Stalled Chery looks for some cheer

Updated: 2011-08-12 11:13

By Wang Chao (China Daily European Weekly)

|

|

Chery's production line in Wuhu, Anhui province. The automaker sold some 700,000 cars last year. Provided to China Daily |

Domestic car brands have suffered a downturn and are eager for new momentum

Chinese carmaker Chery Automobile has been feeling growing pains since it celebrated its 10th birthday three years ago.

The company swept the market with its QQ-series budget cars (price tag: 30,000 yuan, or 3,240 euros) between 2004 and 2008, but it has stalled over the past three years.

The profit margin on budget cars is slim - about 3,000 yuan a car, compared with an average 10,000 yuan for a typical joint-venture car - so while the company is selling more than half a million cars every year, its takings are small.

Experts estimate that in the Chinese market joint ventures swallow up 66 percent of the profits.

On top of that, Chery undoubtedly made a rod for its own back early on, advertising its cars as "cheap cabbages", creating the image of a low-end, working-class car.

Chery, founded in the city of Wuhu, in East China's Anhui province, as a State-owned company in 1997, began making cars in 1999 using a chassis licensed from Volkswagen's SEAT Toledo. Over the next 10 years Chery went from success to success, and last year it sold 700,000 cars, making it the country's seventh most productive carmaker.

In an effort to rid itself of its "cheap car" image, Chery revised its strategy and began to pitch its cars to wealthier buyers, with its Rely and Riich brands, costing between 140,000 yuan and 170,000 yuan. For Chery the results have been disappointing .

"We need time. We have a track record of only 13 years, whereas brands such as Mercedes-Benz and BMW have decades of experience," says the vice-president of Chery Automobile Ma Deji. "Despite the short history, our products have a good reputation in the market."

Jin Yibo, the assistant to the president of Chery Automobile, says the company can continue making money out of budget cars, given the size and nature of that market.

"Budget cars, usually A-level cars, are smaller, cheaper and fuel-efficient; therefore they are the best choice as the first cars for young professionals for daily commuting."

But Jin acknowledges that first-tier city markets are saturated, so Chery is looking at the potential of smaller cities and rural areas. "In Beijing, Guangdong and Shanghai we are just defending our current market share; in emerging markets we are seizing as much territory as possible."

A recent government policy announcement heralds more opportunities for Chery. In June the government introduced a new government car purchase standard, pulling the price ceiling down from 250,000 yuan a unit to 180,000 yuan, and the engine size from 2.0L to 1.8L. Experts believe small-car makers will be able to cash in on this.

|

|

Jin Yibo, the assistant to the president of Chery Automobile, says it is not yet time for Chery to go into Western Europe, despite its fast overseas growth.Wang Chao / China Daily |

But Jin believes there is limited scope for Chery in the new government purchase rules. "The focus is still in the civil market, and Chery will not tailor-design other cars to run for this segment.

"The government adjusted the purchase standards because the cost of cars has dropped significantly over the last two decades. Previously, a car was a symbol of social status, but now it is just a tool for getting about. So long as it is safe and performs well, it works as a government car."

This year is a tough one for most Chinese car brands, and Chery is no exception. The market failed to maintain its momentum over the previous two years, and slumped to a growth rate of 5 percent in the first half of this year, compared with 30 percent in 2009 and 2010.

Domestic brands have been the big victims of the market turndown. Because of the soaring price of oil and hard-to-predict government policies, the domestic companies' small budget cars lost price advantage to joint-venture vehicles. In the first six months of the year the domestic carmakers' market share slipped 3 percentage points to 44.3 percent.

Jin says he hopes to retrieve something over the rest of the year. "I believe policies towards smaller cars will steady, and stable growth will return to the market."

The company announced a new model, the E5, in April, and Jin hopes that once this goes on the market, "the product variety will be enriched, which might attract more customers".

One way Chery is trying to make up for the loss of market share locally is by trying to get more out of the overseas market. The company started exporting cars in 2001, and the international market now accounts for 40 percent of Chery's sales. Most of the cars are sold in South America.

By the end of June Chery had sold more than 70,000 cars in Brazil, Russia, Southeast Asia and other developing countries.

Sixteen factories have been set up overseas, including three that are now being built. Most of the factories are assembly plants to which knock-down kits are brought from China. The first such plant opened in Egypt in 2006, and cars are sold there under the brand name Speranza Chery.

"South America is our most important market," Jin says. "We built a factory in Uruguay, and it has been providing cars to Brazil, the biggest market overseas."

Recently, another factory broke ground in Brazil in a joint venture with the government of the state of Sao Paulo. It is expected to be capable of producing about 150,000 cars in 2013.

Jin sees overseas expansion as radiating from the center. "We start from our neighborhood like Southeast Asia, then further to Russia; finally we reach Africa."

However fast this overseas growth is, Jin says it is not yet time to go into Western Europe. "Since it is the most established market in the world, it is hard for newcomers like Chery to break in. The demands relating to quality, safety and distribution are very tough; besides, the car brands in Europe have more than 100 years' of experience; Chinese brands have only 20. I'm afraid the European customers won't accept us in the short term.

"It took Japanese cars 50 years to enter the first tier and South Korea 30 years. Hopefully China will achieve this in another 20 years."

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

Star journalist leaves legacy

Li Xing, China Daily's assistant editor-in-chief and veteran columnist, died of a cerebral hemorrhage on Aug 7 in Washington DC, US.

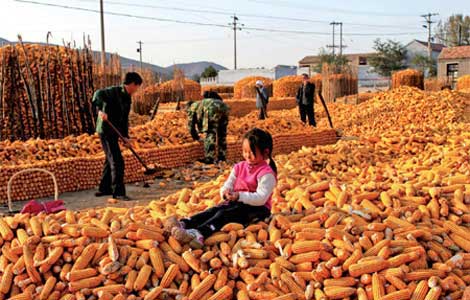

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.