Economic voice with two accents

Updated: 2012-03-23 07:48

By Amanda Reiter (China Daily)

|

|||||||||||

|

Jing Ulrich says her personal growth has coincided with China's. Provided to China Daily |

Opinion of 'citizen of the world' one of the most sought after by investors around the globe

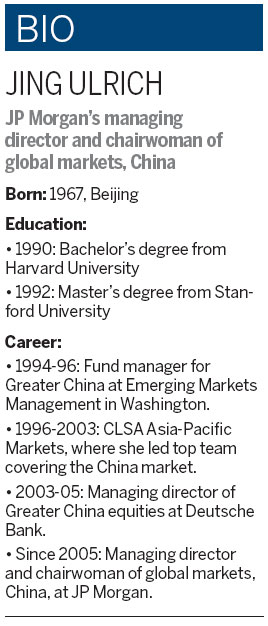

Many people regard Jing Ulrich as an unofficial voice of China, but the woman many rely on to better understand the country's economy sees herself as a citizen of the world.

"I am always busy, full of life and want to be fully engaged in whatever I am doing," Ulrich says.

And she is.

In a two-day trip to Beijing last year, the schedule for the managing director and chairwoman of global markets at JP Morgan in Hong Kong was packed. In an hour's time, she conducted two phone conferences with JP Morgan's London office on a report about China's affordable housing program picking up momentum; she sat down in a 10-seat conference room at the Grand Hyatt Hotel near Wangfujing Street for a quick interview with China Daily; switched seats for a question-and-answer session with investors and potential clients on her micro blog and was off to record a segment, in English and Mandarin, for China Central Television, better known as CCTV.

Thousands of clients worldwide rely on her expertise, sources and research to make informed decisions about investments in the ever-changing developing economy that is China. JP Morgan, where she has worked for almost seven years, claims her insight directly controls trillions of dollars of assets every year.

Ulrich says her personal growth has coincided with China's. She says she is fortunate her parents sent her from Beijing, her hometown, to the United States when she was 19.

"I felt like I was a representative of China and Americans saw me as a window through to China," she says.

|

|

She landed a job as head of China research at CLSA Asia-Pacific Markets in Hong Kong in 1996, when the China market was still developing. She says her boss recognized her unusual background, the potential in China and how the two could work together.

"He said my mission would go well beyond covering a few Chinese companies. In fact, my job would be to interpret the complexities of China to the rest of the world. This has been my mission, my calling throughout my career," Ulrich says.

Ulrich now travels the world, meeting with investors, multinational corporations and attending conferences to shed light on a country that is complex and fast-changing. She is always making new contacts, some of which turn into clients, but she also gleans knowledge from those contacts.

"There are so many facets to the economy that you can never talk to too many people or absorb too much information," Ulrich says.

As her client base grows, along with her contact list on her BlackBerry, so do requests for speaking engagements. But she is not afraid to turn them down because there aren't enough hours in the day. As it is, she says she can only accept 5 percent of invitations and calls.

Time and time again, Ulrich is asked her opinion on the future of China's economy, what investors should be considering or even how the markets will perform in the next six months. And time and time again, her ability to rattle off and regurgitate numbers is fascinating.

"Fifty-five percent of oil consumed in China is actually imported."

"China has $3.18 trillion (2.39 trillion euros) in reserves."

"Chinese tourists spent an estimated $55 billion abroad in 2011."

Her solid foundation of facts and figures, she says, comes down to the need for her clients to trust her. And she does do her research.

She culls tidbits of information from the Internet throughout the day by using multiple smartphones. But she prefers to pore through five to six newspapers every day while using the Stairmaster.

"Aside from looking at public data and the research published by JP Morgan's team of analysts, it helps greatly to speak directly to executives from SOEs (State-owned enterprises), private enterprises, multinationals, scholars and industry specialists to form a complete perspective of the market," Ulrich says.

She says she works with JP Morgan employees across all industries, asset classes and geographical locations. Together they have formed a partnership to create the best advice for their growing clientele because "investors always expect a candid assessment of economic conditions".

Those assessments can be found in nearly weekly reports called the Hands-On China series, an idea Ulrich brought to JP Morgan. She and her team thoroughly analyze relevant topics to guide foreign and overseas direct investments.

Each year Ulrich also hosts the world's premier China investment conference, which attracts 2,000 business and government leaders from 40 countries.

In a statement issued in early March, Ulrich broke down the contributing factors to the easing inflation rate in China, 3.2 percent in February. She cited comments by Premier Wen Jiabao at the annual meeting of the National People's Congress, data on wholesale food prices, oil prices, bank deposits, among others, to come to the conclusion that to keep the economy stable, more cuts are needed to the required reserve ratio, which influences the amount of money banks make available for loans.

For the first time in three years the People's Bank of China cut the reserve requirement ratio for banks by 50 basis points in December, and announced another 50-basis point cut last month.

Ulrich predicts: "Further cuts will be needed to maintain stable economic growth." She has also often suggested that the government might enact further policy-easing measures, such as tax reforms, in response to the changing macro environment.

This type of analysis has led to her being recognized last month by Forbes magazine, as one of Asia's 50 Power Businesswomen. It said her "knowledge of China and financial markets has made her a familiar face on Asian economic and investing matters".

She was acknowledged alongside Zhang Yin, the founding chairwoman of the Hong Kong-listed packaging material producer Nine Dragons Paper.

Forbes had previously selected Ulrich as one of the 100 Most Powerful Women in the World, Fortune magazine ranked her in the 50 Most Powerful Global Businesswomen for the past three years.

But it is not all business all the time. She was approached by Vogue USA for last year's September issue, referred to as The Big Issue. She was also featured in Vogue China in September 2010 as one of 15 globally influential Asian women. Beyond her interest in fashion, she says she wants to convey the idea that there is a soft side to businesswomen.

Xinhua News Agency contributed to this story.

Contact the writer at amanda@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|