The ins of outsourcing

Updated: 2012-07-27 12:11

By Hu Haiyan (China Daily)

|

|||||||||||

Jibin Arjunan paces the rows of cubicles in the spacious software outsourcing center in Shanghai as his team of employees gets ready to address the daily concerns and problems of several customers spread across Europe and the US.

Few of the employees at the center are Indians or Westerners, though. Most of them are young Chinese IT professionals, or in some cases fresh college graduates, who are harnessing their software development capabilities for global solutions at the Shanghai center of Indian IT company Wipro Technologies.

Arjunan, head of Wipro Technologies in China, says that the Shanghai center is now a key link in the company's global operations and a key contributor to the overall revenues. "It is an integral part of the complex global supply chain for global economic development," he says.

Wipro is not the only Indian IT company to have set up outsourcing centers in China. Other big names like TCS, Infosys and HCL have development centers. Also present are big consulting firms like Accenture and conglomerates like General Electric, apart from a host of other Western manufacturing companies.

There is no doubt that outsourcing is booming in China. But what really makes China different from the rest of the outsourcing pack is its capability to attract high-end outsourcing work.

Outsourcing as an industry has often got more brickbats than bouquets in the past decade. But over the years it has evolved into an over $13 trillion (10.7 trillion euros) global practice and an indispensable element in the success of big global firms like Apple Inc and Cisco Systems Inc.

|

||||

Though the $13 trillion industry is facing increasing global headwinds due to financial maelstroms and a clamor to move jobs back home, it looks assured of a robust future in China. Much of that comes from the initial days when it was largely focused on the domestic market and on companies from countries like Japan and South Korea.

There are several other factors that set China apart from the competition - like its willingness to branch out into newer markets, and the ability to cash in on the strong infrastructure, talent pool and diverse language skills. But the key differentiator in the long run will be China's ability to provide outsourcing services for intellectual processes.

"The outsourcing market in China began to take shape in 2000, and moved on to a fast growth phase five years ago," says Ning Wright, the partner in charge of shared services and outsourcing advisory at global consultancy KPMG.

Samantha Zhu, vice-president of the business process outsourcing department at global consultancy Accenture's China operations, is also bullish on outsourcing in China.

"China is like a fast-growing teenager, while India is more like an adult. Although the teenager is not as mature as the adult, they have better development potential and growth prospects," Zhu says.

Positive numbers

According to the China Service Outsourcing Development Report 2012 released by the China Outsourcing Institute under the Ministry of Commerce in May, global offshore outsourcing revenues were about $110 billion last year, with India still in the lead. By 2015, global outsourcing revenues are slated to reach $210 billion.

The same report indicates that China's outsourcing revenue in 2011 was about $32.4 billion, a year-on-year growth of 63.6 percent, with $23.8 billion coming from offshore business.

The industry, which has recorded growth rates in excess of 60 percent for three consecutive years, is likely to be a $90-billion industry by 2015 and account for more than 50 percent of the global market, the report says.

"China's offshore outsourcing market will reach $100 billion by 2015, with a year-on-year increase of 40 to 50 percent in the next five years," says Wang Gang, an analyst at CCID Consulting Co Ltd, a Beijing-based IT industry consultancy.

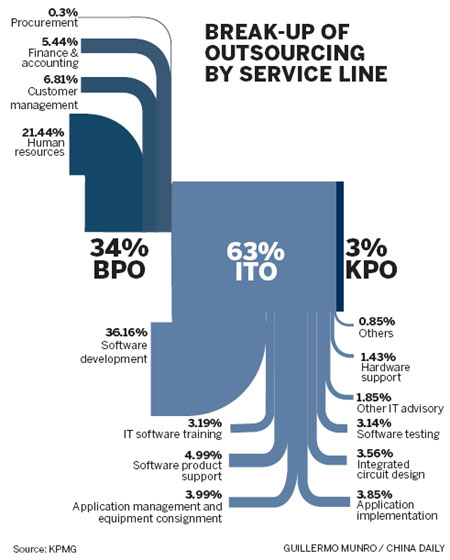

A report on the outsourcing market in China published by KPMG in June this year says that China is a crucial part of the global services and pan-Asia strategies for many global companies. The same report says that outsourcing contracts carried out by Chinese companies currently account for 23 percent of the global total.

The real potential of China's outsourcing industry can be gauged from the latest data provided by the Ministry of Industry and Information Technology. According to its figures for the first five months of this year, the combined value of China's exported outsourcing services grew by 26.4 percent year-on-year to $2.94 billion.

Domestic power

"Many multinational companies are expanding their outsourcing from China not only because of the low costs, but also to gain more business from the fast-growing Chinese companies," says Mao Qiong, an analyst with the US-based IT research company International Data Corp.

The "China-to-China" market is expected to be the fastest growth segment for the industry as more State-owned enterprises and private companies have started to realize the advantages of outsourcing, says the KPMG report.

Fast-growing industries like banking, financial services and insurance, telecom and healthcare have spurred demand for outsourcing services, the report says.

Large telecom companies such as Huawei and ZTE have outsourced most of their software development needs and also set up call centers for customer solutions. In the healthcare sector many leading hospitals have outsourced their IT development requirements. Large banks like China Merchants Bank have also outsourced software development and card processing.

Government role

If there is one factor that all companies unanimously vouch for, it is the strong support accorded by the government to the outsourcing sector.

"We are amazed by government support for the industry," Arjunan from Wipro says.

In February 2009, China designated 21 cities as the trial ground for the outsourcing business, including Beijing and Shanghai. Each of these cities got annual grants of 5 million yuan ($783,000, 644,000 euros) between 2010 and 2012 from the central government to develop their outsourcing service platforms.

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|