Water future

Updated: 2012-03-09 08:36

By Meng Jing (China Daily)

|

|||||||||||

It is also this huge potential that makes the irrigation sector an appealing investment candidate from the perspective of a foreign investor. But what makes it even more attractive is the government's plan to have a 4 trillion yuan investment in water conservancy projects by 2020. According to the government plan, nearly 20 percent of the 1.8 trillion yuan investment between 2011 and 2015 will go for infrastructure projects related to agriculture, such as irrigation projects.

|

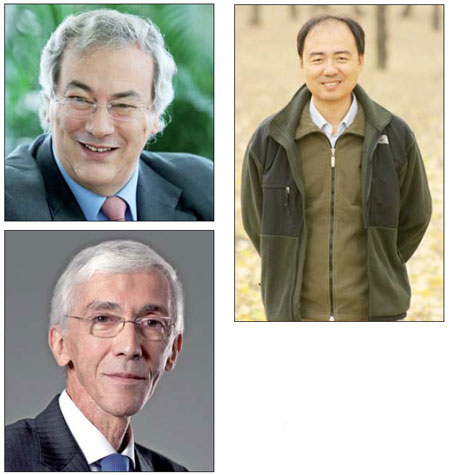

Clockwise from top left: Jorge Mora, Asia CEO of Veolia Environmental Services; Ma Jun, director of the Institute for Public and Environmental Affairs and author of China Water Crisis; Charles Chaumin, Asia CEO of Suez Environnement. Photos Provided to China Daily |

Buoyed by these prospects, Netafim, a global leader in smart drip and micro-irrigation solutions, has already announced plans to invest $10 million on a factory in China to take advantage of the increased business opportunities.

"Government support plays a significant role in developing a water-efficient irrigation industry. With China's massive investment in water conservation and the lower price due to our local manufacture, there is no doubt that for agriculture irrigation producers, China is the future of Asia," says Yacov Pedhatzur-Wiedhopf, managing director of Netafim Asia.

The Israeli company, which introduced drip irrigation in China during the early 1990s, has always believed that China is a big potential market due to its huge agriculture base, population and scarce water resources. The company's irrigation systems are capable of delivering water and fertilizer to the roots of plants and can save 90 percent water and 20 percent fertilizers. But the advanced technology is expensive and despite having no competition, the company has not exactly been able to score a winning run.

However, with the planned government investment and a local factory that is scheduled to start operations in early 2013, the company expects to turn the tide and come out with products at more competitive prices. Pedhatzur-Wiedhopf says the company's revenue from China will jump to $50 million by 2015, from $10 million in 2010.

But the real winners of the water conservation game are not only those who make high-efficiency water equipment. Though water demand has gone up due to China's rapid urbanization and industrialization, it has also led to more water pollution due to increased municipal and industrial wastewater discharges.

According to China's Ministry of Water Resources, as many as 300 million people in China's rural areas lack access to safe drinking water. Ma Jun, whose environmental organization has been naming and shaming water polluters in China, says that about one-third of the water that is consumed in the urban areas are supplied by impure water sources in China. Ma says the number of companies that illegally emit wastewater in rivers and lakes in China has increased from 2,500 in 2006 to about 60,000.

The most recent case of water pollution: an estimated 20 metric tons of cadmium was discharged by a mining company in the Longjiang River in the Guangxi Zhuang autonomous region on Jan 15, with cadmium content 80 times higher than the prescribed safe limits.

Specific targets have been set by the government to make 95 percent of the water in functional water areas reach the qualified standard by 2030, instead of the current 46 percent. In an aim to achieve the goal, increasing wastewater treatment facilities are also priorities in the environmental protection targets envisaged under the 12th Five-Year Plan (2011-15). According to the plan, newly added wastewater treatment capacity in China is expected to reach 42 million tons a day by 2015. To achieve this, China is also more than doubling its investment in the wastewater sector, and reportedly plans to spend about 300 billion yuan over the next five years.

The huge potential for wastewater treatment has also prompted global leaders in the sector like Suez Environnement to hinge their future growth plans on China. The French environmental service provider is primarily focused on water production and distribution in China with about two-thirds of its existing 27 projects in China on the supply and distribution side.

Charles Chaumin, Asia CEO of Suez Environnement, says that with the growing awareness of environmental protection in China, wastewater treatment will play a more important role in future projects.

"In our future portfolio of projects, we will see more wastewater treatment facilities, including sludge treatment both for municipalities and industrial parks. In terms of the number of new projects in China, two-thirds will probably be from wastewater and industrial sewage in the coming five years," Chaumin says.

He says the company's water business in China grew by nearly 15 percent last year due to increased demand for water and wastewater treatment facilities.

"Economic and urban growth are strong drivers for our business. The growing concern for environmental protection will be the real engine that drives our business to the next level," Chaumin says, adding the ambitious goals and regulations for improving water quality and reducing water pollution from cities and industries augur well for future prospects.

"We expect the revenues from our water and wastewater activities in China to grow by 10 percent average over the next five years, higher than our global business," he says.

The rapid development of wastewater treatment in China has also pushed up the demand for sludge treatment, a by-product of wastewater treatment. According to statistics from a thesis published by Zhang Yun, vice-president of Beijing General Municipal Engineering Design and Research Institute, the production of sludge at wastewater treatment plants is estimated to increase to 2.46 million cu m year-on-year between 2011 and 2015.

Siemens is one of the big names that are hoping to make a mark in sludge treatment. It is providing the world's largest solution project to a customer in Shenyang, Northeast China's Liaoning province, with a treatment capacity of 1,000 tons a day. The plant is expected to start operations by September.

"We are closely following up on the sludge treatment market in China, where we have seen clearly the demand for sludge treatment triggered by the government desire for environment protection," says Alfred Ng, general manager of Water Technologies with Siemens China.

Ng says he has noticed the trend that with China's economic development reaching a transitional stage, the previous development mode of high consumption of resources and environment pollution has been replaced with one that is aimed at lower consumption of resources and stringent policies and regulations for pollution control.

"The trend is unavoidable, since many developed economies have experienced the same stage, and China now must and should have strict control over its water environment. Thus we are very positive on the potential of China's water and sludge treatment market," he says, adding the United States is Siemens Water Technologies' largest market in the world but China is no doubt one of the countries with the most growth potential.

For Veolia's Mora, the entire water sector in China is worth investing, and it really does not matter whether it is water production, wastewater treatment or even seawater desalination.

What is more important, Mora says, is to seize the moment and ride the boom in China's water sector. The company, which has not had any major project in China since 2008, due to its cautious approach and the financial difficulties from the global financial crisis, is now ready to test the waters in China again.

"We are restructuring our group by selling our transportation division, so that we can further grow our essential divisions, such as water. China will be the main destination benefiting from the restructure. With the money, our investment in China will take off later this year," he says.

You may contact the writer at mengjing@chinadaily.com.cn

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|