Oh, not again...

Updated: 2011-08-12 11:25

By Xin Zhiming and David Bartram (China Daily)

"In some respects this crisis today is not the same as the crisis in 2007-8. A lot of it is also psychological and we don't know how long this will last. China is paying much more heed today to outside global events than it did during the last crisis in 2007-8. This time they are keeping a very close watch on global events and despite the fact that in the past month there was record high inflation rates, they didn't come out to increase the interest rate despite a lot of speculation they would."

John Ross, visiting professor at Antai College of Economics and Management, Shanghai Jiao Tong University, says "China will have to rely even more on expanding domestic demand through stimulating its own consumption and investment".

|

|

Given that the US Republicans in Congress will not accept a new fiscal stimulus for expanding the budget deficit, any support to the US economy can only be delivered through action by the Federal Reserve such as quantitative easing (QE), he says.

"It increases the chances of QE3 and the dollar is likely to decline, which will negatively affect the real value of China's foreign exchange reserves."

That poses the risk of additional speculative capital flows to China.

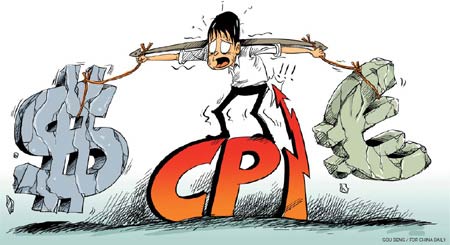

QE3, which will drive down the dollar in tandem with the weak US economy, would see more international capital flowing into developing countries, including China, Zhang of CASS says. "We must closely monitor the capital flows as such liquidity would bring a series of problems, such as rising inflation."

The Chinese fundamentals remain sound, however, and analysts say the overall economy will not suffer much.

"The stock markets may have overreacted," Zhang of CASS says. China's main stock index, the Shanghai Composite Index, dropped by nearly 7 percent in intraday trading in the two days following the S&P downgrade of US debt rating, but has since posted gains.

"The (Chinese) economy continues to show considerable resilience as both year-on-year and month-on-month data show respectable expansions," says a HIS Global Insight report.

Fixed-asset investment increased by 25.4 percent year-on-year in the first seven months while retail sales grew by 17.2 percent year-on-year in July. All indicators remained stable.

China's trade surplus narrowed by 8.7 percent year-on-year to $76.21 billion in the first seven months, but exports remained strong, expanding by 23.4 percent year-on-year, according to Customs.

"The good news is that China has become less reliant on export growth than before the 2008 global financial crisis and the property market is not in a deep downturn as it was back in 2008," Wang of UBS says. "China will be affected by what is going on globally but we are not expecting a hard landing."

She says China still has a trump card to play: the easing of the macroeconomic policy, although the room for more stimulus measures would be limited. "China has already increased its leverage massively in the past three years by investing in infrastructure and there is less scope to do so now."

China initiated a $586 billion economic stimulus package in late 2008 to steer the economy out of the fallout of the global financial crisis then. But it has also left such legacies as excess liquidity, which is believed to have contributed to the current rising inflation in the country, and potential debt problems, especially those facing local governments.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

Star journalist leaves legacy

Li Xing, China Daily's assistant editor-in-chief and veteran columnist, died of a cerebral hemorrhage on Aug 7 in Washington DC, US.

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.