Self-styled approach pays off

Updated: 2013-02-01 09:14

By Cai Xiao (China Daily)

|

|||||||||||

|

Top: A netizen in Beijing browses the website of xiu.com. Above: Ji Wenhong says if his company offers customers diversified fashion prices and good service, the opportunity will be huge. Photos Provided to China Daily |

One-time exporter turns his attention to fashion imports

Ji Wenhong started his career as an exporter in Shenzhen, Guangdong provice, in 1992, just after the then leader Deng Xiaoping toured southern China to reassert reform and opening-up policies.

But now he is an importer, as CEO of China's global online fashion reseller Xiu.com Inc.

In November, the global e-commerce retailer eBay Inc said it would collaborate with Xiu.com Inc, voicing confidence in the company's development as well as China's promising fashion consumption market.

The global venture capital firm Kleiner Perkins Caufield & Byers invested $20 million (14.88 million euros) in Xiu.com in 2011. This was followed by another well-known private equity firm, Warburg Pincus LLC, which invested $100 million the same year.

Xiu.com's revenue in 2011 totaled 1 billion yuan ($160 million; 119 million euros) and revenue is expected to have risen last year.

After graduating from the University of International Business and Economics in Beijing in 1992, Ji was inspired by Deng's speech that year and was determined to seek opportunities in Shenzhen, China's first special economic zone.

Unlike most of his classmates, who found jobs in the government sectors, Ji went to Shenzhen and began his career as a trader exporting clothes and shoes.

Within a year he had earned his first 1 million yuan.

"In the 10 years from 1992 to 2002, China's labor costs remained low compared with other countries, so our export business ran quite well," Ji says.

But in 2002, Ji felt the export business was starting to face a bottleneck because of rising labor costs, so he quit his business and became involved in investment activities.

During his trips throughout the world, he came across many clothes and shoes manufactured overseas that were better but cheaper than similar merchandise selling in China.

"Compared with making investments, setting up a business by myself was more exciting. I felt I was going from small to large," Ji says. "Importing fashion is promising and meaningful."

In 2008, he set up Xiu.com with his college classmate Huang Jin, the company's chief strategy officer and a former venture capital investor, and his co-worker of 15 years Mou Qing, senior vice-president of the company and a professional fashion buyer.

Ji says the difficulty they encountered at the start was persuading overseas companies there was a market in China for their middle and high-end fashion.

Now Xiu.com has more than 3 million registered users, with more than 70 percent of them active, meaning that a customer buys products on Xiu.com at least once a year. Users are mainly between 25 and 35 years old and familiar with global brands through overseas exposure, foreign movies or the Internet.

"Xiu.com customers have strong purchasing power, with transactions per customer averaging more than $100, the highest among Chinese e-commerce websites," Ji says.

There are between 80 million and 90 million such customers in China, according to a joint survey by eBay and Xiu.com.

Mou says that before 2010, they mainly bought clothes, shoes and bags from around the world, and then started to negotiate with companies owning fashion brands to get their authorization to sell their products.

"We have a list of 500 global fashion brands and more than 100 have been our collaboration partners," says Mou, adding that they selected from about 5,000 global brands and found the 500 that are most suitable for Chinese customers, on price and quality.

More than 50 global brands authorized Xiu.com to be their online seller last year, with the Italian luxury brand Salvatore Ferragamo joining hands with Xiu.com in September.

Mou says that of the items they brought in, 60 percent are clothes, 20 percent shoes and bags and the remaining 20 percent other accessories including watches.

In November, Xiu.com worked with eBay to launch the joint site eBay Style so that Chinese customers can access more than 5,000 fashion brands on eBay.

A survey by eBay showed that in the first half of 2012, the time Chinese Internet users spent browsing eBay's global website totaled 17 million hours.

In 2006, eBay pulled most of its businesses from the Chinese market in answer to the free service commitment adopted by the Chinese e-commerce retailer Taobao.com.

Ji says: "Xiu.com and eBay have similar clients and we attach great importance to the cooperation," adding that his company is also open to other global fashion brands.

When a Chinese customer orders a product on eBay Style, the joint site, Xiu.com sends order details to global merchants of eBay in the United States. Then eBay allocates products to the warehouses of Xiu.com in the US and Hong Kong. Finally, Xiu.com brings them to the Chinese mainland and delivers them to customers.

Ji said Xiu.com's main warehouses are in Shenzhen, as imports are the main focus. "We are confident about the payment pattern because our rate of returns is low, only about 4 percent," Ji says.

He also says they will consider going public, but not for half a year.

"Clothes and shoes in Chinese shopping malls are very homogeneous. If we offer customers diversified fashion products with good prices and service, the opportunity will be huge," Ji says.

After the financial crisis in 2008, purchasing power for luxury consumer goods in the US and Europe weakened, with many high-end products selling through outlets malls, private sales and the Internet. US-based Gilt.com is a successful example of selling discount luxury fashion goods.

Many similar high-end fashion online sellers emerged in China, such as 5lux.com, Jiapin.com and Shangpin.com. Many of them target luxury products sold online only.

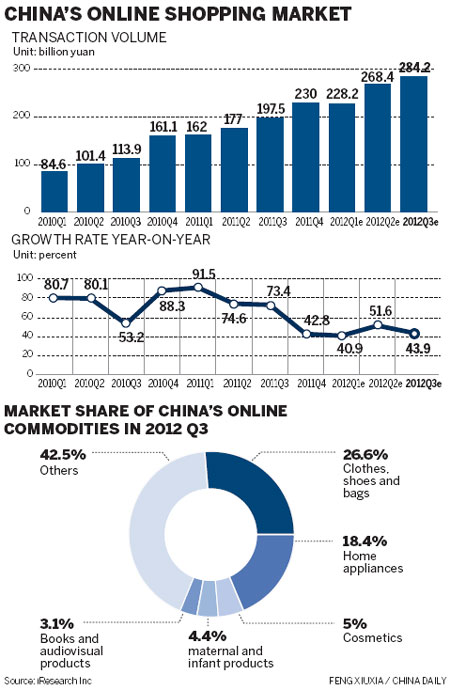

The Chinese Internet shopping market was valued at 284.2 billion yuan in the third quarter of 2012, a 43.9 percent increase year-on-year, according to a report by Beijing-based market research company iResearch Consulting Group.

Taobao Mall has been the largest player among business-to-customer online clothing sellers, with market share of 68.5 percent and trading volume totaling 41.1 billion yuan in 2011, according to iResearch.

Zhao Xueqin, an analyst at CITIC Securities, says online sellers save on rental, labor and operating costs, but have to spend more on storage, delivery and marketing fees than traditional retail companies.

Zhao says that in 2011 the advertising fees of Web portals, search engines and navigation websites increased more than 50 percent on the previous year.

"In the Chinese e-commerce market, most online sellers are striving for customers with low margin and subsidies," Zhao says. "Online sellers with sustainable funding support can survive and improve their profitability to gain satisfying returns."

caixiao@chinadaily.com.cn

(China Daily 02/01/2013 page22)

Today's Top News

List of approved GM food clarified

ID checks for express deliveries in Guangdong

Govt to expand elderly care

University asks freshmen to sign suicide disclaimer

Tibet gears up for new climbing season

Media asked to promote Sino-Indian ties

Shots fired at Washington Navy Yard

Minimum growth rate set at 7%

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|