Not too far to the top of the pile

Updated: 2012-12-28 14:24

By Jeff Gong (China Daily)

|

|||||||||||

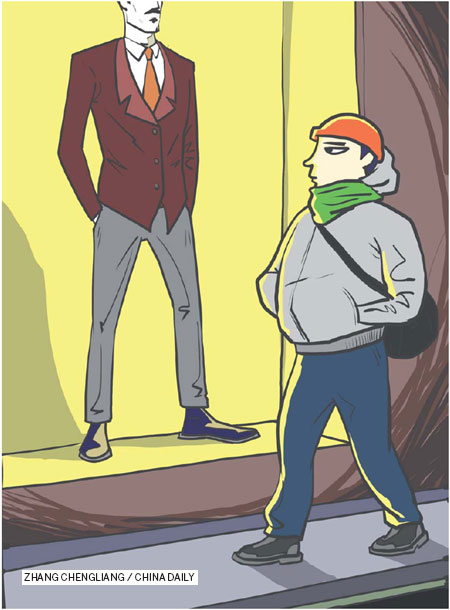

Second-tier luxury brands can succeed in the Chinese market

Encouraged by the performance of luxury brands in China over many years, almost all European second-tier brands have begun to stake their claim in the Chinese market.

For such brands (a price of between 200 euros and 1,000 euros in Europe puts them in the second-tier clothing category), China represents a huge market that can help them overtake competitors.

Unlike in developed markets, in China the gap between second-tier brands and top brands can be bridged relatively easily.

Apart from a handful of international big names, Chinese consumers are unfamiliar with second-tier brands, which means that in trying to win over customers they all start from scratch. And when that market consists of 1.3 billion people whose country has annual growth of near 8 percent the high stakes are obvious.

Second-tier brands are priced slightly below the luxury ones, but higher than mass-consumption ones, and the target group is those on middle incomes.

In China the consumer group for this price range and luxury consumer group overlap to a great degree. Normally they tend to buy luxury-brand accessories such as shoes, bags, jewelry and watches, and spend more on second-tier clothing brands.

Luxury brands generally focus more on consumers at the apex of the pyramid, while second-tier brands focus on medium to high-end consumers. As China's middle class continues to grow, the second-tier brands will pull in a lot more revenue. As their sales and profits rise, so will their status.

The next five to 10 years will be their golden age in China, and those who win the market in the next few years will top the global apparel market, and no one in their right mind would give up that opportunity.

However, even though the potential is huge, winning a piece of the action will not be easy and anyone entering China without an effective strategy risks a quick exit.

Second-tier clothing brands that have come to China include Max Mara, which has been in the country for 30 years and plans to have 330 stores by the end of the year, Trussardi (33 stores) and PatriziaPepe (30 stores).

While some of the second-tier brands are performing well, most are poor cousins to their high-end counterparts. If those marketing them can fully understand the Chinese market, adopting the right strategy, branding and promotion, their sales in China will multiply manyfold.

Anyone doing business in China needs to realize that what are conventional and seemingly correct business strategies in Europe do not necessarily work in China.

Some second-tier brands have failed to make such adjustments. For example, the retail price of most of Europe's second-tier brands in China is generally 30 percent higher than in Europe. Products that cost between 200 euros and 1,000 euros in Europe are often double than in China. That cannot all be blamed on taxes and the like; in many cases it is more likely that operators have simply been misinformed.

When prices are raised, the brands are positioned in a target consumer group higher than in Europe, leading them into an unfamiliar, relatively small high-end market. Success in Europe is not easily replicated in China, and brand operating and marketing costs - and the risks - are a lot higher.

In many cases marketers make no strategic adjustment for the Chinese market and customer demands, and in such circumstances it is impossible to build a good reputation with a target group.

Chinese medium to high-end consumers are savvy, and any sign of a patronizing "This product sold well in Europe so it deserves respect" attitude can end in only one way: marketing failure.

Some brands fail to respect Chinese consumers' brand-cognitive behavior, consumer psychology and media habits. Some have been in China for years, but still do not even have a proper Chinese name. If customers cannot read out the brand name easily, how do they tell their friends what brand of clothes they are wearing?

Many brands too readily resort to public relations activities involving celebrities that simply treat medium- to high-end consumers as star chasers. That shows a lack of understanding of customer needs.

Another problem is that many brand decision-makers pick staff with an overseas background and fluent English. You see many overseas Chinese in important positions, but rarely do you see managers who know the Chinese-mainland market well. It is hard to imagine an Italian who grew up in the US having a better understanding of the Italian market than an Italian who grew up in Italy.

Another problem is that product development and sales are not dovetailed with Chinese customer needs and market characteristics.

Many brands directly transfer product planning, design and type from Europe to China. Their products are not developed according to Chinese customers' cultural backgrounds, aesthetics and body type.

The brands need to do some thorough market research to understand consumer demand. Brand managers need to personally be involved in the research and cooperate with research organizations.

The brands, combining the information obtained by the market research organization with their own, can learn from their competitors, and make clear their consumer group positioning, pricing, regional sales planning, brand operations, management and promotion programs. They should also ensure that they can obtain feedback and tailor what they do to the changing market.

Rapid economic and social development has led to big changes in Chinese consumption patterns, and what was an effective promotion tool yesterday may not be so today.

The brands need to set up a specialized Chinese market team that understands the characteristics of the target customer and consumer demand and designs products according to a customer's complexion, body type, lifestyles and aesthetics.

They should enhance customer services to increase customer loyalty.

Chinese customers pay more attention to relationships between people. They want to be respected but not to be too intimate with sales people. Many are willing to maintain a close personal relationship with shop sales staff, and this friendship is not usually meant to get a more favorable price, but it does bring more sales.

In China's domestic medium to high-end women's clothing sales, VIP customer sales have become important in winning market share. It is not uncommon for one such customer to spend 20,000 euros.

A good example of success in China is Zegna. Its initial core business was to supply high-end menswear fabrics, which has been successful in Asia for 30 years. It now has thousands of retail stores worldwide, and its annual sales account for nearly 30 percent of the global market share of the high-end menswear, so it can no longer be called a second-tier brand.

This was a successful operation that got to the top through its success in China and other emerging markets after having been an Italian second-tier brand. It is rare, but can be copied.

The author is director of Beijing Vogue Glamour Brand Marketing Inc, a brand consultancy. The views do not necessarily reflect those of China Daily. Contact the writer at voguead@163.com

(China Daily 12/28/2012 page11)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|