The private connection

Updated: 2012-04-27 08:49

By Hu Haiyan and Ma Wei (China Daily European Edition)

|

|||||||||||

|

|

Small, medium companies have big role in China's economy

State-owned enterprises have been taking the center stage of China's economy, but that does not mean private enterprises fell by the wayside.

Despite the lack of financial muscle, private enterprises have flourished and played a key role in shaping China's global fortunes in the past few years.

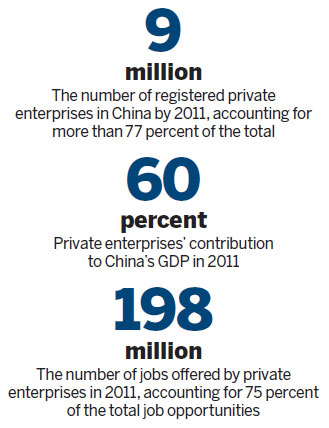

According to the China International Cooperation Association of Small and Medium Enterprises, by the end of last year, the number of registered private enterprises in China was about 9 million, with annual growth of 14.5 percent between 2006 and 2011. Private enterprises also account for more than 77 percent of the companies in China.

They also account for more than 60 percent of China's GDP, according to the association. "In some industries like manufacturing and electronics, private enterprises far outnumber the State-owned players," says Tong Youhao, director of the general office of the association.

According to Tong, private enterprises also have a key role in fostering employment opportunities. In 2011, these companies employed nearly 196 million people, and accounted for 75 percent of the job opportunities in China.

But the real growth point has been the government decision to free up State-controlled sectors like railways, telecommunications, finance and culture accessible for private investment. "With this, private enterprises are now present in most of the key industry sectors," Tong says.

Olivier Horps, the president and chief executive of Club Mediterranee SA Greater China Region, says that the private economy has made many significant achievements in the past few years and considers it the best option to tap the Chinese market.

"Because of the big potential in the Chinese market and favorable development conditions, the growth momentum will continue. For foreign companies like ours, it is better to team up with private enterprises for business development," Horps says.

In June 2010, Fosun International Ltd, a privately owned Chinese conglomerate, acquired 7.1 percent stake in Club Med, a French holiday resort operator. By the end of 2010, Club Med opened its first resort in China at Yabuli, in Heilongjiang province, with assistance from Fosun.

Chen Naixing, director of the Research Center for Small and Medium-sized Enterprises at the Chinese Academy of Social Sciences, says that private companies have also accelerated their overseas activities in the past five years.

"Many private companies have successfully acquired leading global brands, like Lenovo's purchase of IBM's PC business and Geely's acquisition of Volvo. These cases have demonstrated the strong desire of capable Chinese private companies to make global strides," Chen says.

According to Chen, many private companies have also increased their investments in developed regions like Europe and the United States.

Attilio Massimo Iannucci, Italy's ambassador to China, says that the achievements made by Chinese private enterprises are "as gorgeous as the works of famous Italian artist Leonardo da Vinci".

"Private enterprises have played a key role in the development of China's national economy, and enjoy a higher social status than 20 years ago, when I was a minister counselor in the Italian embassy in Beijing," says the 65-year-old diplomat.

Experts agree that the private economy is the new driving force in the country's innovation and economic restructuring process.

"Private businesses have taken the lead in many emerging industries and advanced technology sectors such as green energy and information technology, where their numbers far outweigh that of State-owned enterprises (SOEs). They are also more flexible than SOEs. The key to China's successful economic restructuring lies in these private companies," says Xu Xiaonian, an economist and finance professor at the China Europe International Business School (CEIBS).

But experts also point out that despite the impressive growth, there have also been severe challenges like rising raw material, labor costs, shrinking markets and bleak global financial situation.

"The private companies lack effective financial channels. But they are still more vigorous, capable and rich in terms of orders, thereby proving that they are more adept at handling financial issues like the recent Wenzhou crisis," Huang Mengfu, president of the All-China Federation of Industry and Commerce, an organization representing private enterprises, said in a recent media interview.

Wenzhou, a city in East China's Zhejiang province known for its booming private sector, was one of the regions that was severely affected by the recent private debt crisis.

Last year, about 100 leaders of private companies in the city were reported to have committed suicide or declared bankruptcy, leaving behind debts of about 10 billion yuan ($1.59 billion, 1.2 billion euros).

"Financial institutions for the private companies, especially for the small and medium enterprises, need to be set up immediately," Huang said.

Some experts also say that apart from the financing difficulties, private enterprises should also accelerate the process of upgrading themselves to enhance their competitiveness in the global market.

"The time has passed when many Chinese enterprises could win market share with lower prices. Only those enterprises that can move up the value chain and provide more value-added products will survive the hard times and reap the benefits," Xu from CEIBS says.

But Patrick Nijs, Belgium's ambassador to China, says that it is common for private companies everywhere to encounter problems. "I admire the Chinese private companies' huge vitality and creativity. I believe endowed with China's huge domestic market and favorable development conditions, these problems will not impede their development," Nijs says.

"There must be more and more great private companies, like Huawei and Lenovo, that will come into existence in China in the near future."

Contact the writers at huhaiyan@chinadaily.com.cn and mawei@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|