Homes for the aged

Updated: 2013-05-10 08:45

By Sun Yuanqing (China Daily)

|

|||||||||||

Policy gaps

One risk that investors face is that the regulatory framework in China for the senior care and housing industry is only in its infancy.

"A lot of people are watching without getting involved because the existing policies are not very clear, especially in aspects like pricing. The government has to assure investors on aspects like subsidies to encourage further involvement," says Yang from Tsinghua University.

At the moment, foreign operators do not enjoy the subsidies given to domestic ones on tax, water and electricity, and land.

Market entry norms also vary from region to region, but this is expected to be unified in the latter half of the year after the Ministry of Civil Affairs publishes detailed regulations on establishment and supervision of elderly care facilities, says Michael Qu, a lawyer with Shanghai Co-Effort Law Firm and editor of China Senior Housing and Care Newsletter.

As more investors join in, more needs to be done by the government to allocate resources more effectively, Shobert says. While there are nursing homes that have long waiting lists, there are also others that find it hard to attract clients because of their remote location and demographics.

"Specifically, the government needs to address the excess and poorly planned senior housing capacity that is being built across the country," Shobert says. "Too many real estate developers are accessing land by promising to build senior housing, which they do, but without the sort of market research or operating model that will be necessary for the business to be sustainable."

At the moment, government policies that favor domestic entrants over foreign companies mean local companies have an advantage in getting access to land, Shobert says.

"It's a very long and complicated process to get land in China. We usually end up spending a lot of time on that and it can be very difficult," says Wright of Merrill Gardens.

Challenges ahead

|

||||

"Most retired in the 1980s before the Chinese economy took off. It's impossible for them to afford the senior-care services of today. Moreover, many of them are independent of their children and don't readily ask for allowances," he says.

Gao estimates that the market will truly take off 10 years from now when people who made their money after 1990s get old and ask for senior-care services.

The situation is somewhat better in Shanghai, which is the fastest aging city in China with more than 20 percent of its population over the age of 60. It is also one of the most developed cities in the country.

"From what we see from Shanghai, the consumption power there is enough to support a high-end senior-care market. The elderly might not be rich, but their children are. The potential is huge," says Xie from Cascade.

Shanghai has in fact been a testing ground for numerous investors for another reason: it is also one of the most service-savvy cities in China.

"Seniors in Shanghai are very open to new and Western ideas. It is also much easier to find service-oriented people in Shanghai than in Beijing," says Wei from Vcanland.

Like the hotel business in its early days in China, the senior-care business is seeing a considerable shortage of professionals and caregivers. China did not start training recovery therapists in its universities until 2000. The huge lack of trained healthcare workers has also been a big problem for many operators.

"The early lessons from foreign entrants point back to the basics: finding the right staff to execute the care model. The government needs to incentivize the human resource side of the senior-care industry through expanded state sponsored training of geriatric nurses, doctors and caregivers," Shobert says.

Heavy workloads, low pay and unpromising career paths offer little incentive for someone to become a caregiver.

Aside from training, raising their social status and career prospects are also vital in the long run, says Gao of Golden Heights.

"In New Zealand, caregivers can become nurses with certain training and exams. It's a job with good prospects. But in China, with similar salaries, people would rather work in a restaurant. But if we guarantee them subsidies like housing or further career development, it would change the situation dramatically," he says.

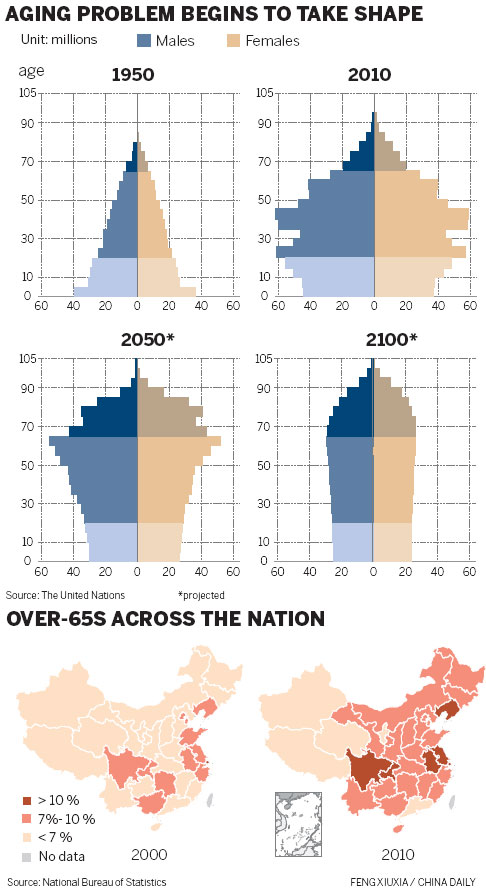

Despite all the obstacles, two things have been set in stone: the irreversible demographic change in China and the burden it will cause for the society.

"The private sector is the only way out. With these two trends set, it's only a matter of time for the industry to take off," says Wei of Vcanland.

sunyuanqing@chinadaily.com.cn

(China Daily 05/10/2013 page1)

Related Stories

Waiting for competition 2013-05-10 08:45

Cherishing the moment 2013-05-10 08:45

Hard lessons from the US 2013-05-10 08:45

Long road ahead 2013-05-10 08:45

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|