Great malls of China

Updated: 2012-09-28 10:32

By Yao Jing (China Daily)

|

|||||||||||

|

Shin Kong Place is the biggest shopping center in Beijing in terms of single-store sales, and is a favorite for international luxury brands. Zhu Xingxin / China Daily |

With the nation's rising disposable incomes, shopping center developers are looking to cash in

Galeries Lafayette, the iconic department store in Paris and a major shopping destination for throngs of Chinese tourists, will be giving it a second shot in China next year.

After failing to garner much attention in 1998 with its store in the Wangfujing shopping district in Beijing, Lafayette plans to open a store in the nation's capital, as well as 15 others across China, over the next five years. Department store buildings will include both retail and office space.

The renewed efforts by Lafayette indicate two important things: First, international retail developers are highly confident in the Chinese buying power at a time when retail is flat in both Europe and the United States; and second, more and more shopping malls are popping up throughout the country.

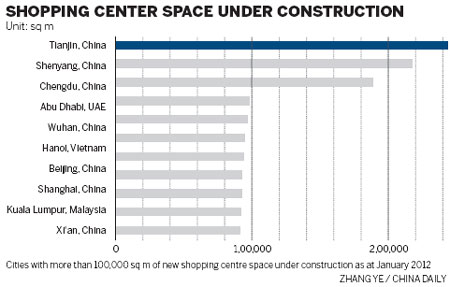

China has built at least 20 million square meters of shopping centers in 14 major cities over the past decade, with nearly 15 million square meters of shopping space currently under construction, according to data released in June by the CBRE Group, a Los Angeles-headquartered property consultancy.

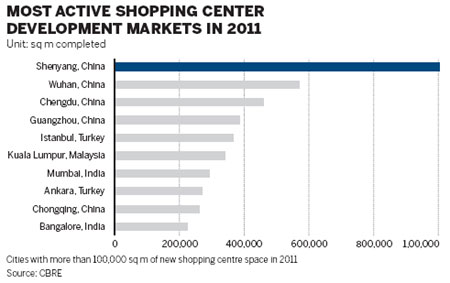

Three cities in China (Shenyang, Wuhan, Chengdu) last year ranked in the top 10 among 180 major cities in the world with the largest amount of new shopping center space.

"China had 2,812 shopping centers over 10,000 square meters in 41 cities we covered at the end of 2011. And the compound growth rate for the amount of shopping space in China is 25 percent over the past 10 years," says Guo Zengli, president of China Shopping Center Development Association of Mall China. "Overseas commercial developers and retailers are doing better than local ones, who are mostly real estate developers that are being limited by the government's clampdown on the country's housing market," he says.

In other words, the central government's efforts to cool down housing prices have been quickly reducing interest among developers to erect apartment complexes. Singapore-based CapitaMalls Asia has established 58 malls in 36 Chinese cities since 2003, while Taubman Asia, a subsidiary of US-based Taubman Centers Inc, and Beijing Wangfujing Department Store (Group) Co Ltd, one of China's largest department store chains, announced a joint venture in August to invest in and manage a shopping center to be built in Xi'an, Shaanxi province.

"The new shopping center experience will provide Taubman with a powerful platform for future retail real estate development and investment throughout the Chinese mainland," says Rene Tremblay, president of Taubman Asia. The long-term goal for Taubman is to have at least 10 to 15 percent of its assets in China, Tremblay says.

Taubman currently owns, leases and manages 28 shopping centers across the US and Asia. Its total market capitalization is approximately $10 billion.

Taubman entered the Chinese mainland via Taubman TCBL, a Beijing-based subsidiary of Taubman Asia, in 2011.

"The partnership with Wangfujing provides Taubman with access to intimate market and consumer knowledge and allows us to leverage their proven track record and expertise in retailing across China," Tremblay says.

The two companies will also work together to expand into second-tier cities in established retail markets.

Tremblay says that in order to be iconic in the mass China retail market, they must pay more attention to how malls are designed and laid out with a mind to offer amenities to shoppers.

"Shopping is now becoming an entertainment, a day out, an experience," Tremblay says.

Tremblay says that Wangfujing's existing footprint and marketing know-how will help Taubman and provide it with a quality anchor tenant in projects they develop together in the future.

For international retail companies, who face challenges in securing space and trying to understand the logistical maze of the marketplace, Guo Zengli of Mall China says establishing a joint venture with a local company has become a major strategy for many international developers seeking to strengthen their presence in China.

"Anyone entering the China market cannot just simply recreate the same store as in their home market, but must use different positioning and branding," Guo says.

"Unlike in the US, where land for development is in relative abundance, most shopping malls tend to be arranged over a single story in suburban areas. In China, by contrast, land for shopping center development is at a premium," says James Hawkey, executive director of retail services for Cushman & Wakefield China, a subsidiary of the New York-based commercial real estate services firm.

The greater density of buildings and residents across major cities in China forces developments to be more vertical and typically five or more stories high. In Europe or the US, there are very few centers offering over 100,000 sq m of space, while in China many malls exceed this, Hawkey says.

"Except that overseas retail developers have to understand the local operating environment as well as local consumer patterns and preferences," Hawkey says.

International shopping center developers have distinct advantages over their Chinese competitors. They have more experience in design and construction as well as in leasing and operating shopping centers, Hawkey says.

But CapitaMalls Asia, with its experience of more than 10 years in China's market anchored by its two popular shopping centers, CapitaMall and Raffles City, has become an example for competitors to follow.

Among CapitaMalls Asia's 53 projects in China, 43 malls are operational today; the other 15 are currently under development.

"In the first half of this year, tenants' sales in our China malls increased 11.6 percent that is driven by tenants' sales in second- and third-tier cities, which grew even faster at 15.9 percent. Shopper traffic in our China malls grew 10.7 percent in that same timeframe," says Lock Wai Han, CEO of CapitaMalls Asia (China).

CapitaMalls Asia has a network of international and regional retailers with more than 10,000 leases. Approximately 4,800 retail brands that the company works with are in China. The brands it has introduced to China include Hollister, Desigual and Kate Spade, which opened their first stores in the developer's Shanghai malls, Han says.

Han says CapitaMalls Asia communicates and shares its expansion plans with its network of retailers, which enables retailers to expand rapidly within key cities.

"Moreover, in order to ensure that our malls stay relevant to shoppers, we continually reinvent retailers. This includes optimizing store layouts and retail offerings, refreshing the tenancy mix as well as (offering) attractive promotions to draw shoppers to our malls," Han says.

Han says the company faces the same kind of challenges that any other company has: The challenge of finding experienced staff to work in management.

"A shopping mall is a local business as locals know best how to cater to the needs of their communities," Han says. "We leveraged on our mall development and management expertise to train our new staff, including sending them on study trips to see how we ran our malls in Singapore, as well as to other leading retail centers such as Australia, Hong Kong and the United Kingdom to study the latest retail trends and concepts."

Today, CapitaMalls Asia has a team of about 3,000 staff members in China, of which only about 40 are foreigners.

"At present, middle managers, such as store managers, are very popular in the market," says Xiong Jie, a lecturer of corporate strategy at ESC Rennes School of Business in France.

"Expatriated managers from the home country of foreign retailers cannot understand the complexity of the China market," Xiong says. "To win in the China market, foreign retailers should rely on local talents who are well educated and understand the local purchasing behaviors," Xiong says.

As shopping centers continue to flourish in major cities across China, Taubman and other international retail developers are now actively looking to expand elsewhere within the country.

"The development trend in the next couple of years will shift further toward smaller cities as firsttier cities becoming increasingly mature," says James Hawkey of Cushman & Wakefield China.

As the market develops quickly, several shopping center developers will encounter different challenges. In many newly developed suburban areas, shopping centers under construction are under pressure to open before the local population has fully moved in, possibly leading to poor retail figures in a shopping center's initial years, Hawkey says.

yaojing@chinadaily.com.cn

(China Daily 09/28/2012 page12)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|