Shifting gears

Updated: 2012-01-13 08:38

By Wang Chao (China Daily)

|

|||||||||||

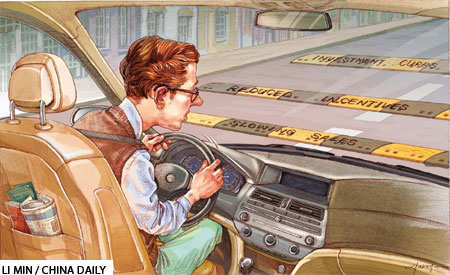

Changing market may prompt foreign automakers to chart new strategies

After years of unbridled growth, foreign automakers seem to be headed for a bumpy ride in China as shrinking profit margins and reduced investment incentives are set to cloud prospects in 2012, even as the market shows signs of rapidly cooling down.

|

||||

Foreign automakers had resigned themselves to 2012 being a year of slow growth after two successive record-breaking years in China in 2009 and 2010. But none were prepared for the move by the Chinese Ministry of Commerce and National Development and Reform Commission toward the end of 2011. In a directive, the ministries said they would no longer automatically encourage foreign investment in the auto sector so as to ensure natural growth.

The ministries have clearly indicated that they are not putting an end to all foreign investment in the auto sector. Rather, they are taking steps to ensure that future foreign investment in the sector is in accordance with China's long-term clean energy policy. Evidence of this was amplified when the ministries added spare part manufacturers for new energy cars to the preferred investment list.

"There is no need to encourage more foreign companies as the sector is already saturated with far too many players. The focus of future endeavors should be to reshape the industry on a more sound footing," says Cui Dongshu, deputy secretary-general of the China Passenger Car Association.

Some industry insiders feel that the new measures will help create a level playing field for domestic auto companies vis--vis foreign firms. They point out foreign automakers had enjoyed two years of spectacular growth in China thanks to low manufacturing costs, a huge domestic market and a host of investment incentives.

More importantly, it also reflects the government's desire to reshape auto market dynamics as evidenced in another December 2011 notification whereby it decided to initiate anti-dumping and anti-subsidy investigation on cars imported from the US with engines larger than 2.5 liters. Though experts feel that this action was more a retaliatory move to similar actions in the US, it highlights the government's commitment to reduce large-emission cars from overseas.

In many ways, the trend for 2012 was set by the tumultuous events of 2011 when growth figures started to taper off and momentum slowed rapidly in the world's largest auto market. Deliveries for 2011 totaled 18.5 million units in China, 2.45 percent higher than the previous year. The figures represent the lowest growth in 13 years, say experts from the China Association of Automobile Manufacturers (CAAM).

Removal of subsidies for car purchases in 2011 was a killer blow for many Chinese auto brands as they ceded more ground to foreign players who not only managed to grow market share but also profits. The market share of Chinese companies fell by 3.37 percentage points to 42.23 percent in 2011, primarily due to the absence of incentives and soaring oil prices.

|

In contrast foreign marquee brands such as General Motors, Volkswagen, Daimler, BMW and Toyota remained on a strong perch.

"In such an uneven market situation, only the strongest brands will survive," says Dong Yang, vice-chairman of CAAM.

Despite the dark clouds on the horizon, many foreign companies are still upbeat about market prospects for 2012.

Kevin Wale, president and managing director, GM China Group, says the China unit of the US-based General Motors has outperformed the industry in 2011. Although the auto giant was tottering on the edge of bankruptcy in 2009, it got a fresh lease of life from the strong showing in China, its largest overseas market. With 2.55 million deliveries, GM led the Chinese market in 2011.

Even the minivan segment, the death knell for many Chinese brands after removal of subsidies, did not clip the wings of GM in China. "We increased our share in this segment; and next year, we expect to see a modest growth of about 5 percent," Wale says. Over the next two years, GM also plans to increase production capacity in China by 25 to 40 percent.

"We're still pretty bullish about the Chinese car market. Gross domestic product is going to be between 7 and 10 percent, but car ownership is low. There is a growing desire to own vehicles, so we think the trend is good," Wale says.

Volkswagen Group said its sales in China grew by 17.2 percent to 2.25 million cars in 2011. With that result, China remained the German carmaker's top market in the world.

|

Kevin Wale, president and managing director, GM China Group, says the company plans to increase production capacity in China by 25 to 40 percent. Provided to China Daily |

The company said in November that it would invest 14 billion euros for the period of 2012-2016 in China to further expand its presence in the world's largest automobile market.

But for the moment, the real game-plan for companies including Volkswagen and GM is how to maintain their edge in the market even as they cobble up fresh alliances with Chinese companies, launch more luxury vehicles and test new energy vehicles.

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|