Aftershocks of US credit rating

Updated: 2011-08-12 11:25

By Yi Xianrong (China Daily)

The downgrading of the US credit rating on Aug 5 by Standard & Poor's Ratings Services, from 'AAA' to 'AA'+ with a negative outlook, has further jolted the global capital and commodity markets and intensified worldwide pessimism about the prospects of the global economy.

The downgrading, the first that the United States has experienced since 1917, has once again aroused concerns about the US' astronomical and still-growing national debt. As well as adding huge uncertainties to the global markets, the move is undoubtedly a heavy blow to the already shaky global financial order and will increase fears of another global financial and economic crisis.

To reduce the impact of S&P's announcement on the global stock markets, the Group of Seven industrial countries held an emergency meeting to discuss measures to stabilize the markets before they opened on Monday. Despite this, the Asia-Pacific stock markets suffered a widespread decline on Monday and Tuesday. The Shanghai Composite Index, for example, ended at 2,526 on Tuesday, hitting a new low for the year. However, stocks did rebound following the Federal Reserve's announcement that it will maintain the current low interest rate policy until mid-2013 at least.

In view of its authority and reputation among international rating agencies and the timing of its announcement, S&P's downgrading of the US credit rating will undoubtedly continue to have an impact on the global financial markets, but its influence is mainly psychological and should not last long.

Instead of focusing on the temporary market fluctuations it caused, we should pay more attention to whether the downgrading will change the dollar-dominated international financial system and overturn people's established preconceptions of market risks.

We should also consider whether the US' borrowing-based economic growth mode will come to an end. These to a large extent will decide the stability of financial markets and the US' economic future.

The current international currency system is dominated by the US dollar, thus, any monetary policies adopted by the Federal Reserve will not only have domestic repercussions, they will also have international ramifications.

While a lower US credit rating will possibly herald the depreciation of the dollar and increase the US' borrowing costs, that does not mean that the decades-long dollar-dominated international monetary system will be changed and the long-established international interest pattern broken.

In the current dollar-dominated international monetary system, the dollar is still the main currency for international trade settlements and international investments and is the leading international reserve currency.

Under these circumstances, cutting the credit rating of the US will prompt people to reassess global market risks, such as the risk premium of the US debt market. It will also likely cause more intensive discussions about whether depreciation of the dollar will cause the decline of the purchasing power of countries holding US debt and intensify debates about whether a country should diversify its foreign reserves investment. All these will add some uncertainties to the global markets, especially the US debt market.

The S&P's announcement has provoked heated domestic debate about China's huge investment in US debt and led to calls for diversification. But that begs the question: Are there any other channels for China to invest its ever-expanding foreign reserves instead of the US national debt?

If China had put its investment in other countries' national debt or some resources-based commodities as some domestic scholars suggested, it would have had a lower ratio of return. In the absence of other investment options, China should not stop buying US debt based on the S&P's downgrading of the US credit rating.

The author is a researcher with the Institute of Finance and Banking under the Chinese Academy of Social Sciences.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

Star journalist leaves legacy

Li Xing, China Daily's assistant editor-in-chief and veteran columnist, died of a cerebral hemorrhage on Aug 7 in Washington DC, US.

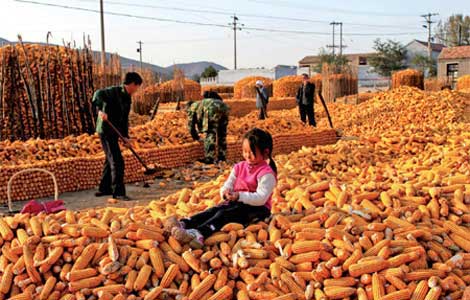

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.