More China, less Bono is prescription

Updated: 2013-03-22 09:10

By Andrew Moody (China Daily)

|

|||||||||||

|

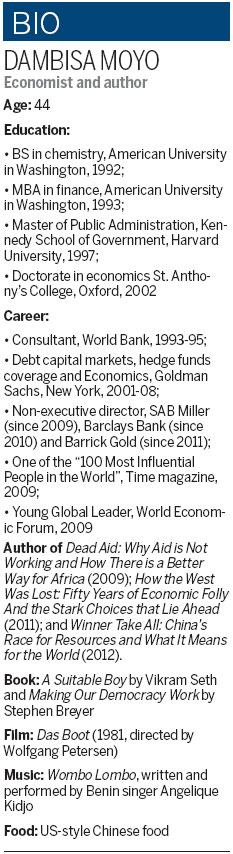

Dambisa Moyo, an internationally-renowned Zambian-born author and economist, believes China is transforming her continent. Mark Wessells / for China Daily |

Internationally-renowned writer says aFRICA needs China to make things happen

Dambisa Moyo insists she is a fan of China because it is a country that is prepared to do business with Africa and not regard it - like many in the West - as an aid case.

The internationally-renowned Zambian-born author and economist believes the world's second largest economy is transforming her continent.

"I am a big Sinophile because I recognize we need China's investment and we need jobs and trade and we need something to happen," she says. "Americans are not prepared to write big checks to drive trade and job creation in Africa anymore."

Moyo, 43, was speaking in the relative seclusion of the 19th floor business lounge of the Westin Cape Town Hotel after being almost mobbed following her keynote presentation at the 20th annual African Mining Indaba conference in February. During our interview, even the son of the Zambian president came to pay his respects.

In the foreword to her bestselling book, Dead Aid: Why Aid is Not Working And How There is Another Way for Africa, a damning indictment of Western aid policy to Africa, leading historian Niall Ferguson wrote we could do with "a lot more Moyo, and a lot less Bono", although the academic has pop star appeal herself.

"Oh, please," she says when I point this out. "It is funny because 80 percent of the people who approach me are government officials who want me to come and give a talk, often about nothing. I prefer to do business things like this that set a new spin on the continent."

Moyo might have forthright views but in private is engaging, often joking and breaking into laughter.

She is undoubtedly one of Africa's most well-known academics (despite lacking a permanent berth) and divides her time between homes in New York, London and in Lusaka.

"I live mainly in Zambia at my parents' farm. If you say I have a home in Zambia, they will say that we wish she would have a home in Zambia," she laughs.

It was Dead Aid that brought her to prominence, leading Time magazine to vote her one of the "top 100 must influential people in the world" in 2009.

Moyo argued that Western aid had become like a drug to many African countries, giving them little incentive to develop industry since aid rather than tax was a more reliable source of government revenue. Aid could also be siphoned off by whoever was in power, meaning winning elections always came with a cash bonanza, often fueling civil wars.

She argues that Chinese investments in infrastructure, such as road and airport construction, have shown another path, but African leaders were wrong to see this as the fruits of a state capitalism model to be followed.

"People make it out to be the China model. It really isn't. China has focused on trade, job creation and infrastructure build-out, which is really the hallmark of Western capitalism. China has been slapped with this horrible moniker," she says.

Although Dead Aid was a New York Times bestseller and achieved critical acclaim, her latest book, Winner Take All: China's Race for Resources and What It Means for the World, has had more mixed reviews.

In the book, she presents a largely Malthusian argument that the world's resources are in danger of running out because of the huge demand by emerging economies. Oil and minerals industry diehards have dismissed the book as naive.

"I don't want to sound naive," she says. "I totally understand that technology has bailed us out historically and there is a very good chance we will get bailed out this time."

Moyo says what drove her to write the book was the realization the world was not quite what she had assumed when she worked at Goldman Sachs in New York during the last decade.

"I had a screen in front of me and it always showed me what commodity prices were, whether it be oil at $95, or what copper was trading at," she says.

She realized she was living in a bubble, divorced from reality, when she moved on to be a director of Barrick Gold, the world's leading gold producer, two years ago and also on the board of an oil and gas company.

"I was absolutely astonished at what I did not know. I didn't realize, for instance, that we were now still living off 1950s and 1960s oil discoveries," she says.

Moyo says what is putting pressure on the world's resources is not just the urbanization of countries but the rapid expansion in the world's population.

"I knew the population was growing, but I didn't know that the speed at which it is growing is such a unique phenomenon. It is set to grow (from the current 7 billion) to 10 billion by 2100. I didn't realize that if you go back to, say, 1400, that the growth wasn't close to where it is today," she says.

Moyo, whose mother is a former leading banker and whose father received a doctorate in the United States, was educated in Zambia but received an undergraduate degree in chemistry and then her MBA at the American University in Washington.

She then worked as a consultant for the World Bank before studying at the Kennedy School of Government at Harvard and then doing a doctorate at Oxford.

Although she has pursued a career both on Wall Street and as a writer and economist in the West, she says someone born today would have more options staying put in Africa.

"I 100 percent believe that. Young Africans understand more than when I was growing up in Africa. They understand their potential and that their limits are not finite," she says.

Apart from Barrick, Moyo sits on the board of drinks giant SAB Miller and Barclays, but laments the fact that women and Africans are poorly represented in the boardroom.

"I sit on the board of Barclays. I always say to them that this company has been around for 320 years. You tell me you have been waiting all this time for an African woman to pop out of the continent and sit on your board," she says.

Moyo, however, is optimistic about Africa's future and does not think the recent economic growth in several countries is solely because of a resources boom fueled by countries such as China.

"I am more sanguine than that. Diversification is critical for African countries. What happens in 10 or 15 years' time if Zambia runs out of copper, for instance? They need to look into the future and be prepared for that eventuality and think of building things like sovereign wealth funds now."

She says they also need to learn from countries such as China and India and not rely on the begging bowl.

"China has a per capita income lower than at least 20 countries in Africa yet you will never see aid appeals or images of poverty that are attached to Africa," she says. "The Chinese and also the Indians doggedly object to being portrayed in this matter. There is a whole lot of dignity that goes with that."

andrewmoody@chinadaily.com.cn

(China Daily 03/22/2013 page32)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|