What lies ahead

Updated: 2013-01-04 09:42

By Andrew Moody (China Daily)

|

|||||||||||

|

Gary Rieschel, founder of Qiming Venture Partners, expects China's stock market to bounce back this year. Nelson Ching / Bloomberg |

|

Junheng Li, founder of J.L. Warren Capital, says China's economy may slow substantially in the medium term. Cui Meng / China Daily |

|

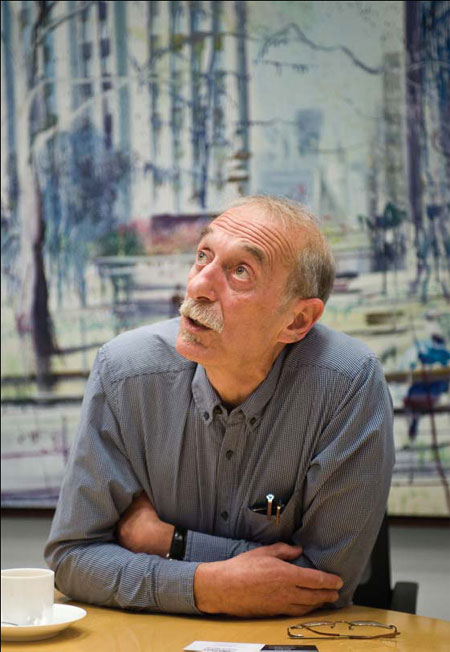

George Magnus of UBS says it takes 10 years to overcome a systemic finanical crisis. Nick J. B. Moore / for China Daily |

|

Top: Goolam Ballim, group chief economist of Standard Bank; Above: Mark Williams, chief Asia economist for the London-based research group Capital Economics. Photos Provided to China Daily |

Performance of Western economies has bearing on China's growth, which in turn could have an impact on African and other developing countries

The world economy enters 2013 with significant risks that could blow any nascent signs of recovery off course - with most experts agreeing there is little chance the new year will be the one when we finally see what is now being called the Great Recession in the rear-view mirror.

China's GDP growth has slowed post-Lehman and was down for a seventh successive quarter at 7.4 percent between July and September with the prospects for this year uncertain.

This is because the world's second-largest economy still remains largely dependent on its vital export markets to the United States and Europe.

The euro deal reached in autumn looks to have staved off an immediate crisis but the German election later in the year could lead to policy paralysis before then.

The US has so far proved to be the most buoyant Western economy but with the "fiscal cliff" barely avoided, there remains the risk that recent spurts of growth might prove a false dawn.

Given the interconnectedness of the world, weak Western economies would impact on China and then also emerging markets in Africa, which is now highly dependent on its largest trade partner's demand for commodities.

How China's main stock market will fare in 2013 after another depressing 12 months will also be of interest to investors trying to buy into the China growth story.

The Shanghai Composite Index hit a 46-month low of under 2000 points in November, less than a third of its heady October 2007 high of 6124.

From pages 6 to 15, we also look in depth at some of the major issues facing China in 2013 from its ageing population (this year its workforce will fall in number for the first time in recent history) through the prospects for the housing market to the development of new sectors such as green energy.

We will also examine the outlook for trade, foreign direct investment into China and, in turn, the country's investment overseas, the prospects for the internationalization of the yuan, the emergence of a consumer society, research and development and also focus on China's stock exchanges.

Gary Rieschel, founder of Shanghai-based Qiming Venture Partners, a $1-billion (760 million euros) fund focused on early stage investments, says 2013 might be the year when growth in China is viewed in a different way.

"I think the China growth story is actually becoming less about the rate of change but the amount of aggregate dollars added to the economy," he says.

"As the economy becomes larger you would expect the rate of growth to slow but it is growing from a bigger base and therefore the volume of business opportunities is increasing."

Mark Williams, chief Asia economist for Capital Economics, the London-based economics research group, was one of the most bearish on the China economy in 2012.

He caused controversy earlier last year by suggesting second-quarter growth was more likely 7 percent, rather than the official 7.6 percent, using flat electricity production data as his benchmark.

Yet he now sees growth in 2013 as higher than in 2012 at 8 percent, although slowing to 7.5 percent in 2014.

"Our view is that the recovery we have seen in the past few months is real but that it is not going to last for too much longer without policy stimulus," he says.

"I think China's long term sustainable growth rate is now between 7.5 and 8 percent and we shouldn't expect it to grow more than that."

Junheng Li, founder of J.L. Warren Capital, the New York-based equity analyst firm, says there is a risk that China's growth could slow substantially in the medium term.

She believes the GDP figure could slip below what some see as the psychological 7 percent floor in 2013 and slide further to between 5 and 6 percent in 2014.

"Without large-scale stimulus, I think the economy will continue to slide in 2013. I predict only 5 to 6 percent normalized GDP growth over the next three to five years at best," she says.

Li believes the Chinese government needs to focus on measures that boost consumer spending.

"They need to focus on domestic consumption by improving the pension system. Most of the pension funds are losing money because of the 65 percent slump in the stock market since 2007," she says.

"There also needs to be emphasis on making healthcare and quality education more affordable so people feel confident they can spend money and not always have to worry about putting money aside for this."

Goolam Ballim, group chief economist of Africa's largest bank, Standard Bank, in Johannesburg, says many African nations now see China's growth figure as a key economic indicator since it could have a major bearing on their economic fortunes.

"China is front and center of Africa's external risks. If China's growth was to slow to 6 percent, which would be nominally respectable, it would be the equivalent of spawning a commodities recession on the continent," he says.

"This would stymie Africa's exports with further consequent impact on local currencies in turn leading to inflation that would erode real incomes and encourage monetary policy tightening. In short, you can clearly see there is a transmission mechanism where any movement in China's growth rate could be quite meaningful to Africa."

The US economy remains one many analysts remain optimistic about.

Steve Brice, chief investment strategist at Standard Chartered Bank in Singapore, believes the US could actually be at the vanguard of something of a global recovery in 2013.

"The fiscal uncertainty looks as though it is going to lead to weak first-quarter figures but once that is out of the way, I think the underlying economy still has quite strong momentum and that GDP growth could average 3 percent in the second half."

The optimism about the US does not extend to Rieschel at Qiming Venture Partners. He believes the world's largest economy is precariously placed and could easily slide into recession again, which would be hammer blow to China and the rest of the world.

"If the US economy just shows level growth in the first quarter and I wouldn't be surprised if it falls into recession in the second quarter, which would weaken the already difficult situation in Europe and be bad for China's exports also," he says.

Europe and the unresolved euro crisis is the big specter hanging over the world economy, made more difficult this year by everyone awaiting the outcome of the German elections.

Williams at Capital Economics believes the economies of the eurozone countries will contract by 2.5 percent in 2013.

"The end to this problem will only come when the single currency area decides to break apart. That will help to relieve some of the stress and will allow their economies to become more competitive," he says.

"It is still the big shadow hanging over the world and if we are looking for where things could go badly wrong over the next year, it is the eurozone."

George Magnus, senior economic adviser for UBS bank in London and author of Uprising: Will Emerging Markets Shape or Shake the World Economy, also is extremely negative for the outlook in Europe.

"I am not sure what the grounds for optimism are. I expect the region to contract by 0.5 percent for the year but in three or four months time, I wouldn't be surprised if this has to be revised downwards."

In China, inflation is one key indicator that is tracked since any signal that prices are rising is usually followed by a policy response. The CPI index was again on a rising trajectory in November at 2 percent, following on from a 33-month low of 1.7 percent in October.

Williams at Capital Economics expects inflation to rise around the time of the Spring Festival holiday in February.

"We could see some eye-catching figures around the Chinese New Year when inflation could again be back up to 4 percent but I think it will come off that to 3 percent for the year as a whole."

Ballim at Standard Bank also thinks inflation is heading upward in China and will be more than double its current level by the end of the year at around 4 percent.

"I think it is an uncomfortable directional trend but I don't expect the authorities to take punitive measures because of the backdrop of the global recession," he says.

Most of China's restrictive measures have focused on the property market, which can sometimes be the runaway engine of the China economy.

Miranda Carr, head of China research at NSBO, the strategic investment research company based in London, estimates that real estate makes up around 12 percent of GDP.

"It is not just industries like furniture but also advertising with real estate advertising being a significant proportion of the whole (advertising) industry," she says.

"One of the reasons why growth was slow in 2012 was that the real estate market was operating under restrictions. We saw one of the biggest pick-ups in real estate investment in November to 28.5 percent year-on-year and this could continue into next year (2013)."

Brice at Standard Chartered Bank is also optimistic about the China property market.

"The big picture is that we are expecting the property market to stabilize and move higher again. The fundamentals for most of the China residential property market remain fairly robust," he says.

One of the weakest aspects to China in 2012 was its stock market with investors preferring to benefit from the China growth story by investing in international companies exposed to China than in those listed on Shanghai.

Rieschel expects a major bounce back from the 46-month low in November to much healthier territory.

"I expect the Shanghai index to increase by 20 percent this year and I wouldn't be surprised if it hit 3000," he says.

"The underperforming nature of the Shanghai market is often about the poor quality of the financial informational available as well as (the capability of) analysts and there is more robust work to be done in this area."

Brice at Standard Chartered Bank says the Shanghai Composite Index can often suddenly surprise even hardened investors.

"There was one year it went up 500 percent. I think going back up to 2007 levels though in short order would be an extremely bullish forecast," he says.

"What we have seen though is that if it (the index) does appreciate, it does so quickly. So if we get past 2,150 in 2013, we could easily get to 2,500. Sentiment can change very quickly."

Li at J.L.Warren remains very bearish about the outlook for the market in 2013 but also the two-year horizon.

"I predict it will be flat or slightly down in 2013 but could have a major blow-up in 2014. The problem is that listed banks generate about 50 percent of the entire A-share (Shanghai-listed companies) market earnings and I believe banks are the weakest sector in the whole China economy at present."

Li, however, is confident about certain sectors of the China economy.

"I like stocks in the healthcare sector, which includes medical devices and pharma. The Chinese are getting older and sicker. I also like companies in the education field. Parents will never stop spending on their children's education. Those in consumer goods will also benefit from greater affluence," she says.

One of the big questions is whether this year will produce some light at the end of the dark tunnel of the economic crisis, which will work through its fifth year.

Magnus at UBS supports the view of economists Carmen Reinhart and Kenneth Rogoff in their book This Time Is Different: Eight Centuries of Financial Folly that it takes 10 years to overcome a systemic financial crisis.

"On this basis we will be only half way through in 2013. Japan is basically my template and it has been 22 years since its bust and the underlying growth rate has been just 1 percent a year," he says.

Ballim at Standard Bank also believes it will also take a decade before the global economy returns to any form of normality:

This year "is certainly unlikely to be a definitive year. What we have witnessed is a crisis of such enormity that no person of working age has ever experienced before".

"What we have to move toward first is a stable equilibrium, one where growth may be low but at least it is stable, unlike now."

He also believes once there is a recovery, the new normal will be a global economy dominated by not just China and other Asian economies but those from Africa and Latin America as well.

"I think the crisis will have accelerated the emergence of a dominance of both eastern and southern markets," he says.

andrewmoody@chinadaily.com.cn

(China Daily 01/04/2013 page1)

Today's Top News

Police continue manhunt for 2nd bombing suspect

H7N9 flu transmission studied

8% growth predicted for Q2

Nuke reactor gets foreign contract

First couple on Time's list of most influential

'Green' awareness levels drop in Beijing

Palace Museum spruces up

Trading channels 'need to broaden'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|