Spinning forward

Updated: 2012-03-16 08:48

By Hu Haiyan (China Daily)

|

|||||||||||

|

|

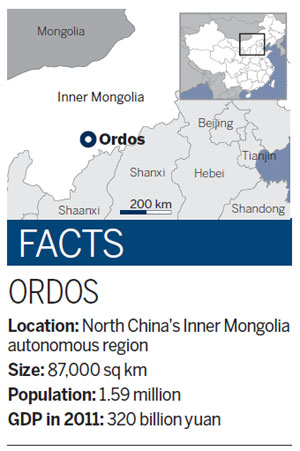

Ordos, which some refer to as the Capital of Cashmere, is searching for a way to upgrade its manufacturing sector

In one of the richest cities in China, once-prosperous cashmere makers may be at their tipping point. As in many cities in China, manufacturers in Ordos in the Inner Mongolia autonomous region are searching for a way to combat an industrial shift as well as the challenging economic environment. According to official statistics, there are about 200 producers of soft wool in Ordos, among which almost 150 are small- and medium-sized enterprises (SMEs). Almost all of the SMEs are not creating their own designs, but manufacturing fabrics and clothes for domestic and foreign brands. They are known as original equipment manufacturers (OEM).

|

The numbers seem positive, because exports are increasing, but figures can be deceiving.

"In the past, we were just doing OEM for foreign brands, making very poor profits," says Zhang Ruiguo, 49, the founder and general manager of Ordos Rui Guo Cashmere Co Ltd.

"With the rising yuan exchange rate, increasing labor costs and the price of raw materials, the profit margin has diminished tremendously. So we decided to establish our own brand, called Xi Rong, in 2008," Zhang says.

"Now, through sales under our own brand, gross profits rose to 300 yuan for one garment, seven times that for doing an OEM piece," Zhang says.

| ||||

Wu La, founder and general manager of Ordos Han Ji Er Cashmere Co Ltd located on the desolate street, is a typical cashmere producer who is battling the odds for survival in a gloomy market.

The 38-year-old had to close three of his workshops and last year cut more than half the number of his employees - to 12 - because of uncertain market conditions.

"Frankly speaking, I made a lot of money when I stepped into this industry in 1993. But now it is probably the toughest period I have ever experienced in my life. I haven't even received any orders so far," Wu says.

|

|

Li Heping, 60, founder and general manager of Ordos Jin Li Cashmere Co Ltd, goes beyond the seemingly promising rising export figures.

"Despite the large volume, China's cashmere makers make very few profits compared with the foreign brands," Li says. Jin Li Cashmere, founded in 2006 with a workforce of 50, made less than 1 million yuan last year from OEM orders.

"Although the orders weren't small, we only made a small amount of profit in return, which is equal to nothing if operation costs are taken into consideration," Li says.

"For the past five years, I got up at 6:30 am every day and went to sleep at midnight. I devote my life to my company's development, yet the return is so poor."

He remembers the "good old days" of cashmere in Ordos in the 1990s when there were fewer domestic players and the foreign players came to China to find suitable manufacturers.

"Back then, the cashmere output could not satisfy the domestic market's needs, let alone the international ones," he says.

But things changed dramatically in 2005. "Coastal cities took the OEM jobs for the foreign brands, which took away large amounts of our orders. And the outbreak of the financial crisis in the Western world also made the situation worse," says Wang Haijun, vice-director of the Dongsheng district economic and informatization bureau.

He says at one time this industry contributed the largest share to the local GDP, yet now, as the price of raw materials and labor costs increase, the profit margins have diminished. Especially after many resources such as natural gas, coal and rare earths have been tapped here, the local government is attaching less importance to this industry's development, Wang says.

The price of cashmere has also impacted the cashmere industry's development.

"The average price of cashmere was 1.2 million yuan a ton back in the 1990s, but now it sells at 800,000 yuan a ton. It is even lower than the price of mutton. Farmers are sometimes not willing to breed the goats to make cashmere, but slaughter them before the cashmere is ready," Li says.

Providing more value-added products is a way to resolve these problems, experts say.

Stephen Roach, senior research fellow at Yale University's Jackson Institute for Global Affairs, says: "To maintain sustainable development, China should shift to consumption-led growth. And the way out for these cashmere producers is definitely to move up the value chain." He made the remarks during a recent discussion on China's economic future during an exchange between Yale and Tsinghua universities.

Ju Xinghai, a chief textile-clothing analyst at CITIC Securities Co Ltd in Shanghai, echoes that sentiment.

"The current problems in the cashmere industry of Ordos are not limited to that city. It is reflecting the problems facing China as a whole. China should establish more global brands instead of winning market share and foreign reserves through cheap labor products, like it did many years ago," he says.

During last week's annual meeting of National People's Congress, Wang Linxiang, president of Erdos Group, proposed that the government ease the tax burden on the textile industry, especially SMEs, to encourage growth and develop new technology.

One company aggressively moving into the high-end market is Erdos Group.

Li Changqing, general manager of Erdos Resources Co Ltd, a subsidiary of Erdos Group, says it takes time and patience to build world-famous brands such as Prada, yet "local cashmere brands boast many advantages, such as large production capacity and rich experience of OEM production".

But one thing China's cashmere industry lacks is unique and creative design.

Erdos Group spends almost 4 percent of its revenue on design and employs 2,000-plus people to develop new patterns and on research and development, says Li with Erdos Group.

Li, a native of the area who has worked for Erdos Group since 1982, says the city of Ordos is endowed with favorable climate conditions to raise goats and produce good quality cashmere.

"Ordos city provides 40 percent of the nation's cashmere and one-third of that of the whole world, and there is no exaggeration to say that Ordos is the 'Capital of Cashmere'," he says.

Kang Ming, 53, the general manager and founder of Ordos Dong Jian Cashmere Co Ltd, owns a small two-room factory that is several steps away from the towering building of Erdos Group.

"Just several meters away, you can enter a different world. It's so dusty and crowded here," says Wu, looking out at the street dotted by lots of small cashmere producers like his company.

Kang says compared with SMEs like his, it is much easier for Erdos Group, a large conglomerate that is supported by its other highly profitable businesses such as mineral resources or real estate, to transform from an OEM-based company to one famous for its own high-end products.

During a lunch featuring the local specialty of lamb's leg, Kang points at the dish and says: "Look, the cashmere makes so little profit now that sometimes I want to shift to just selling lamb," Kang says. "Everyone knows the only way to survive is by making his own brand, but not every one can afford that."

Jin Yudan, the partner of SAIF RMB Fund, a leading Asian private equity firm, says that though the situation is bleak for small companies, it is also an opportune time for the entire industry.

"For some big companies, this situation offers opportunities for them to merge and acquire some suitable small companies to expand their business scale," Jin says.

Despite the SMEs' concerns, the local government is confident of the cashmere industry's sound development. It plans to spend 1.6 billion yuan to establish a textile industrial park in Dongsheng district by 2013.

"This new hub for the cashmere industry will help complete the industrial chain of cashmere production in Ordos and integrate the currently scattered producers," says Wang, chairman of the local bureau.

Wang, who parked in his Volkswagen in a vast, empty lot, says the land will be as prosperous as Dongsheng is today.

"It is expected that sales revenue of cashmere for Ordos city will rise from today's 2.44 billion yuan to 15 billion yuan by 2015."

huhaiyan@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|