High-end manufacturing holds the key

Updated: 2013-03-01 09:12

By Zheng Yangpeng (China Daily)

|

|||||||||||

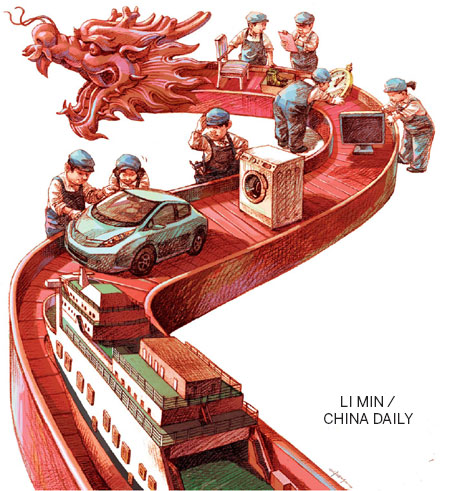

Two major developments that took place earlier this year are expected to have far-reaching implications for the global manufacturing sector, and particularly in China. At first glance, they appear to be rather innocuous economic predictions. But a closer look reveals that while the global manufacturing industry is tottering, China is still proving to be the lifeline for many global companies.

The 2013 Global Manufacturing Competitiveness Index prepared by global professional service firm Deloitte Touche Tohmatsu Ltd and the US Council on Competitiveness, released in January, indicates that China is not only the most competitive manufacturing nation in the world presently, but will continue to retain that ranking for the next five years.

However, that does not mean that everything is hunky-dory in China, as its relatively strong manufacturing edifice is facing severe challenges such as a sharp decline in the absolute working-age population.

Ma Jiantang, the National Bureau of Statistics chief, had earlier in January indicated that though China's labor force had declined by 3.45 million last year to 937 million, it still continued to be the nation's "biggest resource advantage".

Other risk factors for China include rising labor and land costs, the increasing competitiveness of other emerging markets, and a trend of relocating industries from developing countries to developed ones.

|

||||

In real terms, what the decline in working-age population means is that the endless supply of cheap labor from China, which accounts for more than 11 percent of the world's exports, is no longer a reality, but a memory.

Wu Yu, a manager at a Suzhou-based factory, is one of several Chinese businessmen who have been affected by recent developments. Labor shortage and rising labor costs are the main challenges for Wu's company, a unit of the Taiwan-based computer maker Pegatron Corporation.

Wu says that most of his employees are those born after 1990 and work for average seven months before they seek fresh prospects with other companies.

"These youngsters are more ambitious and have bigger dreams than their parents. They want to explore the world and leave the job when they find it boring," he says.

"Like every other Chinese, they also want to own a house. But in Suzhou, that dream is almost impossible to realize. When they realize this, they are disappointed and often leave for a higher-paying job in other cities."

Apprehensions are also growing in industry circles that the floating and shrinking labor force would soon become a grave threat to Chinese companies as they look to make rapid strides in global competitiveness.

"A foreign diplomat recently told me that Chinese products are facing the same challenges that Japanese and South Korean products faced earlier from China. The only difference is that the competition is now from other Southeast Asian nations," says Zhou Shijian, a senior trade expert at Tsinghua University.

The renminbi's appreciation against the US dollar has also been bad for the competitiveness of Chinese products, Zhou says.

"According to the research findings of a Japanese nonprofit trade institute, the average monthly wages for a worker in Guangzhou is 1,850 yuan ($295, 224 euros), while it is 752 yuan in Vietnam. With such a huge gap, China may find it difficult to compete with other Southeast Asian nations in low-end products," Zhou says.

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|