Premium beers reach dizzying heights

Updated: 2012-04-06 11:17

By Li Fangfang (China Daily)

|

|||||||||||

Brewers enjoy boom times as market continues to grow in China

|

|

As bottles of premier beer continue to fly off the shelves in China, from family eateries to trendy night spots, industry insiders say its happy hour all year round for brewers.

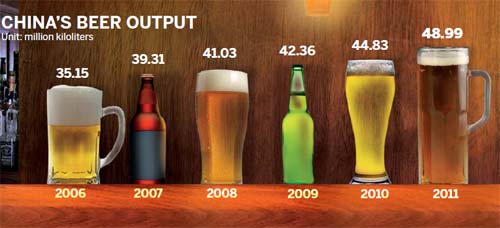

The country is already the largest producer and consumer of beer. Last year it had an output of about 48.99 million kiloliters, a 9.3 percent increase on 2010 and the eighth consecutive year of growth.

Yet, more importantly, the Chinese masses are increasingly filling their glasses with pricey premium brands, including Carlsberg, Budweiser, Bud Light, Heineken and Skol.

The sector may have made up just 10 percent of overall sales in 2011 (a rise of 20 percent on the previous year), but it contributed almost 50 percent of total profit.

China consumes around 43.8 million kiloliters of beer every year, roughly one-fourth of the world's total, according to Stephen Maher, chief executive officer of Carlsberg China.

However, the market has some unique traits, he explains: "Research shows Chinese tend to drink beer more often at restaurants, bars and other entertainment venues, and they like to consume large volumes over a short period of time.

"It (the market) is a challenge and an opportunity, as we have to be constantly on our toes and come up with new brands that can connect with the aspirations of consumers," he says.

Carlsberg, the Danish brewer, has gained lots of local insight during its time in the market, such as the fact that people on the Chinese mainland prefer less bitter flavors, which is different from those in Hong Kong or Malaysia.

"We launched Carlsberg Chill and Carlsberg Light exclusively for customers in China," Maher says. "These beers are ideal for Chinese drinkers, unlike our flagship 'green label' brand, which is a classical European beer with a higher bitterness level.

"Chill is positioned for those seeking entertainment, and Light is for enjoyable moments. Both have well complemented our strategy of creating tailor-made beer products for Chinese consumers," he says, adding: "Connecting with consumers is core to Carlsberg's success."

Carlsberg has also benefited a great deal from its partnership with Chinese brands, including Wusu, Dali, Shancheng and Xixia.

The company owns more than 30 breweries in 11 provinces and autonomous regions, and in particular has been gaining a strong position in western regions of China since the early 2000s.

"Local brands and partners have helped establish a firm base for Carlsberg and provided better consumer insight," Maher says, adding that his company intends to nurture customer loyalty to products by retaining local brands and flavors.

In addition, Belgium-based brewer Anheuser-Busch InBev in November began producing its high-end brand Stella Artois in China, says John Hsu, its president of BU North Business. The company also makes Beck's, Budweiser, Corona and Harbin in China.

Wang Renrong, vice-president in Asia-Pacific for AB InBev, says he believes the Chinese market will contribute 30 to 50 percent to the growth potential of the world's beer industry in the next few years.

He also says China has been one of AB InBev's most important markets, accounting for 12 to 13 percent of its total business. "We hope the figure will be bigger, as we see huge potential here," Wang adds.

Stella Artois retails at 40 yuan for a 330-milliliter bottle in the market, while most beers are priced under 10 yuan.

Along with a spike in consumption, there has also been a marked change in the customers' perceptions, Maher says.

With disposable income on the rise, beer has slowly made inroads in the high-end sector, traditionally dominated by wine and spirits.

Drinking premium beer is now fashionable among affluent, middle-income families as well as younger generations, Maher says.

"There is high profitability in the premium beer segment," he says. "Premium beer will account for 25 percent of China's annual beer capacity over the next five to 10 years. This is good for us, as we have always been strong in the premium segment.

"As consumers move up, they're moving into our playground," he adds.

"From the Chinese perspective, what we are trying to do is to say that beer has a role to play in Chinese celebrations."

Carlsberg has already had more than 20 brands targeting Chinese drinkers, although Maher conceded that companies need to get ahead of the trend if they want to make it big in the Middle Kingdom.

"The market has become more demanding, and the fast-changing landscape means that the one with the ear closest to customer preference clearly walks away with the crown," he says.

After dominating the premium beer sector in China, foreign brewers are turning their attention to low-end customers through acquisitions.

Beijing Yanjing Brewery Co Ltd, the only Chinese brewery without an overseas partner, has looked on as Western rivals have teamed up with companies in second- and third-tier cities.

Based in the capital, and with 42 branches in 18 cities, Yanjing is already one of top three beer producers in China, and it aims to be one of the world's top six brewers by 2015.

To achieve the goal, the company needs to add 3 million kiloliters to boost its annual output to 8 million kiloliters.

Huang Fusheng, an analyst at China Securities, says that over the next five years the competition in the country's beer market is expected to become more intense, as the brewers will seize opportunities in mergers and acquisitions.

lifangfang@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|