Inflation: Challenging task ahead

Updated: 2011-08-12 11:25

By Lu Chang (China Daily)

It is that time of the year when policymakers find themselves facing tough challenges on how to maintain the growth momentum and keep prices under control. At the same time they are also worried about how to instill confidence in the sagging markets as the US and Europe totter on the verge of a financial crisis.

Even as the specter of an economic crisis unfolds, China faces an even bigger challenge of quelling growing inflation.

|

Wang Guoxing, deputy director of the Pudong Institute for the US economy, a unit of the Pudong Academy of Development, says that more challenges await China, as a depreciating US dollar will spark higher prices for gold and oil.

"This will definitely pose a long-term threat to the global economy and increase the risk of imported-inflation in China as the US may continue to issue new bonds to repay its old debt," Wang says.

Oliver Barron, a financial analyst at the London-based brokerage house North Square Blue Oak, feels that the uncertainty over the US economy and fears of a new round of stimulus measures by the US may prompt China to increase the amount of renminbi it prints every month to buy foreign currency from the banking sector. China had increased its money supply in response to the second round of stimulus measures in the US, or QE2, late last year.

"The central bank accelerated the pace of yuan appreciation against the dollar in September 2010 before QE2, and may be forced to do so again now to combat new inflationary pressures."

Analysts also warn emerging markets may see a surge in hot money inflows from the US market.

Zhang Ming, a researcher at the Chinese Academy of Social Sciences, says that China and other emerging market countries, will be the most sought destinations for hot money.

China has a major stake in the future of the dollar as analysts estimate that about 70 percent of its $3.2 trillion in foreign reserves is invested in dollar assets.

Zhou Xiaochuan, governor of the People's Bank of China, the central bank, says that the US must handle its debt responsibly to ensure the safety of Chinese investment.

However, the sovereign downgrade of the US may also be something that analysts and economy watchers have been expecting for sometime, as a falling US dollar would also trigger a sharp decline in global commodity prices.

Tang Min, an economist at Peking University, says that the downgrade would lead to interest rate hikes in the US and slow the investment cycle there, badly impacting demand for commodities like crude oil.

"Due to these factors, there will be a considerable easing of inflation in China," Tang says.

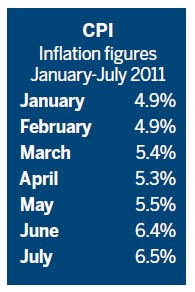

The unexpected pick-up of China's consumer prices may also offer more room for policymakers to cool costs with more tightening policies.

"China is likely to roll out new tightening measures to curb rising inflation," says Ren Zeping, senior economist, at the State Council Development Research Center. "We expect China to increase interest rates again once or twice this year, after taking into consideration factors like the financing difficulties for small and medium-sized enterprises."

Ren says that China is likely to face even more complicated challenges in future. "If the US launches QE3 (a third round of quantitative easing policy), it will send a very negative signal to the global economy as it raises the risks of inflationary pressures."

To curb inflation, the central bank has raised interest rates three times and increased the reserve requirement ratio for commercial lenders by 50 basis points.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

Star journalist leaves legacy

Li Xing, China Daily's assistant editor-in-chief and veteran columnist, died of a cerebral hemorrhage on Aug 7 in Washington DC, US.

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.