London Calling

Updated: 2012-06-15 12:28

By Cecily Liu and Zhang Haizhou (China Daily)

|

|||||||||||

|

A visitor looks at global stock price information at the London Stock Exchange in this 2011 file photo. Three Chinese companies launched their initial public offerings on the Alternative Investment Market in London this year. Simon Dawson / Bloomberg |

Headwinds in the US push Chinese companies to European shores

After facing headwinds in US bourses on a host of issues like corporate governance and accounting standards, more Chinese companies are likely to list their shares on European exchanges to further expand their global outreach and raise capital.

Even though the problems in the US bourses had led to an erosion of investor confidence, that has not deterred Chinese companies from seeking greener pastures in the markets with more flexible listing thresholds. Evidence of the new trend was seen earlier this year when three Chinese companies launched their initial public offerings on the Alternative Investment Market (AIM) in London, followed by two more Chinese floats in Frankfurt.

Though the quantum of funds raised by all these floats is still relatively small, capital market analysts feel that Europe looks well poised to grab a lion's share of the new or planned Chinese IPOs.

Auhua Clean Energy, a Shandong-based green technology company, managed to raise just 1 million pounds ($1.56 million, 1.24 million euros) on the AIM as opposed to the 3 million pounds to 6 million pounds it hoped to raise initially. Similarly, sports retailer Naibu, based in Fuzhou of South China's Fujian province, had looked to raise 50 million pounds to fund its capacity expansion in China. But the company managed to raise only 6 million pounds from private investors.

Prospects on the Frankfurt bourse were no better as the two Fujian-based companies raised less than 3 million euros ($3.8 million) each this May.

| ||||

Part of the reason why these companies have not been that successful in cobbling up the required funds is the "China risk" factor that seems to be weighing heavily on the decision-making process of global investors.

"There are some Chinese businesses in London that haven't done well," says Dugald Carlean, director of corporate finance at Charles Stanley Securities, the nominated adviser for the IPO of Chinese mining services company Rare Earth Global this March.

"Some have fallen below adequate corporate governance whilst others have suffered from poor trading, which can happen to any business. But it often comes back to the fact that the company is Chinese, which is the wrong thing to look at," he says.

In 2007, Chinese lottery operator Betex delisted from the AIM after Chinese authorities detained two senior staff members for illegal gambling. In 2008, the chief executive and majority shareholder of Chinese mobile phone handset maker ZTC Telecoms disappeared after using shares in the company as collateral for a loan.

Familiar with the approach that London fund managers apply to new listings, Charles Stanley insisted that Rare Earth Global should adopt corporate governance measures above what are generally required ahead of its AIM listing.

The company appointed a UK-based director with AIM experience after the listing, and incorporated some aspects from the UK Takeover Code to protect shareholders in the event of a takeover bid. It also employed Deloitte to audit its accounts, although many AIM-listed companies can scarcely afford to hire the "big four" auditors.

Despite the effort, most of the investors were willing to purchase Rare Earth Global shares only at a discount to the indicated IPO price, something that did not go down well with company chief executive Simon Ong. Ultimately the company was admitted to the AIM after raising $10.2 million via private placement, $40 million less than anticipated.

Despite the low valuations on bourses like AIM, Chinese companies know that the potential advantages of overseas listing far outweigh the capital raised.

"Listing on the AIM gives us a lot of visibility to the Chinese government, Chinese banks and our customers," says Raphael Tham, non-executive chairman of Auhua.

As Auhua's CEO Chen Anxiang is currently helping the Shandong government to create regulatory standards of solar water heaters sold in the province, the London listing does put much more weight behind his suggestions.

The AIM listing also helps Auhua get bank loans for expansion, as Chinese banks are "very selective when lending to SMEs", Tham says. Though the company did look at other European exchanges like Frankfurt for the IPO, it chose AIM because of the greater liquidity available for secondary fundraising.

"It is better to first go out to the market, then prove ourselves by delivering to our shareholders, and then raise the amount we require in the medium to long term," he says.

Tham speaks from experience. As CEO of the AIM-listed China Food Co, Tham realized that fundraising gets easier over the years as fund managers learned to trust his team. A total of 2.5 million pounds were raised in the company's secondary fundraising last year.

Naibu CEO Lin Huoyan also shares the same view and says that going public is also a process of standardizing the overall practices after the company reaches a certain size. The work and morale of the employees improve considerably after the company becomes a listed entity, Lin says.

Though Lin's company listed its shares at a price of 124 pence per share on April 5, its value has since fallen to 116.5 pence as of June 8. Admitting that the Naibu shares are valued at prices lower than expected, Lin says it is only a matter of time before the prices return to better levels.

|

Clockwise from top: Lin Huoyan (left), CEO of sports retailer Naibu; Alexander von Preysing, head of Issuer Services at Deutsche Boerse; Tracey Pierce, director of Equity Primary Markets at the London Stock Exchange; and Randeep Grewal, CEO of the Chinese coal bed methane company Green Dragon Gas. Photos Provided to China Daily |

Hard times

A spate of scandals involving Chinese companies in North America partly explains the current hysteria that has also enveloped the Chinese companies listed in Europe.

Since early last year, there have been a spate of issues concerning a host of Chinese companies, most of which centered on fabricating financial figures.

Sino-Forest, a Chinese forestry group listed in Toronto, saw its shares plunge by 90 percent after Muddy Waters, a research firm founded by short-seller Carson Block, accused the company of overstating its sales and the value of its forest land in August 2011. The move inflicted a paper loss of almost $500 million on its largest shareholder, the $37-billion hedge fund run by billionaire John Paulson.

Longtop, a Chinese software company, was delisted from Nasdaq in August 2011 after its auditor, Deloitte, accused the company of "very serious defects", including faking its bank statements.

Meanwhile, problems with many smaller Chinese companies were exposed after an investigation by the US market regulator Securities and Exchange Commission (SEC) unveiled accounting discrepancies in more than 25 New York-listed Chinese companies during the first half of 2011.

What followed was a slash in valuation of almost all the US-listed Chinese companies, many of which sought voluntarily delisting or moved on to other bourses.

In 2011 alone, 29 Chinese companies were delisted from the US bourses, with a combined market capitalization of $5.7 billion. Another 48 companies saw trading in their shares suspended, or receiving suspension warnings from the SEC.

In the same year, only 11 new Chinese listings occurred in the US, with a combined total market capitalization of $2.2 billion, which is a 43 percent drop from 2010, when 45 new Chinese listings raised nearly $3.9 billion.

Unfriendly investor sentiment centered on US-listed stocks has also caused a ripple effect in the financial market. "Before the scandals in the US, Chinese companies in the UK would be criticized if they did wrong, but now it seems Chinese companies are criticized as a whole," says George Zeng, CFO of the AIM-listed petrochemical company Haike.

Haike raised $20 million on the AIM in 2007. The company considered raising more capital after testing the waters, but the unexpected financial crisis a year later deemed secondary fundraising on AIM undesirable. The company is currently $400 million in debt from local banks, and looking for an opportunity to deleverage.

To increase communication with its investors, Haike recently hired Equity Development, a leading investment research company in the UK to publish quarterly reports on the business and to supplement the equity research reports its broker publishes.

"We want to tell our investors and the financial media about what is going on in the company, and make our corporate governance measures more transparent," Zeng says.

Strong fundamentals and increasing transparency of foreign-listed Chinese companies have not escaped all investors, although investors who trade on the basis of fundamentals are not always rewarded.

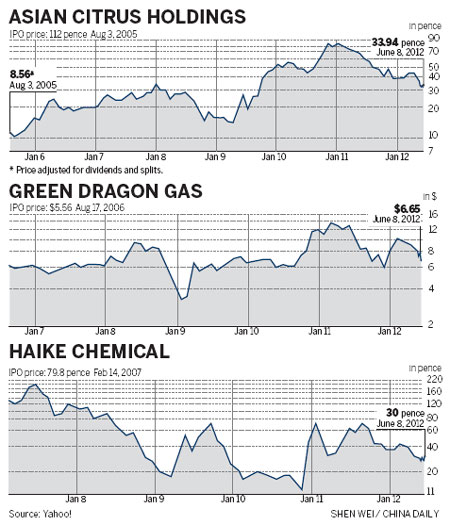

Douglas Lawson, a fund manager at the Edinburgh-based Amati Global Investors, admits that the AIM-listed Asian Citrus "wasn't a particularly successful investment", although he remains invested in the company as he feels that the shares are fundamentally undervalued.

Asian Citrus, a Chinese orange plantation, came under pressure last year when its fertilizer supplier Chaoda was investigated by the Hong Kong Stock Exchange for insider dealing. It suffered another blow in February when Next Magazine, a Chinese-language publication in Hong Kong, questioned its production figures.

Although Asian Citrus has defended itself against both accusations, its share price has fallen to 33.94 pence per share as of June 8, compared to 60.1 pence a year ago. "It was very frustrating to see the share price weaken, even though we were confident that there was nothing wrong with the business," Lawson says. "As soon as you put these rumors out in the public domain, to a certain extent the damage is done."

He says that capturing growth in Asian markets would continue to be the core of Amati's investment strategy. Amati also holds stocks in AIM-listed Chinese companies China Food Co and Sorbic.

"We will definitely continue to have exposure to Chinese consumers, either by investing in UK-listed Chinese stocks, or in UK companies that are exporting to China," he says.

Meanwhile, some Chinese companies have already demonstrated that hard work will be eventually rewarded.

Green Dragon Gas, a Chinese coal bed methane company, raised $25.1 million at $5.56 per share in 2006. Its shares closed at $6.65 on June 8. The company CEO Randeep Grewal says that delivering on business targets is important to maintain shareholders' confidence. To ensure transparency and consistency, the company also employs a single accounting firm to audit its China and overseas accounts.

"This totality in transparency to the auditor eliminates any potential conflicts in the applied accounting principles which has given rise to discrepancies in several other companies," Grewal says.

Europe calling

The global skepticism toward Chinese companies is not yet over, but the long queues of companies waiting for IPOs in Shanghai will mean that new Chinese listings in foreign markets will not stop.

With such huge opportunities at stake, leading bourse operators like the London Stock Exchange and Deutsche Boerse, both of which established Beijing offices in 2008, are now competing with American bourses to attract the Chinese companies.

Tracey Pierce, director of Equity Primary Markets at the LSE, points out that her team has seen an increase in the number of companies looking at a London listing, "possibly because of the situation in the US".

Earlier this year, five Chinese companies came to meet potential investors at an investor markets day run by the LSE. "From the investor feedback, we know that there is interests in Chinese companies in particular," Pierce says. Currently 54 Chinese companies are listed in London, with eight on the main exchange, and 46 on the AIM.

The pipeline for Chinese IPOs in Frankfurt is slowly building up, says Alexander von Preysing, head of Issuer Services at Deutsche Boerse, the operator of the Frankfurt Stock Exchange.

"There are a handful of Chinese IPOs in the pipeline if the market remains stable enough for IPOs before the summer break. For the full year, there are two or three handfuls," von Preysing says.

Out of the 14 Chinese companies that teamed up with the Deutsche Boerse last year, five opted for the Prime Standard, where corporate governance regulations are the strictest. Von Preysing sees this as a sign of Chinese companies increasingly hoping to demonstrate the quality of their corporate governance to investors.

To date, 33 Chinese companies are listed in Frankfurt, with 10 on the Prime Standard, one on the General Standard, six on the Entry Standard and 16 in the Open Market.

Although the US and Hong Kong are still the most popular markets for overseas listings by Chinese companies, the comparative scarcity of scandals concerning European-listed Chinese companies is significant.

Many Chinese companies also faced flak in the US for seeking listing through reverse mergers. In this process, firms buy a publicly-traded shell company to get the listing without the mandatory IPO regulatory scrutiny. The US SEC warned investors about several such Chinese companies in June 2011, and also unveiled new reverse merger regulations in November.

The Bloomberg China Reverse Merger Index, which tracks 82 companies that listed in the US via reverse mergers, fell more than 60 percent in 2011.

"Reverse takeovers, the London-equivalent process, require companies to apply for re-admission like a fresh IPO", says Neil Matthews, a partner at Eversheds, a law firm headquartered in London.

"Where cash is already held in the listed shell, a reverse taking can be a useful means of achieving flotation and accessing that capital when, perhaps due to market conditions, an IPO fundraising might otherwise be very difficult," he says.

Help in hand

The teams of advisers who are working with Chinese companies are now more agile than ever, and often subject their clients to rigid scrutiny much before the company enters the market.

Alei Duan, managing director of the financial advisory firm Abridge Capital, says that he has turned away several unsuitable Chinese IPO candidates.

"All companies want to do the minimum to raise as much capital as possible, but investors will only consider the best companies," he says, adding that unsuitable candidates are often small companies in early stages of development.

As small companies generally follow the will of a key decision maker, it is very difficult for them to change to a corporate governance structure of a public company where all decisions are made by a management board.

London lawyers are also increasingly experienced at working with Chinese lawyers on due diligence, says Nicholas Emmerson, a partner at Eversheds. Since most of the Chinese listings in London have happened after 2005, many of the London lawyers did not know how to search in the "most obvious places" for problems that Chinese companies are likely to have, he says.

"For Chinese companies, it is important to check that the key assets are owned by the company, check company's suppliers and customers, and make sure that key employees have the correct employment contracts," Emmerson says.

Going forward, Chinese companies that practice good corporate governance look well set to withstand the test of time. China's booming economy juxtaposed against the global economic downturn will also continue to be an attraction for Chinese stocks.

"The market had some concerns about the general reputation of Chinese companies, but the overriding attention on China as the place to do business in the future is bucking that trend," Emmerson says.

Contact the writers at cecily.liu@chinadaily.com.cn and zhanghaizhou@chinadaily.com.cn

(China Daily 06/15/2012 page1)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|