Riding the big wave

Updated: 2012-09-21 13:31

By Cecily Liu (China Daily)

|

|||||||||||

Flurry of M&A deals by Chinese enterprises in Europe signals new overseas investment drive

A fresh wave of outbound direct investment by Chinese companies has reached Europe, typically through purchasing undervalued strategic assets to gain a foothold in a new market.

Unlike earlier Chinese investment drives in resource-rich areas like Australia and Africa, the new moves are targeted at a diverse range of industries in Europe such as food, retail, manufacturing, education, clean technology, industrial technology and healthcare.

Shanghai-based Bright Food Group's acquisition of a 60 percent stake in British cereal maker Weetabix in June this year was an example of the focused move. It also marked the largest overseas deal made by a Chinese food company tol date. The deal valued Weetabix at 1.46 billion euros ($1.9 billion).

The diversity in investment pattern was set earlier in the year after Chinese heavy machinery maker Sany Heavy Industry and Citic Private Equity Funds Management Co Ltd teamed up to buy Germany's largest concrete pump maker Putzmeister in a 360 million euro deal.

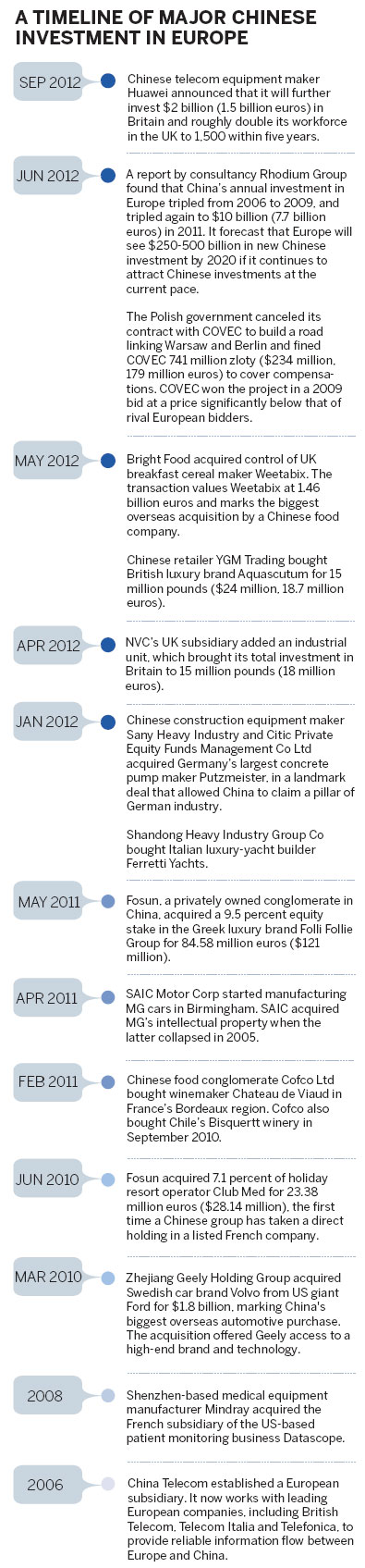

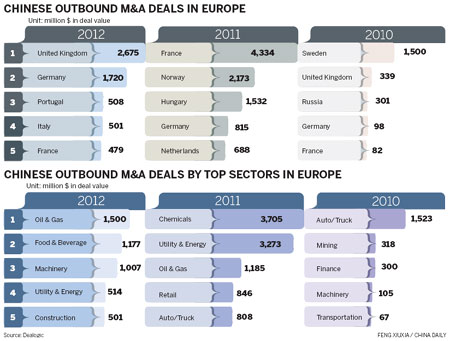

Rhodium Group, a New York-based consultancy that analyzes global trends, said in a recent report that China's annual investment in Europe tripled from 2006 to 2009, and tripled again to $10 billion (7.7 billion euros) in 2011. The number of deals with a value of more than $1 million doubled from less than 50 in 2010 to almost 100 in 2011.

Europe can anticipate new Chinese investment of about $250 billion to $500 billion by 2020, if it continues to attract investments at the current pace, the report said.

Some of the new investments will be greenfield investments, in which the Chinese company will set up new operations in Europe or expand existing operations. However, investment through mergers and acquisitions will continue to increase as it has from 2008.

"Due to the global economic downturn and problems in the eurozone, company valuations have obviously become more attractive. We think it is a good time to make investments," says Maxim Parr, CEO of Quercus Associates, a London-based investment advisory.

"Sectors like engineering, industrial technology, clean technology, biotechnology, consumer brands and education are all areas in which China is trying to strengthen its global competitiveness, and areas where Europe has inherent strengths," Parr says.

|

||||

The Dealogic data also showed that the UK, Germany, Portugal, Italy and France were the most popular destinations for Chinese M&As in terms of deal value.

"A key attraction for Chinese investment in Europe is the desire to acquire technology and brands," says Nicholas Emmerson, a partner at Eversheds, a London-based law firm.

"Some European companies have a lot of good technologies. These are technologies that Chinese companies are willing to buy to take back to China, or for us in Europe," Emmerson says, adding that Bright Food's investment in Weetabix is a good example.

"The technology of putting wheat into dried bricks that can be stored for a long time is a key technology which fits in with the Chinese government's 12th Five-Year Plan (2011-15) on agriculture," he says.

The plan also includes the goal to increase food production capacity to more than 540 million tons by the end of 2015.

According to Emmerson, Weetabix is a famous British breakfast product and a good brand that can be introduced in China as the domestic breakfast cereal market is growing rapidly.

Emmerson's views are echoed by Marcia Mogelonsky, a food and drink analyst at London-based research company Mintel Group, who added that Bright Food can also achieve its internationalization goal by using Weetabix's existing sales channels.

"It's quite hard to get shelf space in Europe at the moment, but if they own Weetabix, they can say, 'let's squeeze a bit of space from Weetabix products and put in one of our own products to see how it works'," Mogelonsky says.

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|