Auto sales still in the fast lane

Updated: 2012-07-13 12:33

By Wang Chao (China Daily)

|

|||||||||||

|

A Volkswagen model is displayed at an auto expo in Jiangxi province. Provided to China Daily |

European brands in the limelight as market picks up in June

Amid the flurry of economic indicators that came out in China this month, the robust pick-up in June car sales is expected to go a long way in bolstering the fortunes of Western carmakers, particularly those from Europe.

|

More importantly, the better June sales figures come after two consecutive months of sales decline. The combined sales figures for the auto industry in China during the first six months of the year showed a year-on-year increase of 5.6 percent to 7.01 million units.

Though the numbers are still a far cry from those achieved in 2009 and 2010, when growth rates were in excess of 30 percent, the current trend augurs well for the future of the industry, experts say.

Rao Da, secretary-general of CPCA, says the market will bounce back in the second half of the year, as June is normally considered to be an ebb period for auto sales in China.

"Going by the numbers, I am confident that the auto industry will enjoy annual growth of 10 percent this year in China," he says.

Joint-venture brands, especially those from Europe, continued to be the major gainers, and going by current trends, seem to be fast outpacing their Chinese peers.

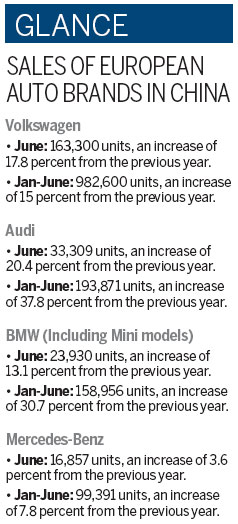

During the first six months of this year, Volkswagen AG, the world's largest auto maker and top European brand, sold nearly 982,600 units in China, a year-on-year increase of 15 percent. The company's global sales during the six months rose by 10 percent to 2.79 million units, aided largely by the strong Asian trends, it said in a statement on July 9.

With the financial situation in Europe still highly unpredictable, Volkswagen cannot expect to make considerable gains in its home turf, analysts say. Volkswagen sales in western Europe (not including Germany) declined by 4.7 percent to 464,300 during the first six months, according to information provided by the company.

Volkswagen's sister brand Audi came in with even better numbers during the same period in China. The brand notched up an impressive growth of over 37.8 percent year-on-year, and maintained its lead in the luxury car segment of the Chinese automobile market. During the first six months, 193,871 Audi cars were sold in China.

Close on the heels of Audi was another German luxury carmaker - BMW. The company sold 158,956 BMW and Mini cars in China in the first six months, a year-on-year increase of 30.7 percent.

Mercedes-Benz came in third in luxury car sales in China with sales of more than 99,391 units in the same period. But the year-on-year growth rate of the company remained less impressive at 7.8 percent.

Chinese automobile brands saw their market share fall to 27.5 percent in June from 30.7 percent in January. Cui Dongshu, deputy secretary-general of CPCA, says that the Chinese brands suffered major setbacks in first-tier cities such as Beijing, Shanghai and Guangzhou as their share of the market dropped to 10 percent.

Xu Changming, director of the State Information Center's information resource unit, says the expansion strategies of the joint-venture brands has paid off and helped offset the price advantage enjoyed by the Chinese brands. "The new emission requirements have further squeezed the profit margins for Chinese brands and rendered competition with marquee brands impossible."

Though European brands have been growing their market share, their profit margins were less, due to the stiff competition and the pressure to maintain mid-year sales targets.

Earlier this year Mercedes-Benz announced that it was reducing the price of its S-class model by more than 200,000 yuan. Similar price cuts have been announced on other models such as Audi, BMW and Volvo.

According to Audi's financial report, profit in the Chinese market has grown from 144 million euros in 2009 to 270 million euros in 2011. However, the Chinese unit's contribution to global profit has slipped from 11 percent to 6.15 percent.

Zhang Xiaojun, executive vice-president of FAW-VW Audi sales division, says competition among foreign brands will be even fiercer in the next six months. "We will need to find alternative strategies to boost profits," he says.

"In mature markets, like the US and Europe, the profit from selling cars is fast diminishing. Dealers are paying more attention to after-market services like financing, insurance and leasing," he said in a recent interview with Netease news portal.

Zhang says over the next four years, Audi will invest more than 2 billion euros globally to develop new models and new technologies.

On July 9, the central government issued its long-term fuel-efficient and new energy vehicle development plan (2012-20), pledging to support electric and plug-in hybrid vehicles, and to raise the sales of electric and plug-in hybrid vehicles to 500,000 units by 2015.

With the Chinese government dedicated to develop fuel-efficient and new energy vehicles over the next 10 years, foreign auto brands will need to gear up to take advantage of this huge market opportunity, experts say.

French carmaker PSA Peugeot Citroen is expected to launch four diesel hybrid models globally, including one gasoline hybrid model in China. BMW has already developed a hybrid version for its 5-Series model in 2010, and also launched a new hybrid 3-Series recently.

Su Bo, vice-minister of industry and information technology, says that the electric vehicle plan is not only a guideline for China's auto industry, but also a reflection of the common strategy of the global auto industry.

"Although it is difficult to realize the goal (selling 500,000 electric and plug-in hybrid vehicles by 2015), we must try and achieve it."

Su says that there should not be any difference in the subsidies for new energy vehicles, be they Chinese brands or joint-venture brands, "as long as they are produced in China".

wangchao@chinadaily.com.cn

(China Daily 07/13/2012 page20)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|