Open the doors, and we will do the job

Updated: 2012-11-30 09:53

By Davide Cucino (China Daily)

|

|||||||||||

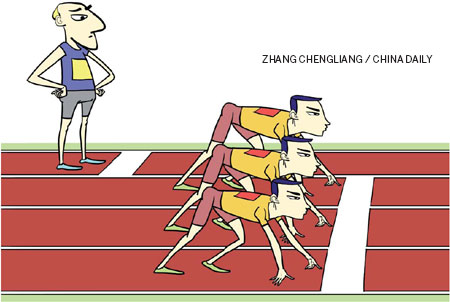

Foreign businesses yearn for changed rules and equal access for all

European industry, in general, is doing well in China. Its profits and revenues in most industry sectors continue to grow and are reaching levels comparable to other world regions. The strategic importance of China for European companies is increasing and their investments have brought big benefits to the Chinese economy and Chinese society. These are important points to make, but this success story is all too often lost in regulatory complaints and, increasingly frequently, in trade disputes, because a dormant potential to massively grow the scope of this mutual benefit persists. This is because European industry is regarded as exactly that: European; foreign.

The European Union has no term for categorizing investment as foreign. If a Chinese or other non-EU company legally invests in Europe, the resultant legal entity is considered European. Rather than starting from the premise that foreign investment and healthy competition in an open marketplace is positive in and of itself, China places conditions on the opening of markets to foreign investment. This is reflected in the piecemeal opening of markets and control of foreign investment in the Foreign Investment Industrial Guidance Catalogue. It delineates a sharp distinction between domestically-invested and foreign-invested industry and prescribes conditions for the acceptance of foreign investment only where it is perceived to serve clear industrial policies.

It is now widely accepted that state control of business needs to be reduced and greater play given to private industry. Continuing to restrict access for European and other foreign-invested firms would inhibit the full realization of the various and sizeable contributions that increased European investment would give to China's economy, business and society, apart from the great harm that continued inequity would cause in the form of increased trade friction, which is already becoming apparent.

Never has the idiom that when someone sneezes everyone catches a cold been truer than in today's globalized economy. No doubt the severe downturn in Europe has sharpened this perception of interdependency for China. It holds true for the trade relationship and increasingly so for the investment relationship and is reflected in China's determination to speed up the negotiation of investment treaties with its major partners, including efforts now for a bilateral EU-China investment agreement. China's process of rebalancing will bring the economies of the EU and China closer together. This will bring synergies but will also put China and the EU into greater competition.

Amid the downturn, Europe remains staunchly and resiliently open. With China increasingly being recognized as an economic competitor, asymmetries in the levels of market openness between the two partners become more apparent, and perceptions of unfairness become more marked among Europeans. Europe absolutely believes in the benefits of an open investment environment and actively encourages Chinese investment, but remaining open will become an increasingly hard sell to European constituencies if asymmetries persist. This is why trade tensions are rising and why it is imperative that all parties keep an eye on the long term. Open markets must be viewed as two-way streets. It is in no-one's interest for this pressure to lead to a closing of markets.

China's degree of openness to foreign business will therefore increasingly have implications for the interests of Chinese business on a global stage, especially as Chinese firms are stepping up their overseas investments. Chinese policymakers are aware of this and will need to increasingly take into account the impact of trade friction in their internal economic policy-making to ensure that Chinese firms can enjoy the benefits of access to large marketplaces worldwide. But the main reason for China to further open its internal marketplace not only to private domestic firms, but also foreign-invested firms, is for the direct benefits that increased foreign investment in China would bring.

The European Chamber of Commerce in China is encouraged by recent policies such as revisions to the "36 Clauses for the non-State-Owned Economy" to allow private investment in sectors where little competition is allowed. Such moves would not amount to less government monitoring of the business environment, but a liberalization of central government control.

When China laid out the list of strategic emerging sectors to be promoted, European business in China initially viewed the plan with great enthusiasm. European business is traditionally strong and is the global leader in many of the technology driven sectors identified in the strategic emerging industries, such as energy-efficient and green technologies, new energy technologies, next-generation IT and high-end equipment and transport manufacturing. However, access to the Chinese market for foreign-invested enterprises in these strategic emerging industry sectors and in other traditionally administrative monopoly sectors is greatly curtailed. Much of the access exists in areas of the supply chain where China has not developed the technologies or expertise, or is only possible in the form of minority equity stake joint ventures with domestic Chinese firms that are often conditional on a transfer of technology by the European partner.

A recent publication the European chamber produced on how patent-related policies and practices in China are hampering innovation referred to these examples of forced technology transfer requirements as raw deals. The same study noted that evidence shows that European cutting-edge innovation-intensive operations do not generally agree to these raw deals and that these policies only deter enterprises from contributing valuable technological knowledge in Chinese operations. This consequence is the opposite of what China wants as it aims to carry out industrial upgrading and stimulate innovation.

Those sectors in which Europeans are least able to fully participate - the strategic emerging industries and the traditionally administrative monopoly sectors - are exactly the ones where we would be able to most fully contribute. As China further develops and urbanizes, it will be necessary to find ever more sophisticated, sustainable and efficient ways to meet its growing needs and consumption demands. Europe has already gone through much of the same industrialization and urbanization processes that China must go through today. We made mistakes, we learnt lessons and we have developed some tools. European industry is bringing this experience and many of these tools to China, and we are working together with Chinese industry, academia and the government to develop new solutions to meet China's needs.

China has a historic opportunity to raise its economy to a new level. Its state-led investment development model has supported growth for the past 30 years, but by design it is unequal and no longer sustainable. China possesses the necessary ingredients, including the technology and physical infrastructure bases, as well as the human capital to make this shift. However, reforms to substantively reduce state involvement in the business environment and to give full play to market principles are needed. The 12th Five-Year Plan (2011-15) recognized this need for change, but meaningful implementation has been lacking. With signs of over-investment and poor productivity returns already perceptible and with the demographic dividend coming to an end, these changes are now urgently required not only for China, but also for global economic growth.

At its core, China must create the conditions that ensure that the drivers of innovation, productivity and efficiency prevail. Rebalancing the economic growth model requires equal access for all companies, whether private or state-owned or whether Chinese or foreign-invested, not only to markets, but also to public procurement, technology innovation, treatment under the law and to finance and subsidies.

To stimulate healthy competition and to comprehensively realize the benefits that European and all foreign industry could bring, both singularly and in partnership with domestic industry, China must re-evaluate its mindset toward foreign investment. European industry wants to be here, and we want to contribute to bolster the marketplace and to meet China's needs. To do so, China must allow European and all foreign companies the same access and the same operating conditions as Chinese firms, including in the strategic emerging industries and in all those industries that China plans to open to private investment. We want to achieve the same ends. We would like to be regarded as Chinese.

The author is president of the European Union Chamber of Commerce in China. The views do not necessarily reflect those of China Daily.

(China Daily 11/30/2012 page8)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|