Changing the game

Updated: 2012-07-20 12:21

By Lin Jing and Su Zhou (China Daily)

|

|||||||||||

|

A large variety of smartphones is available at a mobile phone store in Nanjing, Jiangsu province. Provided to China Daily |

Internet-based companies in China are diving headlong into the smartphone industry, but will they reap success or sink into failure?

Ren Fujia, a marketing assistant with a fashion magazine in Beijing, says surfing the Web is simply more convenient on her smartphone. In her commute to work, the 25-year-old uses her smartphone to check e-mail, chat with colleagues or browse the news. "I am used to getting on the Internet with a smartphone instead of a laptop," she says.

Ren is not alone in her reliance on, and preference for, a smartphone. There were more than 513 million Internet users in China by the end of 2011; 356 million of them accessed the Internet via mobile phones, according to the China Internet Network Information Center.

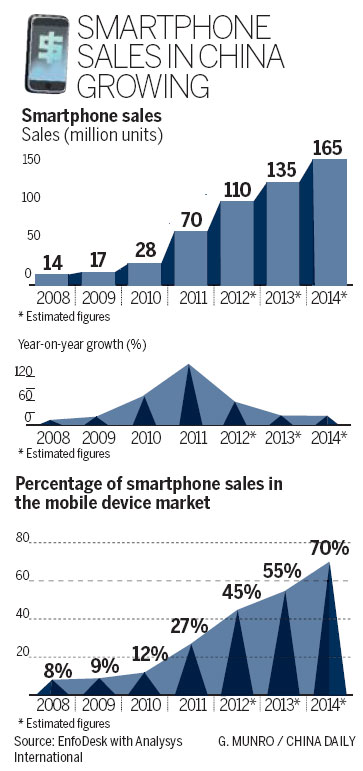

The vast number of users has spawned numerous domestic smartphone makers across China, especially in the low- and mid-tier markets. Shipments of smartphones on the Chinese mainland reached 18 million in April, accounting for more than half of China's mobile phone market. More than 77 percent of those shipments came from domestic brands.

|

||||

And they are not just jumping on the bandwagon, they are evolving the way smartphones are produced in China.

Known for their reputation as leading software developers and researchers, these online-based businesses are playing up to their strengths in creating smartphones. Instead of getting involved in every step of making a smartphone, they're collaborating with manufacturers and focusing on what they know best - programming.

Alibaba Group, the e-commerce leader in China, was one of the first to set foot in the industry. In July 2011, it launched its first smartphone, called the W799.

But it was not involved in producing the hardware or in selling the phone, authorizing K-Touch, a smartphone producer in Beijing, to manufacture them.

Yang Lei, public relations director of Alibaba, says the company has about 2,000 engineers working on the cloud computing aspect of the phone and 200 researchers working to perfect the phone's operating system, dubbed Aliyun (yun means cloud in Chinese).

Cloud computing provides services using a user's data, software and computation over a network.

Alibaba has so far launched more than seven types of smartphones. Shipments of smartphones with the Aliyun OS surpassed 1 million by the end of May, according to Reuters.

"Alibaba Group won't do the manufacturing because it is not our strength," says Wang Jian, president of Aliyun.com, a subsidiary of Alibaba. "Our focus is on the OS."

Or as Yang puts it: "You may say half of the functions in the OS rely on the smartphone and the other half on cloud computing".

Yang says more functions, such as electronic payments and entertainment programs will be integrated into Alibaba's smartphones.

"Every user can have 40 to 100 gigabytes of storage, to save their data, photos and contacts in the cloud server. And they do not have to download apps to their smartphones, which will take up their memory. All apps will function on the cloud server," Yang says.

Baidu Inc is also focusing on cloud computing in its phones. Its first phone, called the Streak Pro D43, was produced along with Dell and released in December (it initially retailed for 2,999 yuan). The smartphone uses the Baidu Cloud OS, which allows users to utilize apps provided over the cloud network and reportedly saves on power and memory.

In May, Baidu launched its second smartphone, dubbed the Changhong H5018 and manufactured by Foxconn Technology Group. It sells for 899 yuan ($125, 103 euros).

But not all domestic producers are relying on their own operating systems. In fact, most build smartphones based on Google's Android OS, the leading OS for smartphones. More than 76 percent of China's smartphones sold in the first quarter of 2012 run on the Android OS.

Qihoo 360 Technology, a dotcom company that specializes in Internet security services, worked with three manufacturers, including Huawei Technologies Co Ltd, China's leading telecom infrastructure provider. Qihoo 360's latest smartphone is called the Haier Battlefield, retailing at 1,888 yuan and produced in conjunction with Haier, a Chinese consumer electronics company.

With a crowded house of phone producers, the average price for smartphones is dropping, from 2,300 yuan in the first quarter of 2011 to 1,670 yuan in early 2012, according to Analysys International, a consultancy in Beijing. The market share of smartphones priced from 1,500 yuan to 2,000 yuan has recently dropped to 14 percent.

Yang from Alibaba says that a lower price will be where the industry is heading toward because companies will not be making a profit from sales, but from users purchasing services offered in the phone's apps.

Yang believes that most Internet-based companies producing phones will keep this practice of having "low margins from smartphone sales and high returns from long-term services".

In May, Shanda launched its own smartphone, called the Bambook S1. It took an R&D team of 300 engineers one year to officially launch the smartphone with a 4.3-inch screen and dual cores. The smartphone retails for 1,299 yuan.

"We want to promote the mobile Internet by selling our smart phones at the cost price," says Guo Chaohui, CEO of Shanghai Nutshell Electronics Ltd, a mobile phone subsidiary of Shanda.

Guo says that with this price, the company will not make a profit and could even lose money.

"It is still too early to talk about revenue or a business model," Guo says. "What we are doing right now is lay the foundation, together with other Internet companies."

Sun Peilin, an analyst with Analysys International, says that Internet companies have expanded into smartphones for mainly two reasons.

On the one hand, they are treating smartphones as a marketing ploy to gain more users to support their existing services or products, such as Xiaomi Corp and Qihoo 360 Technology. On the other hand, Baidu, Alibaba and Shanda are attempting to build up their cloud computing efforts, Sun says.

"But the motive is the same, to compete for the traffic from mobile devices and to promote their existing services," Sun says.

Yang Xingping, the former CEO of Dopod (the first generation of Chinese smartphones), says that even though these Internet-based companies are surging, they will not be able to shake industry leaders Apple Inc and Samsung Electronics Co from their perches.

"China's high-end market is dominated by well-established brands such as Apple and Samsung," Yang says. "Internet-based companies can dive into the low-end market, which is not an easy game to play because profit margins are lower and the competition may be fiercer."

But Yang is optimistic in China's smartphone industry and believes that the spirit of collaboration will create what he calls a "new market order".

"After the cake is big enough, there will be numerous business models," Yang says.

Kai-Fu Lee, the former founding president of Google China and currently the founder and CEO of an investment firm Innovation Works, is not so glowing about the current rush in the smartphone industry.

He lists eight reasons in his micro blog on Sina Weibo, writing that most Chinese Internet companies will fail in their smartphone ambitions. His reasons include that Internet companies will not cultivate a good reputation by binding their own services while rejecting services from competitors on their smartphones. He also says it is impossible to create a high-profit ecosystem with the Android OS.

Sun suggests that local companies should evaluate their return and investment as hardware costs drop and as competition shifts from sales to the quality and quantity of applications.

"Companies without smartphone operations but with a focus on cloud-based apps can also maintain their competitiveness," he says.

China is expected to surpass the United States in sales of smartphones. It will increase its market share of smartphone shipments from 18.2 percent to 20.7 percent in 2012, according to a report from market research firm International Data Corp. The US, on the other hand, will drop from 21.3 percent to 20.6 percent.

Contact the writers at linjingcd@chinadaily.com.cn and suzhou@chinadaily.com.cn

(China Daily 07/20/2012 page12)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|