French company sees opportunity in rubbish

Updated: 2013-05-10 08:50

By Meng Jing (China Daily)

|

|||||||||||

|

Suez Environment has operated seven landfills in Hong Kong and is going to expand its business on the Chinese mainland. Provided to China Daily |

Energy from waste an attractive proposition, even if not everyone likes the idea

Where one person sees piles of trash, Jean-Louis Chaussade sees mountains of opportunity.

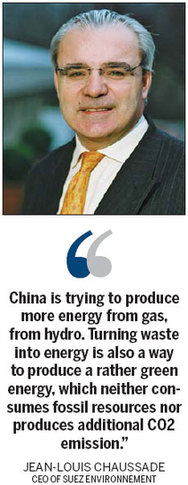

The opportunity that Chaussade, CEO of Suez Environnement, envisages is for China to more widely use waste to generate power, and at the same time reduce its carbon emissions. The solid junk piles he has in mind can be as valuable as hydro power in helping China with its huge energy demands, he says.

"China is trying to produce more energy from gas, from hydro. Turning waste into energy is also a way to produce a rather green energy, which neither consumes fossil resources nor produces additional carbon dioxide emission."

Late last month his company, one of the world's largest water and waste solution providers, signed a joint venture deal in Beijing to gear up for expansion in China's teeming waste treatment market.

Waste-to-energy facilities, where waste can be converted into power by means of thermal treatment, also known as incineration, is expected to be one of the main focuses in Suez Environnement's new joint venture in China.

But for all Chaussade's crusading enthusiasm, the process is not without its detractors, who say it poses many public safety issues. In China as elsewhere, some environmentalists argue that burning garbage will lead to emissions that can endanger health, such as toxic dioxin, particularly that of people living near incineration plants.

Suez Environnement's joint venture with Beijing Enterprise Environmental Group Ltd, a subsidiary of the Hong Kong-listed Beijing Enterprises Holdings, will offer maintenance and operational services to the existing waste treatment facilities of Beijing Enterprise as well as new projects.

Chaussade says his company's financial investment is small at the moment, given what is being provided, but that the company nurses greater ambitions for China's waste treatment market.

"Our investment in this joint venture at the moment is more about our company's more than 100 years' international experience and know-how in the full cycle in the waste treatment industry, but in future we will share in any form of investment to manage or even build new waste treatment facilities together with our Chinese partner."

He goes no further on that issue, but predicts that in another 10 to 15 years about half of the Paris-based company's revenue in China will be generated from waste-related business; it now accounts for about 20 percent of the company's revenue in the country.

Suez Environnement, which had global revenue of 15.1 billion euros last year, has 27 water-related joint ventures in China and 3 waste-related joint ventures in Hong Kong, Macao and Shanghai.

The company's subsidiaries had revenue of 1.3 billion euros in China last year, about 80 percent of that from water-related business.

Despite the company's strong ambitions with waste in China, Chaussade emphasizes that in a country going through rapid urbanization fueled by strong economic growth, water will continue to be a large part of its business.

"We are going to grow the two businesses together, but the waste sector probably will grow faster," he says, adding that in developed markets such as Europe, the company's largest, the mix of waste and water business is 50:50.

"When you look at the progress of different markets, the first step is always to have drinking water, then people start to want to have a safer environment, which usually comes with the demand in sewage treatment and sludge treatment. Then people start to realize the waste is also a source of pollution.

"China has been on the same path and has reached a point when solid waste treatment has become a major issue because people start to realize when they put their garbage in any field, at the end of the day there will be pollution in their underground water."

The company's decision to focus on waste-to-energy technology in China is linked to the government's strong interest in the sector, he says.

According to the 12th Five-Year Plan (2011-15) in municipal waste treatment issued by the State Council in April last year, China aims to treat 35 percent of its garbage through waste-to-energy technology by the end of 2015; the figure is now about 20 percent.

The Chinese Academy for Environmental Planning in Beijing has predicted that investment in solid-waste treatment facilities between 2011 and 2015 will reach 800 billion yuan ($129.76 billion; 99.2 billion euros), most of it for waste-to-energy plants.

China overtook the United States in garbage output in 2004 and the amount of garbage has been rising at up to 10 percent a year.

Experts say little progress has been made in recycling and sorting China's garbage, and there is less available space for landfill.

China International Engineering Consulting Co of Beijing has said in a report that about a third of the country's 700 landfills will reach capacity by the end of 2015.

Despite questions over the safety of waste to energy, Chaussade and other industry insiders in China say it is a better fit given the country's garbage crisis.

Xu Haiyun, secretary-general of the municipal solid waste treatment with the China Association of Environmental Protection Industry, said earlier that compared with incineration, landfill, a method that treats about 60 percent of China's waste, often generates more greenhouse gas emissions.

"And since garbage is buried in the land, there is a greater risk of it contaminating underground water and the soil," he says.

Mark Venhoek, the Asia CEO of SITA Waste, the waste subsidiary of Suez Environnement, says waste-to-energy is a far more advanced technology.

"These kinds of facilities can bring in a lot of benefits in terms of environmental protection, energy recovery and improved living conditions for Chinese people."

He does not think public concerns about the safety of waste-to-energy facilities will be a hurdle to the company's plans in China, he says, and its main challenge is finding the right way to work in the country.

"Each market is different from another. That's why we set up the joint venture with a Chinese company: to have real roots within the market. The waste market in China is going to be more professional and consolidated with higher standards and the founding of new entities combining international know-how.

"This is going to be a very exciting era in the next five to 10 years when it comes to the seriousness of environmental protection in China."

mengjing@chinadaily.com.cn

(China Daily 05/10/2013 page19)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|