Flying into the unknown

Updated: 2012-06-01 09:12

By Todd Balazovic (China Daily)

|

|||||||||||

|

Global players such as Scandinavian Airlines are ready to take off in China. Provided to China Daily |

International Airlines look to capitalize on China's many smaller, but still massive, cities

Travel to China's rapidly developing destinations is set to take off to new heights as international airlines eye expansion plans in the nation's flourishing second- and third-tier cities. With the untapped growth of China's hinterlands luring multinational companies, as well as curious travelers, away from high-cost commercial centers such as Shanghai, Guangzhou and Beijing, international air carriers are following suit and discovering new emerging markets to serve as transportation hubs.

"It's a chicken and egg scenario," says Welf Ebeling, regional director for the Global Business Travelers Association Asia. "Sometimes industry goes into a destination first and the airlines follow, sometimes it's the other way around."

|

Related readings: |

"First, airlines all went to Beijing and Shanghai, but now, in order to stay competitive, they are heading to second-tier cities," Ebeling says.

Although no solid definition exists, second-tier cities are described informally as the provincial capitals and special administrative areas, with third-tier referring to any county or prefecture-level capital.

Finding its wings early, the German airline Deutsche Lufthansa AG opened two new routes last month, enabling easy access for business people traveling back and forth from Frankfurt to Shenyang, one of China's heavy industrial cities and capital of Liaoning province, and to Qingdao in Shandong province.

"Lufthansa's strategy is to grow with our customers," says Juerg Christen, managing director for Lufthansa Greater China.

He adds: "When they show a considerable demand for mobility and new destinations, we are happy to provide those connections when they make sense economically."

But for Christen, calling such cities second- or third-tier is difficult, considering both Lufthansa's new China destinations dwarf even the largest of Germany's cities.

It's the sheer size of China's 23 second-tier cities that has made the shift so alluring for international carriers. Several have populations of 5 million or more.

Lufthansa, which in 1926 was the first international airline to fly to China, is among several now flying to places previously unknown to the outside world.

Finnair began operating its first direct flight from Southwest China to Europe in May, running four weekly flights from Chongqing to Helsinki. Their new route is expected to boost passenger numbers by at least 100,000 annually.

Middle East carrier Qatar Airways has also recently added Chongqing to its destination list.

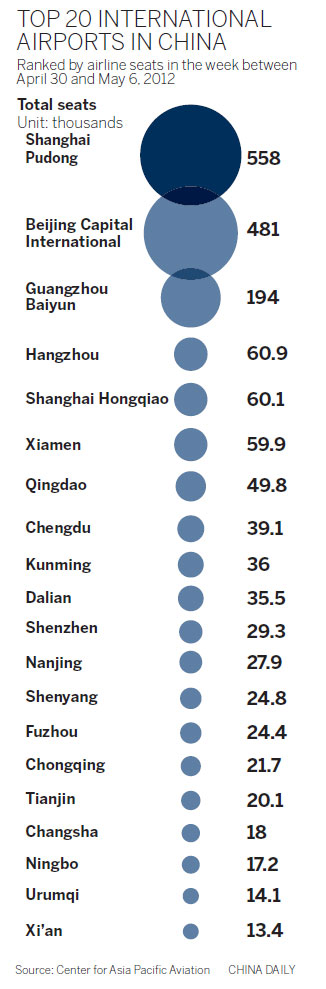

Other hot second-tier destinations for international travel include Dalian, Shenyang, Fuzhou and Kunming.

"It is extremely expensive to open a new route," says Lars Olofsson, general manager for Scandinavian Airlines (SAS) in China. "It's a multi-million dollar investment.

"Some international airlines are operating in various second- and third-tier cities and are not profitable."

Even after opening a new route, it can take up to two years before it begins to turn profitable.

Docking, equipment rental, staff wages and plane maintenance costs quickly add up, when airlines are already suffering hard times due to the global financial crisis.

Last year, they yielded only $8 billion in profits, down from $16 billion in 2010, with only $3 billion expected in 2012, according to the International Aviation Transport Association (IATA), which represents more than 230 airlines from 118 countries.

Adding to the burden of fuel and air navigation costs, the fees charged for certificates and services at airports in China are among the highest in the world.

Olofsson says SAS is using partnerships with Chinese airlines, primarily Air China Ltd, to utilize their Beijing and Shanghai routes as a base to explore new locations.

"From there we can determine which cities are most likely for us to expand into," he says.

He says currently they are researching areas including Ningbo and Hangzhou, all cities with heavy Scandinavian influences.

However, if global airlines want to maintain revenues and look to new cash streams, China is a must, says Tony Tyler, director-general and CEO of the IATA.

"China is a big market and it's growing fast. It's a no-brainer that you're going to want to be here," he says.

The driving force behind the growth is not fueled solely by Western multinational companies moving away from China's main cities. The real potential lies in the increased number of Chinese travelers venturing out of the country.

By 2015, the number of Chinese traveling by air is expected to grow to 212 million - a quarter of the projected 815 million worldwide.

Currently, the average American citizen is expected to take two air trips per year, compared with an average of 0.2 for Chinese citizens.

"When the Chinese travel as much as the Americans do - considering the population here is six times that of the United States - just think of the number of passengers that will be," Tyler enthuses.

Over the past 10 years, the number of air passengers in China has expanded exponentially.

In 2001, there were just 32.5 million seats per year on international flights operating to and from China, compared with 92.4 million in 2011.

And that number continues to rise, with an expected 10 percent growth in the number of airline passengers China-wide in 2012, according to statistics from the Civil Aviation Administration of China released last month.

In an effort to accommodate China's burgeoning passenger numbers, there have been major efforts to build hundreds of runways, control towers and state-of-the-art airport facilities throughout the country.

In China's 12th Five-Year Plan (2011-15), the government intends to build 56 new airports, and expand 91 of the 175 existing airports.

In July, Hefei, the capital of southeastern province Anhui, is expected to complete the 3.87-billion-yuan ($610 million, 487 million euros) Hefei Xinqiao International Airport, capable of accommodating 5.2 million passengers a year.

Designed to attract international businesses and tourists, Anhui, once considered among one of China's least developed provinces, has already taken steps to attract foreign airlines.

It has offered millions in subsidies in the form of tax exemptions and bonuses to airlines who bring in a high number of passengers.

Across the board, China's second- and third-tier cities are offering subsidies, ranging from free docking to fuel price reductions, to help ease the financial burden on foreign airlines looking to open new routes.

"It can make the difference between an airline wanting to take the chance or not," Tyler of IATA says. "An airline knows there's going to be red ink before there's black ink. If an incentive can dilute the red ink, or even take it away, it's going to make the difference in deciding to go in or not - particularly in difficult times such as these."

In Anhui, their efforts are already paying off. Even without the new facilities, the number of international travelers passing through Hefei's gates has grown by more than 30 percent for the second year in a row.

When the new airport is officially opened, the once overlooked provincial capital could soon become an international hotspot.

"Now is the time for international airlines to seriously review their operations in these types of cities," Olofsson of SAS adds.

toddbalazovic@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|