Rich looking overseas to preserve wealth

Updated: 2013-05-10 09:03

By Wang Xiaotian (China Daily)

|

|||||||||||

Privately held wealth on the Chinese mainland hit 80 trillion yuan ($13 trillion; 9.9 trillion euros) in 2012, with more than 700,000 individuals now holding 10 million yuan or more in investable assets, more than double the number at the end of 2008, according to a new report.

But the annual growth of private wealth moderated between 2010 and 2012 to 14 percent, from 28 percent between 2008 and 2010, amid an economic slowdown.

The findings, from China Merchants Bank and US-based management consulting firm Bain & Co, showed that the richest on the mainland are stepping up their investment in foreign assets as they try to preserve their fortunes in the face of uncertain economic prospects.

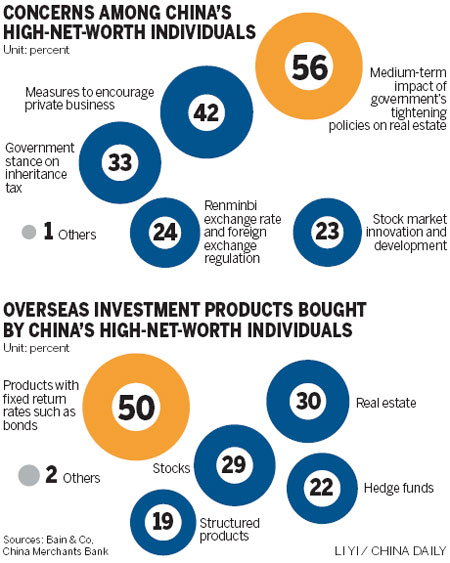

Many of those surveyed said they are becoming increasingly concerned by potential changes in Chinese regulatory policies, financial market volatility and other business risks.

About 60 percent of respondents indicated they were now focused on preserving their wealth, against using it to make more.

Chen Kunde, wealth management business director at China Merchants Bank, said the shift in priority was being driven by uncertainties over economic growth.

"As the rich gradually age and their knowledge changes, they are tending to focus more on preserving the wealth instead of fighting to create more, in a business environment where it is becoming more difficult to make extra money."

The increased prudence has also been highlighted by a rise in the proportion of assets invested in lower-risk bonds in the domestic market, which now account for an 8 percent share of investments against 2 percent in 2011.

Thanks to tighter government control of the property market, more than 60 percent of respondents said they had a "hold-and-see" attitude toward investing in real estate in the short term, indicating they have no immediate plans to sell.

About 35 percent said they planned to lower their property investment levels.

More than half of those with 10 million yuan of investable assets or above were concentrated in five coastal provinces, while Chongqing municipality, Heilongjiang, Shanxi and Shaanxi provinces and the Inner Mongolia autonomous region joined the club with more than 10,000 such individuals in 2012.

On top of cash holdings in traditional bank accounts, individuals said they had a strong interest in forming family trusts, and in creating a diversified portfolio of international interests to preserve their wealth and spread the risk, said the report, with more than half having overseas investments.

Half of the respondents said they were looking to invest in less-risky fixed-income products, while 30 percent wanted to put their money in overseas properties.

Hong Kong remained the favorite destination for cross-border investment.

Jennifer Zeng, a Bain partner in Beijing and a co-author of the report, said: "We don't see a great difference between high-net-worth individuals in China and other countries when it comes to their goals, although the situation here is changing and the shift toward the preservation of wealth might accelerate as the speed at which the wealth was created was faster than in most parts of the world."

The report said that Chinese banks had strengthened their position in the domestic wealth management market, while foreign banks had a much lower share of the market due to business restrictions.

It said the need for overseas asset allocation among the rich is rising, and China's banks should be encouraged to develop overseas business models and accelerate overseas expansion, to better cater to that rising demand.

wangxiaotian@chinadaily.com.cn

(China Daily 05/10/2013 page3)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|