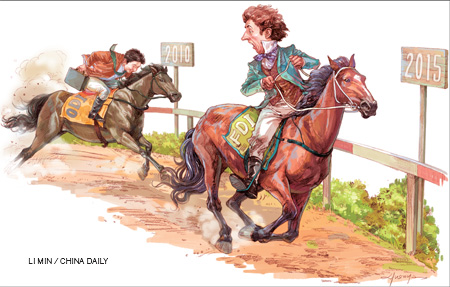

High stakes in investment race

Updated: 2011-07-15 11:02

By Andrew Moody (China Daily European Weekly)

Overseas investment could surpass inbound investment in a few years - a major milestone in the development of China's economy

|

||||

On his five-day visit to Europe, which also took in Germany and Hungary, the premier also announced a number of other major Chinese investments, including a 1.1-billion-euro funding deal for BorsodChem, a Hungarian chemical company that was taken over by Chinese chemicals maker Wanhua in February.

Instead of just being a recipient of inbound foreign direct investment (FDI), Chinese State-owned corporations and private companies are becoming major foreign investors in their own right.

According to the Ministry of Commerce, outbound direct investment (ODI) will overtake inward FDI on an annual basis by the middle of the decade, seen by some as a significant moment in the development of China's economy.

Zheng Chao, a commercial counselor at the Department of Outward Investment and Economic Co-operation in the Ministry of Commerce, says there is now major impetus behind China's ODI.

"Outbound direct investment is set for the fast track and will grow between 20 to 30 percent in the next five years," he says.

In 2010, China's ODI was $59 billion (42 billion euros), well behind FDI on $105.7 billion, according to Ministry of Commerce figures, but on the current trajectory it could surpass the inward investment in 2014.

Lu Jinyong, director of the China Research Center for Foreign Investment at the University of International Business and Economics in Beijing, says that if China's ODI does become larger than its FDI, it will be a key moment in the evolution of China's economy.

"I think its significance will be huge. It will mark a historical change from being an economy that is dependent on trade to being a country which is a major investor around the world," he says.

According to official China figures, ODI rose from only $900 million in 1990 to $59 billion last year. By 2010, accumulative ODI was $258.8 billion, compared to $1.05 trillion of FDI that has been invested in the Chinese mainland over the past 30 years.

E-paper

Burning desire

Tradition overrides public safety as fireworks make an explosive comeback

Melody of life

Demystifying Tibet

Bubble worries

Specials

My China story

Foreign readers are invited to share your China stories.

Setting the pace in Turkey

China is building a 158-km high-speed railway in Turkey.

Moving up the IMF ladder

Christine Lagarde has proposed the appointment of Zhu Min to the post of Deputy Managing Director.