The allure of the east

Updated: 2013-03-01 09:16

By Ding qingfen (China Daily)

|

|||||||||||

|

Technicians inspect excavators at the Guangxi Liugong Machinery Co Ltd assembly plant in Liuzhou, Guangxi Zhuang autonomous region. Last February, Guangxi Liugong Machinery took over Huta Stalowa Wola, a Polish road machinery maker, for about $100 million. Lai Liusheng / Xinhua |

Eastern Europe becomes strategic bridgehead for a growing number of ambitious Chinese investors keen to explore the broader European market

As countries in Western Europe continue to struggle against a tide of debt and stalled economic growth, countries east of the continent have been receiving record amounts of Chinese investment over the past year.

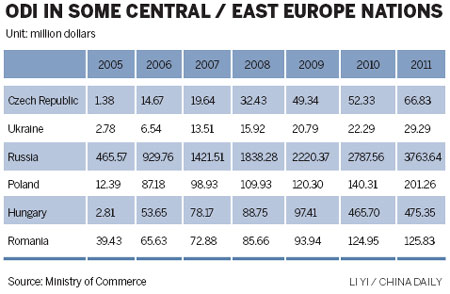

The growing interest in Eastern Europe is clear, with explosive growth in capital flowing into Russia last year.

According to the latest figures from the Ministry of Commerce, China's outbound direct investment into Russia in 2012 surged by as much as 120 percent from 2011, four times higher than the country's overall growth of 29 percent for overseas direct investment during the period.

During that time, nations in Western Europe - a strong investment market for China for the past two decades - have either been reducing investment or pulling capital out of Eastern Europe.

And experts say that has left the region as an ideal bridgehead for Chinese companies to either invest there, or use it as a base to distribute goods to other EU nations.

"There has never been a better time (to invest in Eastern Europe) than now, and we expect the next decade to be a golden period for Chinese companies to invest in Eastern Europe, especially with the west having little or no spare cash as they take care of their own economies," says Yao Ling, a research expert at the Chinese Academy of International Trade and Economic Cooperation, a think tank affiliated with the Ministry of Commerce.

"Chinese companies have been investing in sectors where they hold an advantage, including textiles, light industry, machinery, infrastructure and telecoms," she adds, explaining that Eastern Europe is attractive to Chinese investors on various fronts.

"First, it provides them with a shortcut into all of Europe. Also, the region has a competitive edge in terms of technology for China to learn from; it's a huge market and labor costs there are relatively low compared to other Western markets," she says.

The latest high-profile move by a Chinese company into the region came in December when Shanghai's electric-vehicle maker BYD Co Ltd signed a 50/50 joint venture with a Bulgarian partner to build an electric car and bus assembly plant in the country.

Located in a town west of the capital Sofia, the plant is expected to produce 40 to 60 buses per month, the first of which should roll off the production line this month.

BYD also expects the Bulgarian facility to make its entire product line of batteries and LED lights.

"We already have sales in Western Europe, but very little. The east of Europe is strategically important for BYD and as a market in itself," says Chen Yongping, its senior manager for the Europe region.

In January 2012, BYD beat two major competitors from the United Kingdom and the Netherlands to win an order for six electric buses from the Dutch government, its first overseas electric bus order.

Then in October, it secured another order of 50 electric cars from London cab service provider Green Tomato Cars.

Chen adds that the orders provided solid evidence "that made-in-China electric buses are not low-quality goods".

"We Chinese hold a competitive edge over our peers from developed countries in this particular high-end category," Chen says.

BYD recently gained the important EU "Whole Vehicle Type Approval" that allows it to sell its electric buses in all EU member states.

"The competition in western nations in the EU is always high. The east is easier with fewer restrictions, and certainly, expansion into the east provides us with much easier access to the rest of Europe," Chen says.

BYD plans to first sell its Bulgarian-made electric buses locally, then to neighboring European countries.

"The well-educated workforce and lower factory wages" of Eastern European nations make them very attractive, he adds.

"We don't exclude the possibility of establishing similar plants in other Eastern European nations, such as Hungary."

China's investment interest in Eastern Europe has actually been late compared with some other regions of Asia and Africa.

According to Ministry of Commerce figures, China's cumulative investment across the 10 main Central and Eastern European countries had reached $830 million (635 million euros) by the end of 2010, accounting for just 6.6 percent of its total EU investment at the time.

Poland, Hungary and Romania were the major destinations, accounting for nearly 90 percent of total Chinese investment in the region.

But over the past two years, Chinese interest in Eastern Europe has grown considerably, through direct investment and mergers and acquisitions.

Last February, Guangxi Liugong Machinery Co Ltd, for instance, took over Huta Stalowa Wola, a Polish road machinery maker, for about $100 million, marking China's biggest investment to date in Poland.

The same month, Chinese automaker Great Wall Motor Co Ltd developed China's first automotive project in the EU by opening an assembly plant in northern Bulgaria.

In late April, during a visit to Poland, Premier Wen Jiabao said that a $10 billion special credit line would be provided for joint investment infrastructure and technology projects in the Eastern European country.

Shortly after that, Vice-Premier Li Keqiang visited several European nations, including Hungary, as well as Russia.

In Moscow, Li signed 27 deals worth $15 billion with companies including Russia's United Company RUSAL, the world's top aluminium producer, and Gazprombank, the banking arm of Russian natural gas company OAO Gazprom.

In Hungary, he signed seven more deals, including a $1 billion credit line for projects including a Chinese-built rail link to Budapest Ferenc Liszt International Airport.

Tan Zuozhou, president of Liugong Poland, says: "So far, our major battlefield has been the east of Europe, although Western Europe is the real high-end market, and gaining a foothold there is our ultimate goal.

"The east is a relatively easier market than the west, and Europe in general sets very high technology standards for us to reach, but the main advantages of the east are cheap labor and rapid growth in terms of consumption market," Tan says.

The building equipment maker has seen its overseas sales rise fast over the past two years, hitting $440 million in 2011.

"We expect the figure to grow to 100 billion yuan by 2020, accounting for 30 percent of the corporate total sales," Tan says, with Europe seen as its most important market.

After its Polish takeover last February, Guangxi Liugong set up its European headquarters in the country and a manufacturing base and research and development center.

"Through the deal, we obtained the technology and intellectual property rights of our partner, and set up a whole chain of operations from R&D and purchasing to production and sales in Poland to sell our goods and provide services to all over Europe," Tan says.

Eastern Europe contributes nearly 90 percent of Liugong's sales in Europe, but Tan said cracking the west of the region will be harder.

"We cannot call our European business a success until we win real recognition in the west," he said. "It will be a long process."

Yao Ling adds that as companies from many Western European countries focus on their own economic recovery, investment into eastern regions has been cut back significantly, which presents great opportunities for Chinese companies.

"Eastern Europe is in need of capital, and some nations have strong welcomed Chinese companies," says Yao.

"Cooperation with China is a win-win situation.

"Chinese companies can help their Eastern European counterparts tap into the Chinese market, while in return, the Chinese can expect to gain influence in Europe through such deals," she says.

The Polish government launched a "Go China" program early last year in a bid to attract more investment from and to promote exports to China.

Hungary, meanwhile, is believed to be considering plans to introduce new immigration regulations that will allow foreign companies and individuals who agree to buy Hungarian government bonds worth 250,000 euros to gain permanent residence - a move many are reading as a direct incentive for Chinese entrepreneurs to invest in the country.

Russia, which entered the World Trade Organization last summer, has also vowed to turn itself into the world's fifth largest economy from its current 11th position by the end of the decade, betting high on foreign investment.

However, faced with so many growing investment opportunities in Eastern Europe, Yao also cautions that Chinese companies should be mindful of any deal they make, or step they take in a region where conditions can differ greatly from country to country.

dingqingfen@chinadaily.com.cn

(China Daily 03/01/2013 page21)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|