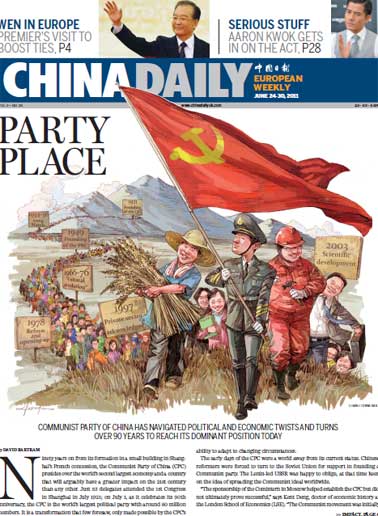

First lady of world finance

Updated: 2011-07-01 10:41

By Li Xiang and Wang Xiaotian (China Daily European Weekly)

|

|

French Finance Minister Christine Lagarde leaves TF1 private television studios on June 28 after a prime-time news program in Boulogne-Billancourt, near Paris. Gonzalo Fuentes / Reuters |

Emerging powers hope new IMF chief Christine Lagarde will make good on her pledges

It came as little surprise that French Finance Minister Christine Lagarde was appointed the 11th managing director of the International Monetary Fund (IMF), defeating Agustin Carstens, head of Mexico's central bank, after a month-long race. Former lawyer Lagarde, 55, will be the first female to head the IMF. Unlike her predecessors, she will also be the first IMF chief that does not have a background career as an economist.

Lagarde's win, as some analysts point out, once again reflects Western dominance over the IMF's leadership. It seems that the world is not prepared for a non-European boss to lead the key financial institution, especially at a time when the European debt crisis is still haunting the global economy.

The IMF has traditionally been led by a European since it was established in the aftermath of World War II. Lagarde received support from major Asian powers, such as China and India, after she pledged to increase the influence of emerging economies at the fund.

The People's Bank of China, China's central bank, welcomed Lagarde's appointment and said that it expects her to implement further reform of the IMF.

Carstens, Lagarde's sole rival for the post, also issued a statement of support. Lagarde will be a "very capable" IMF chief, he said and expressed his hope that she would make meaningful progress in strengthening governance of the fund.

Lagarde has a wealth of political experience and formidable negotiating skills to bring to her new post. She has gained wide support in Europe for her ability to reach compromise and strike deals among different parties under pressure.

She has also won a reputation as a good communicator and consensus-builder between developed and emerging economies.

She likes to attribute her teamwork spirit and self-discipline to her training as a synchronized swimmer at a young age. She also gained firsthand and practical experience of addressing thorny economic problems during France's presidency of the G20 and the sovereign debt crisis of the eurozone.

Her more than 20 years of experience working as a lawyer at Baker & McKenzie, a leading US law firm, also makes it easy for her and the Americans, who have the biggest voting quota at the IMF, to relate to each other.

"Her strong negotiating skills are definitely considered a plus by the European nations and her experience working at a well-known US law firm also makes her very relatable to the Americans, which helped her land the job," says Dong Yuping, an economist with the Institute of Finance and Banking at the Chinese Academy of Social Sciences (CASS).

When asked by reporters what new ideas she would bring to the IMF while she was running her campaign in China, Lagarde mentioned inclusion and diversity. She said that her goal is to make the IMF "more representative, more involved and more legitimate".

"The world has changed and it cannot operate on the basis of the 'Washington consensus' as it is often portrayed," Lagarde said. "I would hope that the IMF remains relevant and plays a pivotal role in transforming the international scene."

|

|

Agustin Carstens was Mexico's candidate to head the IMF. Karen Bleier / Agence France-Presse |

The IMF in recent years has been faced with increasing criticism from emerging powers as it failed to recognize the shift in the global economy. An example is the slow pace the fund has taken to adjust the quota shares of its members, particularly those of the emerging economies, which account for 80 percent of the world's population and almost half of the global gross domestic product.

During her recent visit to China, Lagarde promised to give emerging economies such as Brazil and the Republic of Korea a greater say in the organization if she succeeded in her bid to be the IMF chief.

She also said she would back the decision to increase China's voting rights in the IMF from 3.65 percent to 6.4 percent to give the country the third-strongest voice in the fund.

On June 27, Lagarde gained critical backing from China on the eve of the IMF's announcement of its new leader when Zhou Xiaochuan, governor of the People's Bank of China, told reporters in London that China had given "quite full support" to Lagarde.

Now Lagarde will come under pressure to walk her talk to restore the fund's reputation and its role as a competent international financial institution that is relevant to the world economy today.

"The IMF is charged with representing the interests of its entire global membership, so it is important for the managing director to make sure that everyone is on board," says Murtaza Syed, resident representative of the IMF in China.

"The reality is that the emerging markets are going to lead global growth for many years to come," Syed says. "Listening and responding to their voices, wishes and concerns will become more and more important."

Economists have said that Lagarde is likely to name Zhu Min, the special adviser to the managing director of the IMF and former deputy governor of the People's Bank of China, as a deputy head of the fund. Lagarde has personally praised Zhu as a capable and suitable person who should play a more significant role in the fund.

But some analysts point out that Lagarde's rise to the top of the IMF may only bring a symbolic rather than substantial change to the organization.

"So long as the US has the veto power and the voting structure of the IMF remains unchanged, Lagarde's influence may be more of a symbolic one," says Chen Daofu, director of the policy research center at the financial research institute of the State Council's Development Research Center.

Meanwhile, Lagarde's selection on June 28 coincided with a general strike in Greece. The European debt crisis is widely viewed as Lagarde's top priority after she assumes her post.

"What is important is to make sure the next managing director is able to deal with major issues in the world, among which the first is the euro crisis," says Marc Uzan, executive director of the Reinventing Bretton Woods Committee.

But doubts remain whether Lagarde is a suitable person to deal with the eurozone debt problems as Greece risks becoming the first Western European country to default in six decades.

"She is very charming and very smart. But she's too close to the Europeans," says Ronald McKinnon, a professor of economics at Stanford University. "Strauss-Kahn has already lent too much to these small in-debt European countries. We need someone who is impartial and neutral."

Lagarde defended her qualifications to head the IMF in a statement, vowing to be impartial toward European nations seeking aid.

"I will not shrink from the necessary candor and toughness in my discussions with the European leaders," Lagarde said. "I am not here to represent the interest of any given region of the world, but rather the entire membership."

In the meantime, Lagarde's lack of an academic economics background also raised concerns about her economic expertise in search for solutions to the European debt crisis.

Lagarde responded to these concerns in a recent interview with the Financial Times, saying that the skills and experience she has accumulated over the years have given her the qualifications as the top IMF leader.

"I don't know many people who have had the luxury of four years of one of the worst financial crises in decades, the presidency of the European Union at exactly the same time, and the emergence of this new institution, the G20, while maintaining the French economy in a reasonably stable position," she said.

"Her lack of a background in economics means that she has to rely on her team to make key decisions. It will certainly be a test for her powers of execution and her decision-making ability," Dong from CASS says.

Chinese analysts expect that Lagarde is unlikely to press China too hard on currency issues such as revaluation and the free convertibility of the yuan.

"She is known for her ability to wield her influence through charm rather than bullying," Dong says. "She will need China's support on a wide range of issues and she is unlikely to bring the IMF in a head-to-head situation with China. But we should not expect too much from her, either, because she will be no different from any of her predecessors in terms of following the Anglo-Saxon approach in dealing with economic and political issues."

E-paper

Shining through

Chinese fireworks overcome cloudy times, pin hopes on burgeoning domestic demand

Pen mightier than the sword

Stroke of luck

Romance by the sea

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city