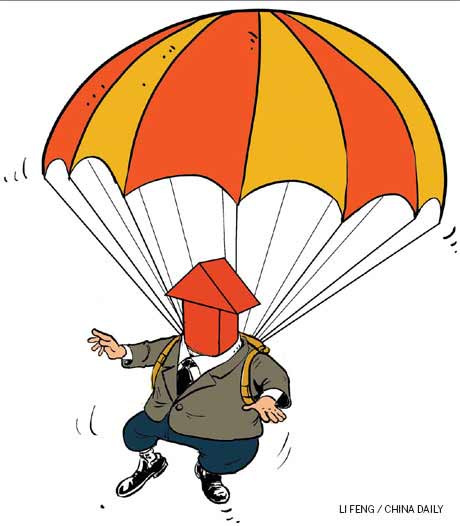

No hard landing yet for China

Updated: 2011-07-01 10:41

By Zhang Ming (China Daily)

Income growth, development of service industry to keep economy chugging along smoothly

|

|

There has been heated discussion on whether the Chinese economy will experience a hard landing.

In a survey conducted by Caijing.com.cn, the news portal of China's leading business and finance magazine, most analysts with 35 institutes predict a decline in China's GDP growth rate.

The GDP rate in the second quarter of this year is expected to grow slower, from 9.7 percent to 9.4 percent year-on-year.

Some Chinese economists have pointed out that if the Chinese government continues to maintain the current austerity policy, China's economy will face a bigger risk of having a hard landing.

The growth rate of consumption is getting slower, industrial production is dropping significantly, the government is tightening control of the real estate industry and foreign demand is facing a new round of shrinking.

A research report by French bank Socit Gnrale warned that China's economy has been out of control since the country has been repeating the mistakes the United States made in 2007. The reports said the bursting of China's economic bubble will be the biggest risk to the global economy.

Will the Chinese government need to adjust its tightening policy, or should it keep it to the end? Will China's economy in the short term or medium term face a hard landing?

China's GDP growth in 2011 will probably be no lower than 9 percent, and no lower than 8 percent in 2012. There is little risk that China's economy in the short term will experience a hard landing.

The growth rate of consumer price index in the second half of this year will decline. The decline in inflationary pressure will lead the authorities to adjust its tight monetary policies, and the policies will gradually become more neutral from August and September this year.

However, if the Chinese government fails to seize the opportunities for economic restructuring but continues to rely on investment and exports to drive the economy instead, it will face problems of overcapacity and the threat of an asset bubble in the medium term, which will cause the decline of the growth rate.

The recent lower growth of consumption was largely related with the decline of car sales. The decline was partly due to the fact that the government ended the tax preferential policies for car purchases in mid-2010.

There are 60 car owners among a thousand people in China, which is far below the global standard of 220 vehicles among a thousand people . This means that there is still a lot of room for China's auto market.

From 2009 to 2010, wages in China's coastal areas have also increased about 50 percent. The next wage increase is expected to be substantial.

The 12th Five-Year Plan (2011-2015) proposed that people's income growth rate should not be less than that of GDP. The growth will continue to promote China's economic development by boosting consumption.

In the next few years, if China's service industry can record faster development, it will also promote consumption growth.

There are two reasons for the weak performance in manufacturing operations. First, continued tight monetary policy leads to increasing costs for small and medium-sized companies.

Second, the fall of international commodity prices have led to Chinese enterprises reducing the inventory of raw materials.

The China Banking Regulatory Commission recently issued policies to help tackle the financing problems of the small and medium-sized enterprises but the financing difficulties will remain for some time. International commodity prices will continue to be at a high rate and Chinese companies will still maintain less inventories of raw materials.

As for real estate investment, although the cumulative growth rate of property investment is still higher than 30 percent year-on-year, data from SouFun, a leading property web portal, indicate that in May, the growth rate of housing prices year-on-year in 35 cities have fallen to zero. That means that if the macro-control policy is not relaxed, real estate investment industry will decrease significantly for some time.

However, there are three reasons to remain optimistic about investment growth rate for the second half of this year. First, from the enterprise fixed asset investment point of view, 2011 is the first year of the 12th Five-Year Plan, which has identified seven strategic emerging industries. There will be large-scale investment plans in those seven industries in the second half of this year.

Second, despite real estate investment in the commercial properties declining in the second half of this year, that will be offset by a surge in the construction of affordable housing. This year, the Chinese government is set to build 10 million units of affordable housing. By the end of May this year, 30 percent of that affordable housing will begin construction. That means that in the second half of this year, investment in affordable housing may be increased dramatically.

Third, according to our forecast for inflation, the growth rate of the consumer price index this year is expected to fall to the range of 4-5 percent. This may lead to the end of interest rates rising in the third quarter of this year. Changes in interest rates may be expected to promote investment growth.

From the export point of view, the economic growth of the US, Europe, and Japan are expected to be generally lower. The emerging markets are still keeping a tight policy. So China's exports may face further decline in the second half of this year.

In summary, if we look at the sectors that contribute to the growth of the economy in 2011, net exports will play a limited role, while consumption and investment will play a major role in growth. New investments on new strategic industries and affordable housing will also ensure that this year's fixed asset investment growth rate will not be less than 20 percent.

At the consumption level, income growth and the development of the service industry will drive consumption. In 2011, the lower growth rate of GDP may come between the second and third quarter, but there is a slim chance that the annual GDP growth rate will stay below 9 percent. China's economy will not experience a hard landing in a short period of time.

The author is a researcher with the Chinese Academy of Social Sciences.

E-paper

Shining through

Chinese fireworks overcome cloudy times, pin hopes on burgeoning domestic demand

Pen mightier than the sword

Stroke of luck

Romance by the sea

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city