Silver screen, golden sheen

Updated: 2012-08-03 11:09

By Liu Lu (China Daily)

|

|||||||||||

|

The movie-going frenzy in China has attracted investment in the cinema business. Provided to China Daily |

Investors are pouring money into the cinema business, and the cash is likely to keep on coming

As Hollywood filmmakers scratch their heads over what they can do about flat box-office takings in much of the world, the business is booming in China. More than eight new cinema screens are being opened a day in the country, faster than anywhere else. This roaring success can be attributed to the moneyed middle class in China who have taken to movie-going as they spend their hard earned cash on leisure. Flushed with this success and flush with the cash windfall it is bringing, industry insiders are confident that this building spree will continue and that China will replace the United States to become the world's largest cinema market in 10 years or less.

"China is undergoing a cinematic growth spurt, driven by the country's soaring box-office takings and people's savvy of a better movie-going experience, such as a throbbing soundtrack and a cozy cinema environment," says Gao Jun, a veteran filmmaker who has worked in the country's film industry for more than 20 years. He is also a former deputy general manager of New Film Association, one of China's oldest cinema chains.

| ||||

Li Qiang, an analyst with EntGroup, says this theater building wave will continue over the next three to five years as more movie theaters are designed in smaller cities where people are gradually adopting cinema-going as a leisure pursuit.

"State-of-the-art theaters are replacing humble movie houses not only in wealthy urban centers such as Beijing and Shanghai, but also in some bustling small cities, where we will install more screens in the future," Li says.

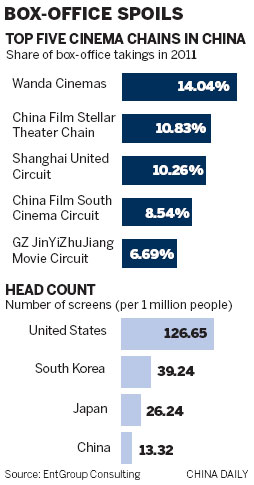

Gao says that while more investors are piling money into the business, there is no risk of oversupply and China still has a long way to go to catch up with the US in screen numbers and the number of screens per person.

"Despite the strong growth, China's cinema market is still far from being saturated. As there is only one screen for every 220,000 inhabitant in China compared with one for 9,000 in the US, the business has plenty of room to grow."

This huge untapped market together with China's movie-going boom opens up several noteworthy investment opportunities, prompting Chinese movie studios and cinema chains to ramp up cinema construction to capitalize on the potential growth.

Shanghai United Circuit Co Ltd, one of the largest cinema circuits among the country's 39 cinema chains, has taken the lead in this market expansion.

It has attracted more private investors to join its cinema construction in recent years, and 60 new franchised cinemas opened last year alone.

"Our brand name has attracted a lot of private capital to join us, allowing us to experience a growth peak last year," says Xu Xiaoping, the company's general manager.

|

Xu says many movie theater outfits in China have a certain degree of government ownership, but the movie boom has lured more private developers to invest in cinema chains by joining the large ones, and her company welcomes the investment from private developers.

This year her company will open at least another 30 franchised cinemas, most in the affluent Yangtze River Delta.

Xu says building a cinema is not cheap, each costing between 30 million yuan ($4.7 million, 3.9 million euros) and 50 million yuan in larger cities such as Beijing, Shanghai and Shenzhen, and perhaps half that in smaller cities. The newest ones are usually equipped with the latest in technology, such as Dolby DTS sound systems and 3D screens, and some may even have the IMAX projection system.

"Cinema building needs huge investment, and the participation of more private investors will give us the money to build new cinemas, and in return we could offer them our experience in running cinemas," Xu says, adding that open franchised cinema has already become one of the key ways for major Chinese cinema chains to expand.

"It usually needs at least two to three years for a cinema chain to cover costs, but franchised cinemas reduce the investment risk, and that's why they are becoming more popular."

Apart from taking in private capital, Shanghai United Circuit is preparing to seek financing by launching an initial public offering on the Shanghai Stock Exchange next year, which Xu believes will greatly boost the company's development.

Cheng Guangyan, general manager of the marketing department of China Film Cinema Investment Co, says successfully running a cinema depends not only on sufficient money flow, but on the choice of location.

Apart from a city's cultural center, a shopping zone is a preferred location, she says.

"Fancy movie theaters are being built as part of the wave of shopping malls springing up around the country, because commercial real estate can bring cinemas constant streams of potential customers."

Most Chinese moviegoers are 15-35 years old, she says, and they happen to be the biggest consumers in shopping centers.

"In recent years, with more shopping malls popping up in smaller Chinese cities to match the growing purchasing power of locals, more cinema chains have entered the market," Cheng says.

"At present, movie theaters are still in short supply in some second- and third-tier cities, particularly in western China, where most local cinemas are timeworn and outdated."

She says the skyrocketing rent in first-tier cities has also forced investors to shift their focus to build theaters in second- and third-tier cities.

"The movie box office has experienced substantial growth in recent years, driving up the rent in first-tier cities like Beijing and Shanghai. Some big shopping districts may even charge a movie theater tens of millions of yuan in rent, and that has increased the theaters' investment risk in big cities."

Cheng says China Film Cinema Investment began to tap the market in smaller cities several years ago, and about half of the company's cinemas are now located outside Beijing, Shanghai, Guangzhou and Shenzhen.

"Years of operation prove that cinema-going enthusiasm for residents living in those cities are very high and keeps rising," Cheng says. "With the exorbitant rents in big cities, it will be faster to recover investment in small and medium-sized cities."

Her company will increase its number of screens to between 800 and 1,000 and the number of cinemas to 100 by 2014, she says.

But Cheng warns that despite the rising demand for entertainment in more Chinese cities, cinemas are not risk-free investments, and rapid expansion also means high risk, especially for those who lack experience in running cinemas.

In addition to developing the domestic market, Chinese enterprises have also taken steps to tap the overseas cinema chain market.

In May, Dalian Wanda Group Corp Ltd, China's largest cinema developer by box-office receipts, bought the world's second-largest theater chain, AMC Entertainment Holdings Inc, for $2.6 billion (2.14 billion euros), expanding into the US and creating the world's biggest cinema owner.

Wang Jianlin, Wanda's chairman, told China Daily that the purchase will turn Wanda into a "truly global" cinema owner.

But besides overseas expansion, industry experts believe the acquisition will greatly enhance the "soft power" of Wanda's cinema chains.

"The acquisition not only allows Wanda to get access to state-of-the-art theaters but, more importantly, they learn a lot of advanced management concepts and service practices from their US colleagues by learning more about the demand of modern audiences," Gao says.

He says China's cinema industry will have at least 15 years of stable growth and that the number of Chinese cinema-goers will some day exceed the total population of the US.

"China has an urban population of more than 700 million, and they are the main consumer group for movies, but the total US population is only 300 million."

However, with the competition among theaters becoming more intense, more small theaters may be taken over in the future. At the same time, the types of cinema will be subdivided.

"In Beijing in recent years several membership-based art cinemas have emerged," Gao says. "This business model has matured in the US and Europe, but it has just appeared in China."

But Gao says the key to the development of China's cinema chains lies in the development of domestic films.

"The development of Chinese cinema chains should not rely too much on Hollywood movies, which will leave Chinese cinema chains as passive onlookers.

"More well-made China-made films will ultimately benefit the development of China's cinema industry in the long run."

liulu@chinadaily.com.cn

(China Daily 08/03/2012 page12)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|