Building value

Updated: 2012-03-23 08:47

By Hu Yuanyuan (China Daily European Edition)

|

|||||||||||

|

Office buildings in the central business district of Beijing posted substantial rental growth last year. [Provided to China Daily] |

Despite a nationwide drop in home prices, the cost to rent prime office space in Beijing is skyrocketing

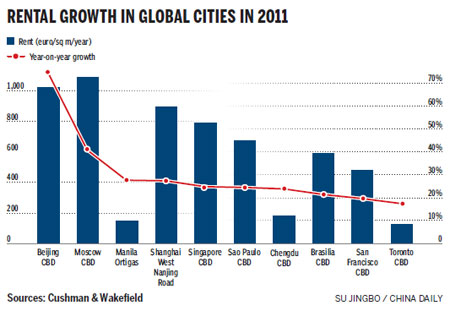

While Hong Kong might still be the most expensive city to rent office space, Beijing made a splash as the city with the highest growth in prime office prices in the world last year. Prime office rent in Beijing's central business district (CBD) soared 75 percent in 2011 from the previous year, the highest increase of any city in the world, according to a report by real estate consultancy firm Cushman & Wakefield. Across Beijing, the total occupancy cost for prime office space increased by 38 percent, according to DTZ, a global real estate adviser headquartered in London.

The eye-popping growth placed Beijing as the fifth most expensive city in the world to rent prime office space, according to Cushman & Wakefield. Hong Kong retained the top spot in the report, followed by London, Tokyo and Moscow. New York ranked sixth behind Beijing.

The rise in Beijing, Shanghai and other major cities in China follows on the heels of a slowdown in the country's property market, with housing prices depreciating across the nation. But the central government's efforts to cool down home prices have clearly not affected office rent.

In the Asia-Pacific region, the cities of Beijing and Shanghai led the way in terms of rental growth, while the region as a whole continued to grow in 2011, appreciating 8 percent over the year.

The report states it now costs $130 (98 euros) a year for a square foot of grade A office space in Beijing. It costs $239 in London's West End and $120 in midtown Manhattan.

"The strong rent growth is driven by very limited supply and robust demand," says Zhang Ping, research director for Cushman & Wakefield.

Zhang says that "in addition to demand for self-use buildings, mostly from domestic companies, leasing demand continued to be driven by financial services companies, consulting firms, law offices and high-tech and manufacturing companies".

As a result of increased demand for office space, the vacancy rate in the capital has dropped. In 2011, the vacancy rate for grade A office space in Beijing fell to 4.2 percent, the lowest in a decade, according to real estate service provider Savills.

In Shanghai, the price to rent grade A office space climbed 17.4 percent in 2011. The average rent in the city rose 8.8 yuan ($1.39, 1.05 euros) per square meter per day in the fourth quarter of 2011, according to Jones Lang LaSalle.

Leasing demand softened in the fourth quarter of 2011 in Shanghai as concerns about Europe and a slowdown in China caused tenants to become increasingly cost-sensitive, according to the report by Jones Lang LaSalle.

Frank Marriott, senior director of Savills Real Estate Capital (Asia-Pacific), says the market for office space in Beijing and Shanghai are considered ideal for international institutional investors, especially for real estate funds that prefer relatively lower risks. Still, the supply for office space is growing thin, which would make it more difficult for international investors.

Domestic insurance companies and State-owned enterprises, on the other hand, may continue to dominate the market for office space as they did last year, industry analysts said.

Known collective sales in Beijing hit $3.63 billion in 2011, down 13 percent from the previous year, according to Cushman & Wakefield. Chinese institutional investors dominated the market in terms of capital, making up 83 percent of the deals for office rent, compared with 60 percent in 2010.

In Shanghai, deals for office space went in the opposite direction, climbing nearly 10 percent from 2010 at $5.25 billion last year. Foreign institutional investors accounted for 51.2 percent of all deals for offices, according to Cushman & Wakefield.

"Shanghai remained the most-favored city by international investors because the market is more mature and there are more tradable assets for global investors," says Ye Chengyu, director of investment at Cushman & Wakefield.

According to Savills, the demand for Beijing office space will remain strong over the next three years. But despite the robust rental growth of prime office space in Beijing, there are no signs so far that multinational enterprises are relocating out of the capital's high rent areas.

"We didn't see the trend of enterprises moving office just because of the strong rent growth last year," Zhang says.

She says major companies actually didn't really suffer from the growth in rent prices.

"To maintain quality clients, especially big name companies, most grade A office landlord will offer favorable terms and prices to those tenants. Therefore, they don't suffer a big rent growth as new tenants do," Zhang says.

Carlby Xie, head of research at the real estate consultancy Colliers International (Beijing), agrees.

"Some multinational companies did relocate their offices last year, but not merely because of rent growth," Xie says. "Other reasons that led to enterprises relocating include business expansion for more floor space and favorable taxation policies offered by district governments."

Nokia, for instance, moved its headquarters from the CBD to the Beijing Economic-Technological Development Area in 2006 after the government of Yizhuang offered competitive tax rates.

Zhang says the last major relocation by a number of multinational companies happened in 2007 when companies such as Motorola moved from the CBD to the neighborhood Wangjing, located outside Beijing's North Fourth Ring Road.

"But that round of relocation was also not triggered by rental growth but better opportunities to design their office park and offer their staff better traffic conditions and accommodation," Zhang says.

Other companies, on the other hand, have kept their sales divisions at the CBD while moving other divisions outside the business district.

Hans Leijten, regional vice-president of Regus Group (East Asia), says a German software IT service company moved its research and development center out of China Central Plaza, a landmark office building in Beijing's CBD, to a tech-park outside central Beijing last week.

As the world's largest workplace supplier by market value, Regus rents spaces in office buildings from owners or management groups and sublets them, sometimes on a temporary basis.

This demand, Leijten says, is ideal for multinational companies that want to expand to China's second- and third-tier cities, especially on a trial basis.

Despite reduced economic growth forecasts and record high rents, overall demand in the Beijing and Shanghai office market is expected to grow in 2012. The spike in rental prices will slow down as the supply of office spaces increases in the two cities, according to research from real estate consultancies.

"Rents are projected to grow more slowly than in 2011," says Qin Xiaomei, chief researcher at Jones Lang LaSalle.

This year, seven office projects are scheduled for completion in Beijing with a total floor area of about 420,000 square meters. Leasing-only projects account for half of the projects with the rest taken up by self-use owners, according to Jones Lang LaSalle.

"We believe the rent growth will be definitely slow down to a reasonable level this year," Zhang says.

The amount of prime office space in Beijing will likely increase by 18.5 percent this year, according to Savills' predictions. Shanghai should see a growth of 12 percent.

Meanwhile, the job market in China remains rosy, with 64 percent of surveyed companies stating they will increase their number of employees, according to Savills research. In Singapore and Hong Kong, 40 percent of companies polled said they will increase the total number of employees. The expansion of business and employment should help to create more demand for office space.

"There is no end in sight to even higher occupancy costs for companies in Beijing, as we forecast costs to rise by an annual average of nearly 10 percent over the next five years," says Karine Woodford, head of occupier research at DTZ.

This makes Beijing the fastest growing market in the world by cost and the fourth least affordable office market in the Asia Pacific in 2016, according to DTZ research.

"In fact, Beijing emerges as the biggest mover over the next five years, shifting 13 places to enter the top 25 least affordable markets globally by 2016," Woodford says.

Despite sustained growth, China is also home to some of the most affordable markets globally - Qingdao, Chengdu, Dalian and Tianjin. These second-tier markets are gradually being transformed by the injection of quality grade A office space, providing tenants with more choices at a relatively low cost, according to DTZ's report.

Occupiers in Europe, on the other hand, are anticipated to experience more muted occupancy cost increases over the same period amid the continent's austerity measures and financial uncertainty. In the US, the price to rent office space is expected to show modest increases, according to the DTZ report.

San Francisco had the highest rent as demand swells from technology and financial companies. Prime office rates in the city grew by 24 percent to $37.75 per square foot a year.

huyuanyuan@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|