 after it acquired German concrete pump maker Putzmeister in a $470 million deal last year.

"Sany has already invested more than 500 million euros in the European market, and (after the merger) its aim is to more than double growth rate and size in the next five years," says Bart Decroos, general manager of Sany Germany GmbH.

Huawei is another example of successful Chinese investment in Dusseldorf. The telecom equipment maker entered the European market a decade ago, and since 2011 Europe has been its largest market outside of China. It earned $400 million from the region in 2012, or about 13 percent of its total global revenue.

It started its European operation in 2002 at a time when companies there were keen to attract international partners. The company now has around 7,000 employees in Europe, 70 percent of whom are local workers.

"In the next three years, we plan to recruit another 4,000 local employees, and reduce the number of our Chinese employees," says Tao Jingwen, president of Huawei West Europe Region.

"About 10 years ago, German people were apprehensive about Chinese companies coming to the region," Schuhen says. But those apprehensions have vanished after Chinese companies started gaining reputation in the global market, and also showed that they can make a difference by adding jobs.

Local government officials admit that there has been a sea change in perception of Chinese enterprises. "A decade ago, Chinese companies had the image of cheap products," Kerkmann says.

Though a machinery industry veteran with more than 20 years of experience, Decroos says building up Sany's business in Europe has not been easy after the merger. Branding is often the first step that most Chinese enterprises need to tap the European market, he says.

"All Chinese companies are unfortunately labeled as companies with low-priced products. This is a perception that needs to be changed if Chinese companies want to make further strides in Europe," Decroos says.

Kerkmann says there is still space for Chinese companies to further improve their branding. Good products for good prices is not the only thing that European people care about. Other factors like good branding and company image are also very important. "We believe that Chinese companies are aware of the facts and will get better and better in the future," he says.

tuoyannan@chinadaily.com.cn

(China Daily 05/24/2013 page6)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|