Fast forward

Updated: 2013-05-03 08:26

By Andrew Moody and Lv Chang (China Daily)

|

|||||||||||

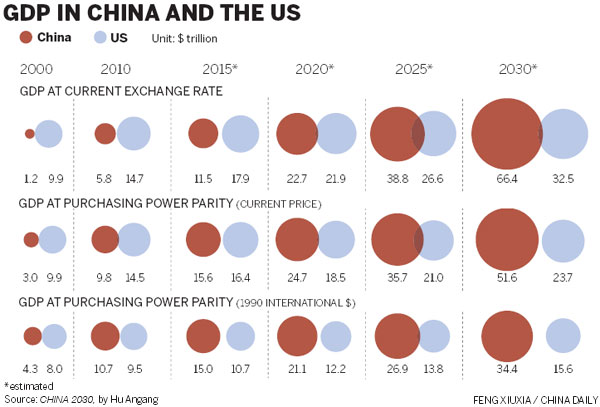

Xu, who nonetheless believes China's GDP will overtake that of the US by 2018, believes growth could fall below 4 percent in the 2020s as the economy suffers from the "convergence effect" the nearer it gets to the world's technology frontier the slower its growth rate becomes.

"The export-led model has come to an end for China. China is already an upper middle-income country, and the room for catch-up is significantly smaller than 30 years ago."

Martyn Davies, chief executive of Frontier Advisory, the research and strategic advisory firm based in Johannesburg, also believes China's state-owned enterprises are a barrier to future growth.

"They have done their job driving growth for the past three decades but now it is time to move on. Every Chinese SOE friend I speak to knows this. They also tell me it is going to change quicker than people think."

Qinwei Wang, China economist at London-based economics research organization Capital Economics, says China overtaking the United States should not be seen as some form of economic superpower battle since the United States would be a beneficiary of China's advance.

|

||||

"This is in contrast to the first stage of China's growth, which was all about buying commodities such as iron ore and copper from Africa, Latin America and Australia."

Ballim at Standard Bank also thinks China's growth over the next two decades will have a dramatic effect on salaries in the scientific and professional sectors.

"Because of its comparative advantage, China has caused the global price of blue collar and manufacturing labor to fall over the last two decades. With China churning out engineers and accountants by the millions, it will prevent runaway wage inflation in the professional sector, too."

Whatever the timeline, it is almost inevitable the Chinese economy will become double the size of the US economy at some stage - even if the date is way beyond 2030 - because it has more than four times the population.

There is no such inevitability about it overtaking the US' per capita income, however. The US had the sixth highest per capita income (on a purchasing power parity basis) in 2012, according to the IMF, at $49,922 a year, whereas China was ranked 93rd - sandwiched between the Maldives and Jamaica - on $9,162 a year.

Carr at NSBO says the US suddenly collapsing is not on the cards.

"It would require something catastrophic for US income levels to suddenly start dropping. These things do happen, however. If you suggested to someone in 1850 in China what the state of the country would be in 1950, people would have thought you were insane."

Davies at Frontier Advisory wonders whether it is even possible for China to overtake the US on this measure.

"It is possibly unachievable because it is a numbers game and it would be difficult to get 1.3 billion people in China on the same income level as Americans."

Contact the writers at andrewmoody@chinadaily.com.cn and lvchang@chinadaily.com.cn

(China Daily 05/03/2013 page1)

Related Stories

Experts look ahead to 2030 2013-05-03 08:26

Real potential underestimated 2013-05-03 08:26

Don't mind the size, feel the quality 2013-05-03 08:26

It all depends on how you measure it 2013-05-03 08:26

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|